USD/NOK

The dollar traded higher against almost all of its G10 peers during the European morning Tuesday. It was lower only against NOK.

The euro plunged against the dollar after the Eurozone’s CPI slowed to +0.3% yoy in September, its lowest level since November 2009. Core CPI also slowed, showing that this was not due only to lower oil and other commodity prices. The unemployment rate remained unchanged in August as was broadly expected. With only two days before the ECB meeting, the data shows that the risk of deflation remains in the Eurozone. The impact of the recent measures from the ECB are yet to be reflected in the data and the economy will take more time to respond to them.

The Norwegian krone was the only gainer against the dollar after the country’s central bank announced that it will start selling foreign exchange equivalent to NOK 250 mln per day in October. Norway will start for the first time to convert some of the oil revenue it gets in foreign currency into NOK to cover increasing budget needs. On top of that, the nation’s retail sales excluding volatile items rebounded in August. Nevertheless, the need to convert oil revenues to cover budget needs raises concerns about the country’s finances.

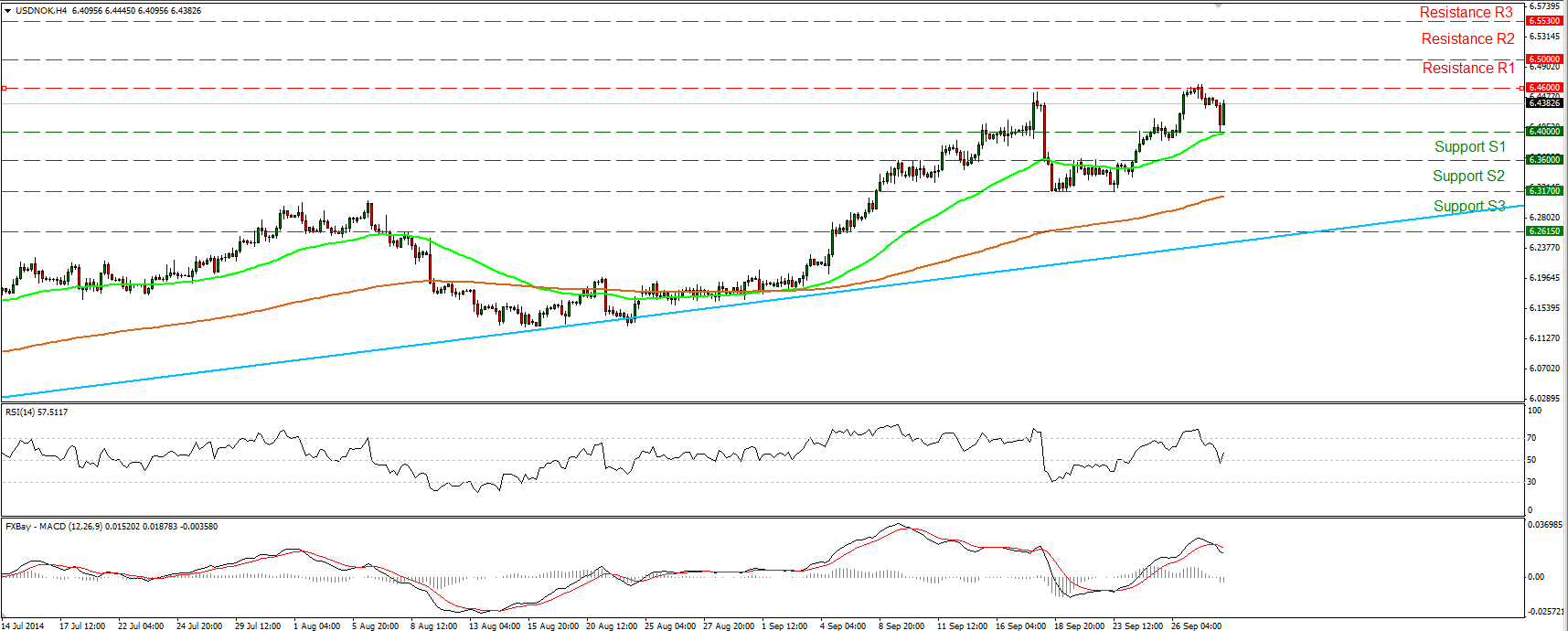

USD/NOK moved lower after it failed to break the 6.4600 (R1) resistance level but bounced back once it found support at the 6.4000 (S1) zone. A break above the 6.4600 (R1) level could trigger a bullish extension towards the psychological line of 6.5000 (R2), on the other hand, the failure once again to break up from this level raises some doubts. On the daily chart, I still see a longer-term uptrend from a technical view. The rate is printing higher highs and higher lows above the light blue uptrend line drawn from back at the low of the 8th of May.

Support: 6.4000 (S1), 6.3600 (S2), 6.3170 (S3) .

Resistance: 6.4600 (R1), 6.5000 (R2), 6.5530 (R3) .

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.