USD/NOK

The dollar traded mixed against its G10 peers during the European morning Friday, reflecting the restrained mood ahead of the US nonfarm payrolls for August, due out later in the day. It was higher against SEK and NOK, in that order, while it was lower against AUD, CHF, EUR and JPY. The greenback was virtually unchanged against CAD, NZD and GBP.

The Swedish krona weakened after the country’s industrial production unexpectedly contracted in July. The worse-than-expected figure added to the recent evidence of a slowdown in Sweden’s economy and pushed SEK down vs USD, sending the pair to levels last seen back in July 2012. As we said in previous comments, we still expect that the uncertainty over the Sep. 14 general election, on top of the weak data coming from the country and the need for further policy easing to boost Sweden’s economy could weaken SEK further down the road.

Although the recent data coming from Norway were mostly strong, the industrial production in July reading disappointed by showing a large drop. Ahead of the US employment report later in the day and expectations of a slowdown in Norway’s inflation, due out next week, we could see USD/NOK to appreciate and test the strong resistance and psychological zone of 6.3000.

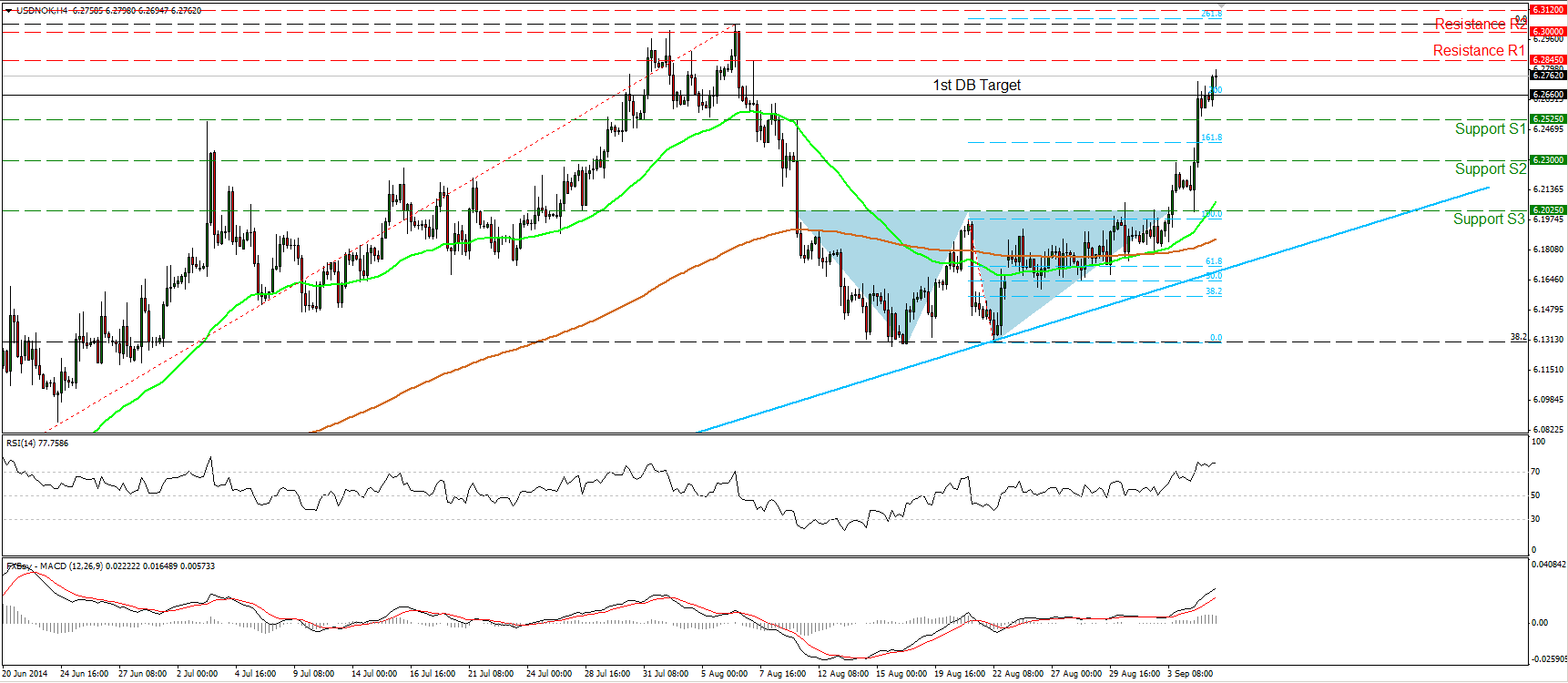

USD/NOK surged on the 3rd of September violating the 6.2025 line and completing a double bottom reversal formation. The two bottoms were formed at the 38.2% retracement level of the 8th May – 6th August uptrend, signaling that the 6th - 18th August down move was just a corrective phase. Today, during the European morning, the pair extended the recent bullish wave, reaching and breaking above the 1st price objective of the double bottom pattern (6.2660). Taking all the above into account, I would consider the near-term bias to be to the upside and I would expect another leg higher, towards the key resistance zone of 6.3000 (R2), slightly below 261.8% extension level of the double bottom’s width. Nevertheless, having in mind that the recent rally was too steep and that the RSI lies within its overbought territory, I would be cautious of a possible pullback before we experience further upside. On the daily chart, the rate is trading above both the 50- and the 200-day moving averages and above the light blue trend line, drawn from back at the low of the 8th of May. This supports my view for further bullish extensions, at least towards the strong resistance area of 6.3000 (R2).

Support: 6.2525 (S1), 6.2300 (S2), 6.2025 (S3).

Resistance: 6.2845 (R1), 6.3000 (R2), 6.3120 (R3).

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.