USD/SEK

The dollar traded unchanged against almost all of its G10 peers during the European morning Thursday, in anticipation of the policy meetings of the Bank of England and the European Central Bank. The greenback was lower only against SEK.

Sweden’s central bank decided to hold the repo rate unchanged at 0.25%, saying that last month’s cut was enough to battle the deflationary risk. As in the previous forecast, Riksbank considered it appropriate to begin raising the repo rate near the end of 2015, when they expect inflation to be near their 2.0% target. This disappointed those who expected the Bank to start discussing non-standard measures to support economic activity and USD/SEK declined approximately 0.20% at the news. However, we still expect that the uncertainty over the Sep. 14 general election, the poor data coming from the country and the need for further policy easing to boost Sweden’s economy could weaken SEK in the coming days.

The markets were stable during the European morning as investors’ eyes are on the most important event of the day, the ECB meeting and President’s Draghi press conference following the decision. After Draghi’s speech at Jackson Hole, the chances to see further ECB action combined with the TLTROs in two weeks have risen. We expect some clarifications about the ABS purchases program at the press conference, which could be EUR-negative.

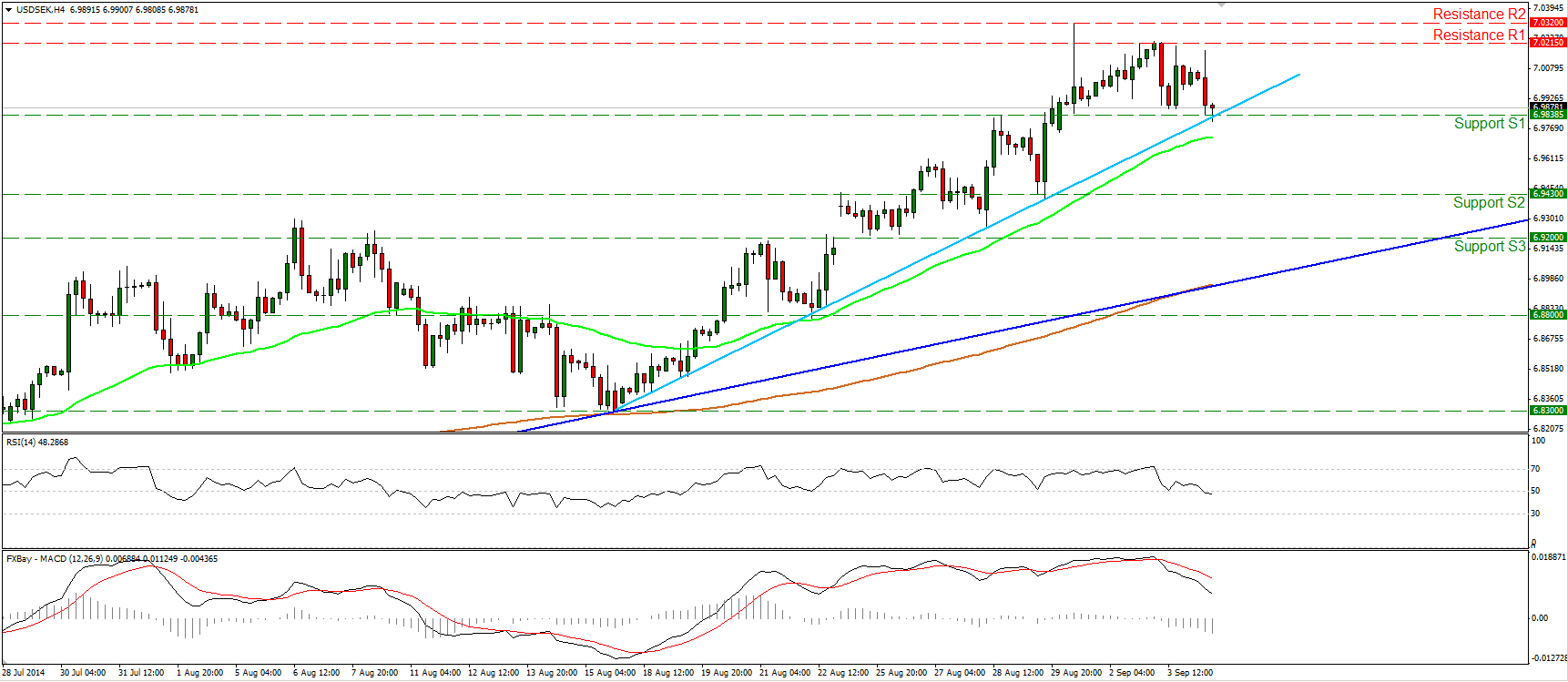

USD/SEK declined during the European morning Thursday, after the Riksbank kept its benchmark interest rate unchanged. At midday, the rate is sitting near the short-term uptrend line (light blue line drawn from at the low of the 15th of August) and the support bar of 6.9838 (S1). This keeps the near term upside path intact, but even if we see a dip below these levels, I would expect it to be limited to the 6.9430 (S2) barrier, or near the longer-term uptrend line (blue line taken from back the 19th of March). From a technical front, the picture remains positive as the rate rebounded from that long-term trend line five times since March (see the lows on the daily chart). The fundamentals are also in favor of a higher pair. Today’s meeting does not change my view on Sweden’s economic outlook, especially compared to the improving US economy. The 14-day RSI exited its overbought zone and is pointing down, while the daily MACD appears willing to move below its signal in the close future. But taking all the above in consideration, I would expect any possible pullback to provide renewed buying opportunities.

Support: 6.9838 (S1), 6.9430 (S2), 6.9200 (S3).

Resistance: 7.0215 (R1), 7.0320 (R2), 7.0775 (R3).

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.