BP Plc

The dollar traded unchanged against most of its G10 peers during the European morning Tuesday.

The New Zealand dollar was the only G10 currency to lose against the dollar, after the country’s biggest dairy exporter reduced its forecast milk price for the 2014/15 season. The drop in price from last season will reduce the collective income of New Zealand dairy farmers by around 1.9% of GDP. Kiwi dropped approximately 0.40% against dollar after the announcement to trade at midday in Europe at levels last seen 10th of June. NZD/USD hit 0.8555 and moved lower. I would expect the decline to test the support barrier of 0.8478 in the near future, marked by the lows of the 9th of June.

BP Plc announced its financial results for Q2 2014. Profits were approximately 34% higher than the same period last year and up 13% from Q1 2014. The company warned however that "if further international sanctions are imposed on Rosneft or new sanctions are imposed on Russia, this could have a material adverse impact on our financial position and results of operations". BP is one of the largest foreign investors in Russia through its 19.75% stake in Russian state oil company Rosneft, one of the entities that is the target of sanctions.

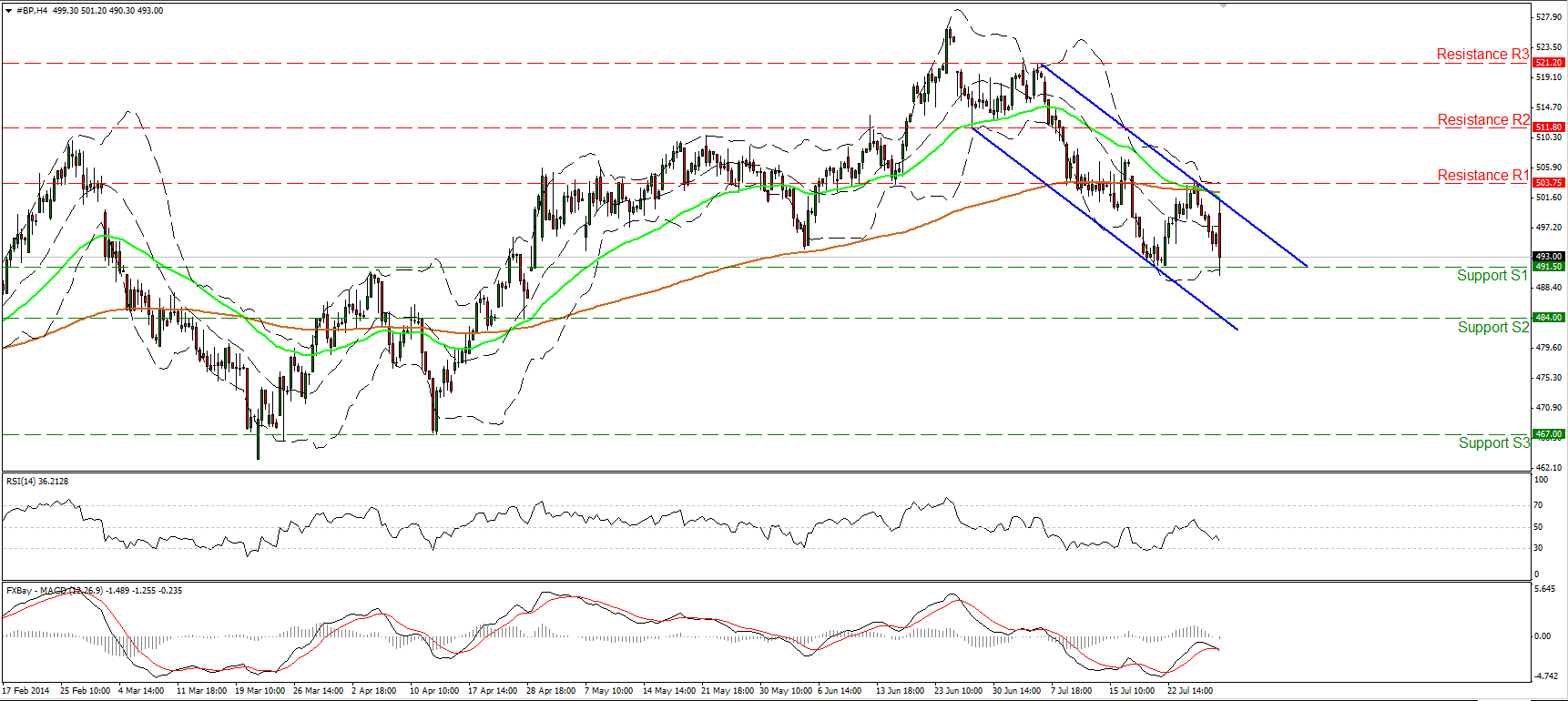

BP shares were down about 0.9% at midday. The decline was halted near the previous low at 491.50 (S1) and the price rebounded somewhat. From a technical point of view, the price has the necessary momentum to move below that barrier, since the RSI lies below 50 and has further to go before signaling oversold conditions, while the MACD, already negative, edged below its signal line. A clear move below 491.50 (S1) could trigger further extensions to target the next support at 484.00 (S2), first. As long as the price is printing lower peaks and lower troughs within the blue downside channel, I consider the near-term path to be to the downside. Moreover, the 50-period moving average fell below the 200-period one, adding to the negative picture of the stock. In the bigger picture, a weekly close below 491.50 (S1) could signal the completion of a possible head and shoulders formation on the daily chart and could reverse the overall longer-term uptrend. The daily MACD remains below both its trigger and zero lines, while the 14-RSI hit its 50 line and moved lower, corroborating my negative stance.

Support: 491.50 (S1), 484.00 (S2), 467.00 (S3).

Resistance: 503.75 (R1), 511.80 (R2), 521.20 (R3).

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.