USD/NOK

The dollar traded lower against almost all of its G10 peers during the European morning Thursday. It remained stable only vs JPY and CAD.

EUR/USD moved higher as the bloc’s PMIs managed to remain above the neutral level. Even though the Eurozone’s preliminary composite PMI - covering both the manufacturing and service sectors - missed the forecast and fell to 52.8 from 53.8 in July, it remained above the neutral 50.0 level for the 14th consecutive month. Added to that, PMIs from Germany, the bloc’s strongest economy, beat market consensus, pushing EUR/USD up slightly. However, since the overall outlook remains negative in my view, I believe that any further rebound is likely to remain limited and I would expect the bears to prevail again soon.

The British pound weakened against USD after UK retail sales for July came out. Even though retail sales excluding gasoline rose by more than anticipated on a month-on-month basis, the year-on-year figure missed estimates. The news pushed Cable down by approximately 0.10%, however sterling managed to recover some of the losses. We believe GBP/USD could end the day lower again given the negative sentiment towards the British pound and the USD-supportive data expected later in the day.

The Swedish krona strengthened after the country’s unemployment rate declined to 7.1% from 9.2%, beating the market consensus of 7.2%. The strong improvement in the labor market offset the recent unchanged CPI reading and strengthened SEK. The positive data will most likely take off some pressure from Riksbank at their September meeting, and the chances to see a further rate cut lessen.

Norway’s economy grew 0.9% qoq in Q2, after expanding 0.2% qoq in Q1, beating the +0.5% qoq estimate. On top of the recent robust data coming from the country, NOK strengthened approximately 0.50% pushing USD/NOK further down.

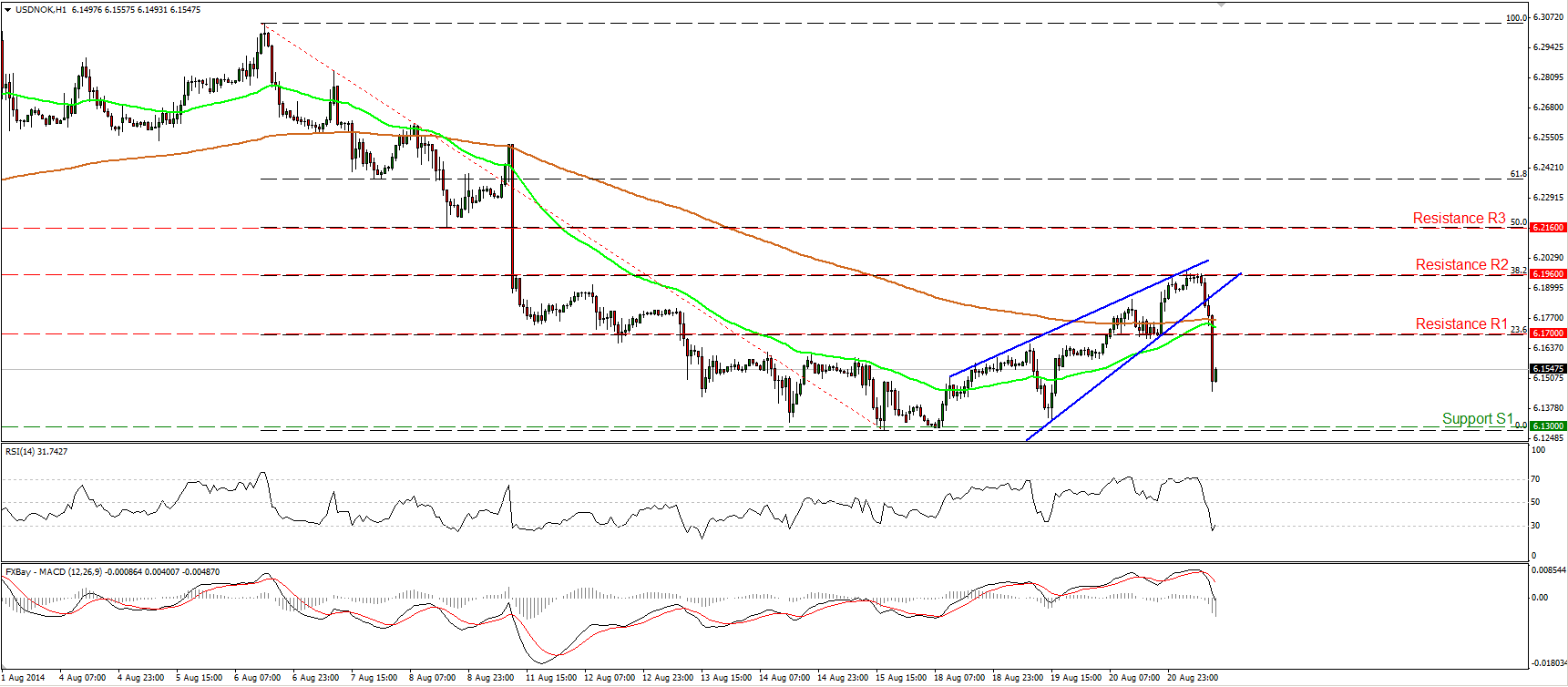

USD/NOK collapsed during the European morning Thursday, after finding resistance at 6.1960 (R2), the 38.2% retracement level of the 6th - 18th August down move. The rate fell below the 6.1700 (support turned into resistance) line, confirming the exit from a rising wedge formation. Having that in mind I would see a cautiously negative outlook and I would expect a test near the 6.1300 (S1) zone, which in turn is the 38.2% level of the 8th May- 6th August longer-term uptrend. As a result, only a clear dip below 6.1300 (S1) could clear the picture and trigger further extensions towards the key support of 6.1000 (S2). The hourly MACD, already below its signal line, crossed below its zero line, supporting my view for further declines, at least towards 6.1300 (S1). However, the 14-hour RSI exited its oversold field, thus I would expect a bounce to provide renewed selling opportunities.

Support: 6.1300 (S1), 6.1000 (S2), 6.0775 (S3) .

Resistance: 6.1700 (R1), 6.1960 (R2), 6.2160 (R3).

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.