USD/CAD

The greenback traded within a narrow range of ± 0.2% against all the other G10 currencies and all the EM currencies we track, except RUB.

During a quiet European morning with no economic releases or market affecting news, only NOK and NZD among the G10 currencies outperformed the dollar somewhat. The Norwegian Krone added to its gains of yesterday’s following the faster-than-anticipated acceleration in Norway’s GDP for Q2. As expected, USD/NOK touched our line of 6.1300, which is the 38.2% retracement level of the 8th May- 6th August longer-term uptrend, and rebounded somewhat. Having in mind the improving data coming out of Norway, I would maintain my bearish stance on USD/NOK and I would wait for a dip below the aforementioned line to open the way for our next support at 6.1000.

The loonie traded virtually unchanged ahead of Canada’s CPI and retail sales data. The market expects the headline CPI to have slowed in July, something that could start convincing investors that the previous rise in the inflation rate was due to “temporary factors”, as BoC admitted in its latest policy meeting.

The Ruble was the main loser among EM currencies after Moscow’s foreign ministry warned against any attempts at disrupting a Russian aid convoy that has already crossed the Ukrainian boarder. Presidents Putin and Poroshenko are planned to meet next Tuesday to discuss the situation in eastern Ukraine. I see the ruble’s recent rebound as a corrective move and, at least until Tuesday, I would expect the currency to weaken more. In my view, USD/RUB is likely to challenge the resistance zone between the 36.550 and 36.700, where the 261.8% extension level of the inverted head and shoulders’ width lies (completed on the 17th of July). At the time of writing the MICEX stock index is trading approximately 1.15% down.

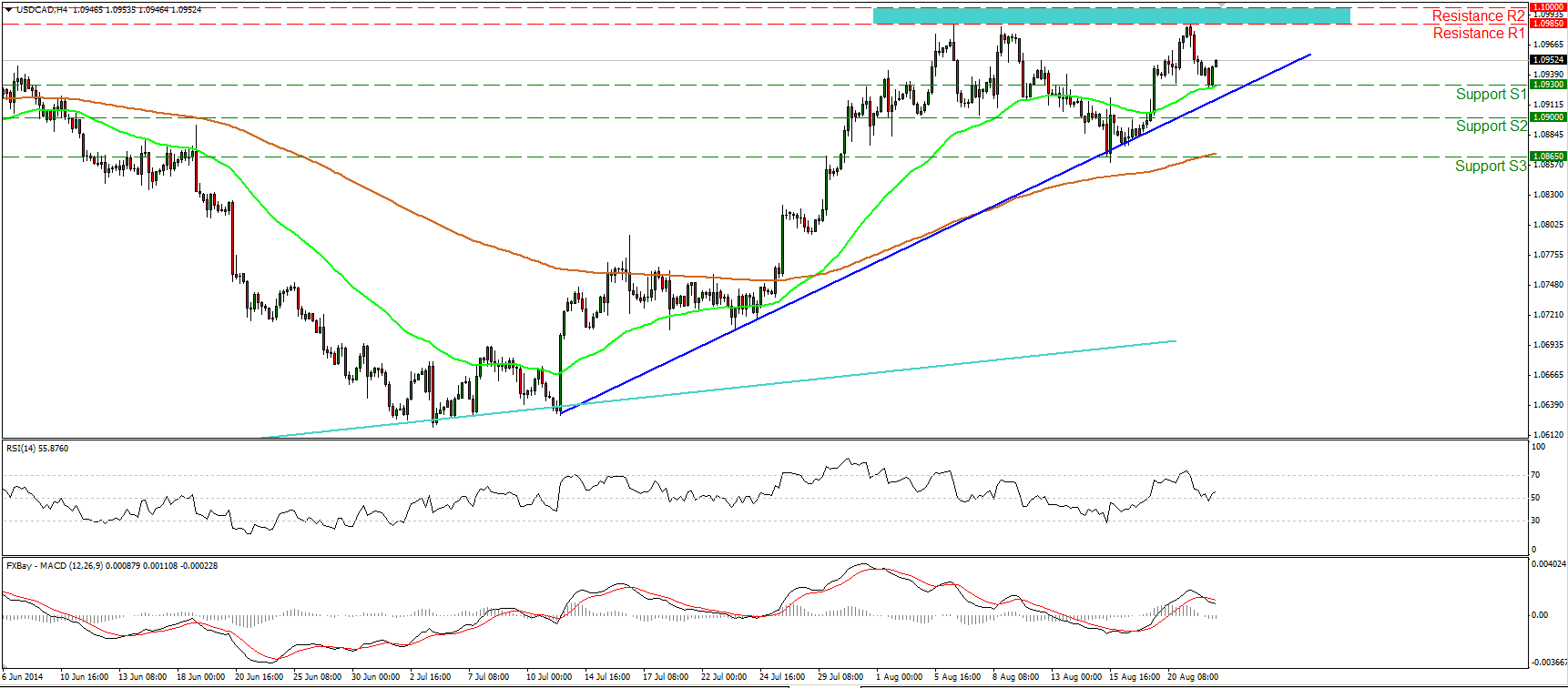

USD/CAD declined somewhat during the European morning Friday, but after finding support at 1.0930 (S1), it rebounded to meet its opening levels. Technically, the near-term uptrend remains intact, since the rate is trading above the blue uptrend line and above both the moving averages. However, I would wait for a move above 1.0985/1.1000 to signal the continuation of the uptrend. The pair tested the 1.0985 (R1) line three times in August and failed to overcome it. If Canada’s CPI and retail sales data come out soft as expected, we may see the bulls overcoming that strong resistance zone, pulling the trigger for extensions towards the next hurdle at 1.1055 (R3). Zooming on the 1-hour chart, the 14-hour RSI moved above its 50 line and is pointing up, while the MACD has bottomed and crossed above its signal line, amplifying the case for further upside, at least within the zone of 1.0985/1.1000. In the bigger picture, the overall long-term trend remains to the upside, as marked by a strong uptrend line connecting the lows on the weekly chart from back at the lows of September 2012.

Support: 1.0930 (S1), 1.0900 (S2), 1.0865 (S3) .

Resistance: 1.0985 (R1), 1.1000 (R2), 1.1055 (R3).

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.