FTSE 100 futures

The dollar started Monday weak in Asian trading but regained its glamour and traded higher against all of its G10 peers during the European morning as investors start to see improving US economic fundamentals and the Fed preparing for rate hikes. On top of which, pressure on Europe at the G20 finance ministers and central bank chiefs’ summit increased the perception of a divergence between the economic prospects for the US and the Eurozone. The dollar’s biggest advance was against the AUD amid speculation that the slowdown in China will lower demand for commodities and will hurt the Australian economy.

Asian and European shares fell during European midday as China’s finance minister admitted that there won’t be major changes in policy despite downward pressure on the Chinese economy. However, his remarks contradict somewhat last week’s liquidity stimulus by the People’s Bank of China to support loan growth and boost the country’s economy. Manufacturing data expected on Tuesday could provide more evidence of a slowdown in China and put further selling pressure on the equity markets.

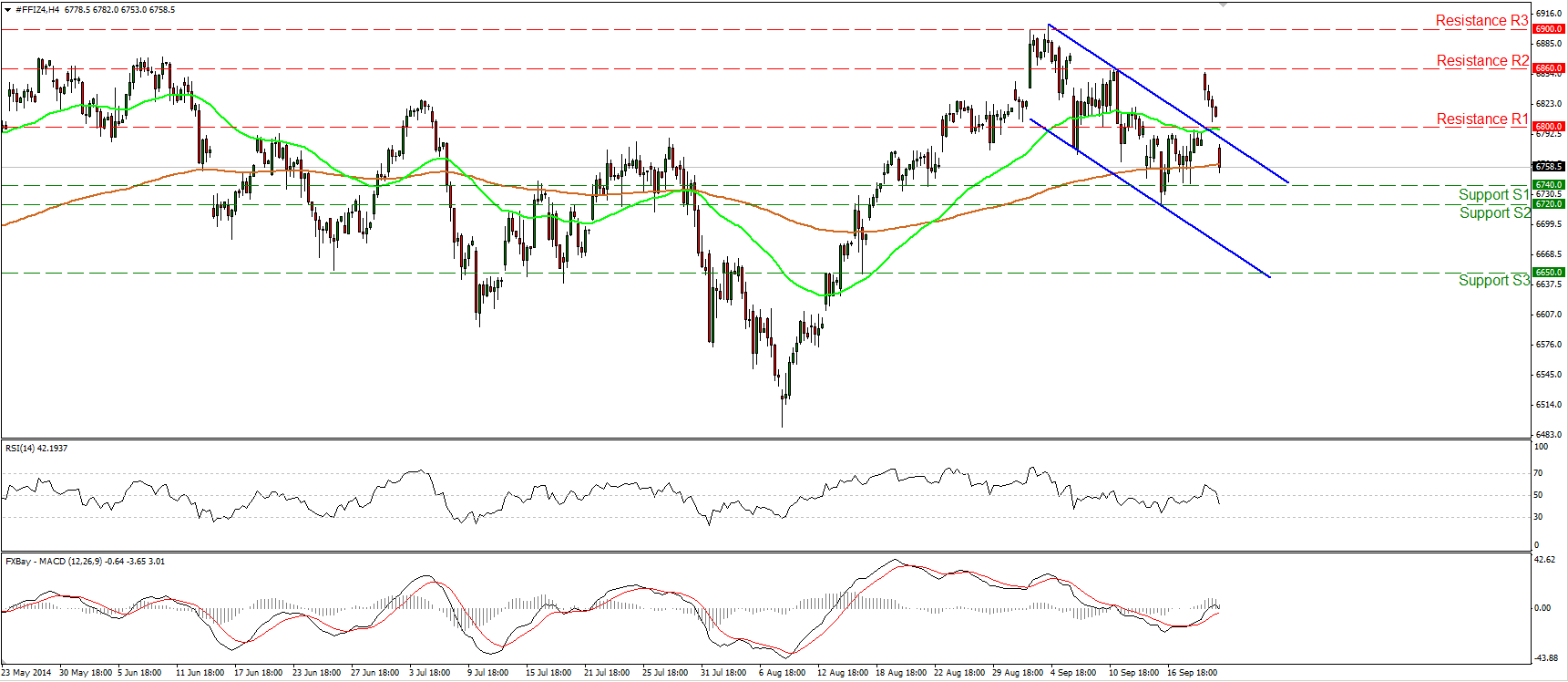

After the results of the Scottish independence referendum were announced, FTSE 100 futures opened Friday’s session with a bullish gap, breaking above the upper line of the near-term downside channel. However, the price found resistance at 6860 (R2) and, after China’s finance minister diminished expectations for further stimulus measures, it opened today’s session with a gap down to return back within the aforementioned channel. Taking that into account, I would see a cautiously negative near-term picture, but I would prefer to wait for a dip below the support line of 6720 (S2) before getting more confident about further declines. Such a move is likely to set the stage for extensions towards the next support line of 6650 (S3), determined by the lows of the 15th of August. Our momentum studies also confirm the recent bearish momentum. The RSI crossed below its 50 line and is pointing down, while the MACD appears to have topped marginally above its zero line and could dip below its trigger in the close future. In the bigger picture, on the daily chart, a longer-term upside channel contains the price structure, thus I would consider any further declines within the channel as a corrective phase of the longer-term uptrend.

Support: 6740 (S1), 6720 (S2), 6650 (S3).

Resistance: 6800 (R1), 6860 (R2), 6900 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.