USD/SEK

The dollar traded unchanged or higher against most of its G10 counterparts during the European morning Wednesday. It was higher against SEK, AUD, JPY and CAD, in that order, and was virtually unchanged against NOK, EUR, NZD, CHF and GBP.

SEK plunged after Sweden’s preliminary Q2 GDP grew +0.2% qoq, disappointing the market with its below consensus reading. Although a rebound from the final Q1 -0.1% qoq, the worse-than-expected figure send the krona down approximately 0.5% against the dollar to trade at 6.8900 at the time of writing. On top of the recent rise in the unemployment rate to 9.2% and the decline in the nation’s consumer confidence, the poor GDP growth adds to the growing body of evidence that the economy is not as strong as the market was expecting.

EUR/USD dropped below 1.3400 during the European morning for the first time since 13th of November, ahead of the preliminary German CPI for July and amid expectations of strong US data coming later in the day. The first indication of a decline in the German inflation rate came several hours before the country’s headline figure. The CPI for the region of Saxony slowed to 0.8% yoy in July from 0.9% yoy the previous month, increasing the likelihood of an overall slowdown in Germany’s consumer prices. However, expectations for robust US data are most likely the main reason for the tumble of EUR/USD. If the forecasts are met, I would expect the rate to slide further and see as a first target the 1.3350 zone in the near future.

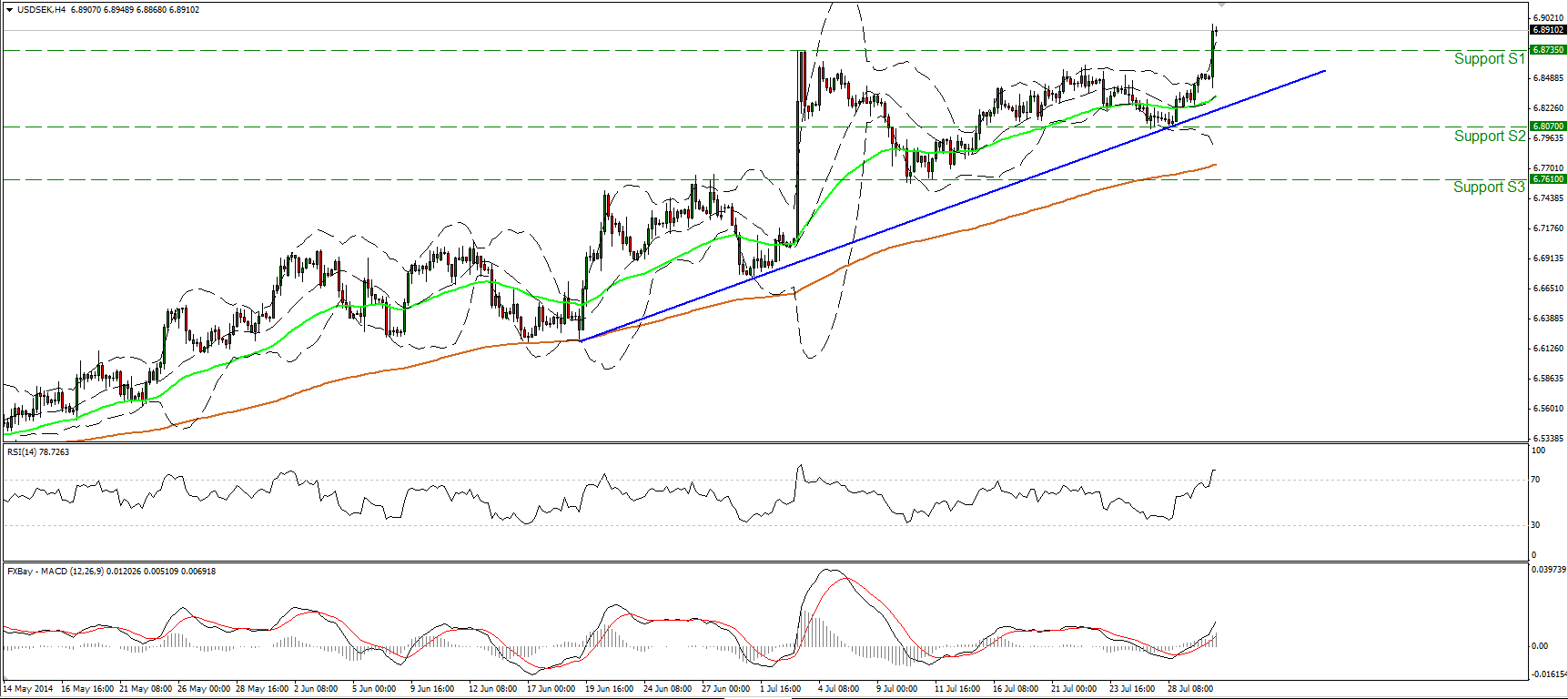

USD/SEK rallied during the European morning Wednesday, breaking above 6.8735 (resistance turned into support), the highs of the 3rd of July. Such a move confirms a forthcoming higher peak and could pave the way towards the 6.9200 (R1) zone. As long as the rate is trading above the blue uptrend line and above both the moving averages, I see a positive near term picture. Nevertheless, zooming on the hourly chart, the 14-hour RSI lies within its overbought field and is pointing down, thus I would expect a pullback before the longs take control again. In the bigger picture, the major upside path is in force since the 19th of March, while the 50-day moving average lies above the 200-day one and is pointing up. This amplifies the case for the continuation of the longer-term uptrend.

Support: 6.8735 (S1), 6.8070 (S2), 6.8610 (S3) .

Resistance: 6.9200 (R1), 7.0000 (R2), 7.0775 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.