USD/TRY

The dollar traded unchanged or lower against most its G10 peers during the European morning Wednesday. It was lower against SEK, NOK, AUD, NZD and CAD, in that order, and was virtually unchanged against CHF, EUR and JPY.

The British pound was the only G10 currency to lose against the dollar, after the release of the Bank of England minutes of its latest policy meeting. As expected, the vote to leave rates unchanged was unanimous. The key point for the market was that the Committee believed that the contradictory signals from employment and wages had increased the uncertainty about the degree of slack in the economy. “In light of this uncertainty, an argument could be made for putting more stress on the expected path of costs, particularly wages, in assessing inflationary pressures,” the minutes said. Since the Committee noted that “the weakness of wages in the face of strong rises in employment was becoming more striking,” this suggests that the MPC are becoming less concerned about inflation. Moreover, the only reason given for the surprise jump in the inflation rate to 1.9% in June was a change in the timing of summer sales, meaning they do not see any rise in the underlying rate of inflation.

GBP strengthened ahead of the news in the expectations of more hawkish signals but as soon as the minutes were released, it gave back all the gains and weakened further. The decline of cable was stopped by our support of 1.7035. The rate found some buy orders marginally below that level, thus I would wait for a clear dip below that bar before expecting a test near the psychological zone of 1.7000.

The Turkish lira was the main winner among the EM currencies we follow. It has benefited from the crisis in Ukraine as investors move funds out of Russia and into other high-yielding markets. Carry trades will most likely perform well even if “risk off” returns, as there is not much contagion from the Ukraine crisis to other EM countries. On top of that, the recent narrowing in Turkey’s current account deficit has boosted TRY.

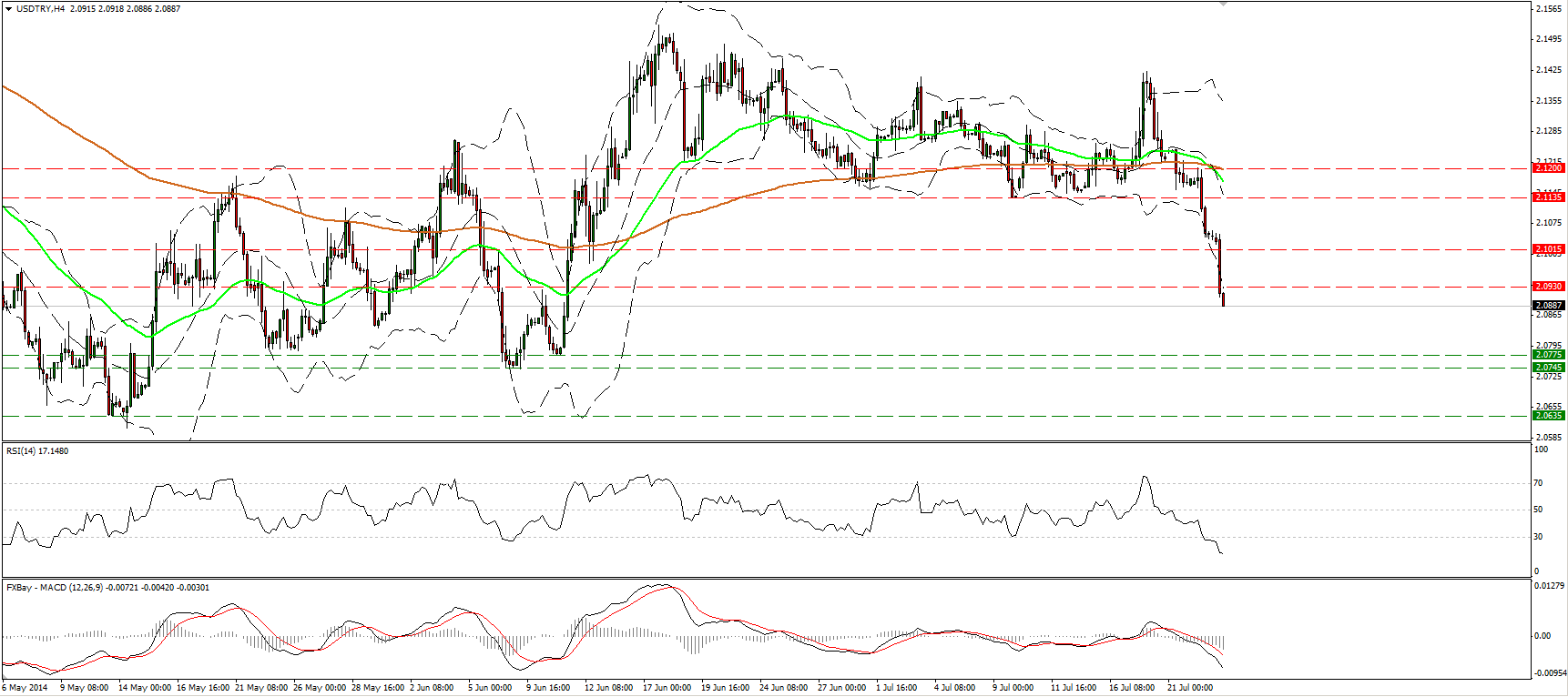

USD/TRY has been collapsing since the 18th of July with yesterday’s dip below the 2.1135 barrier, giving the signal for increasing selling pressure. The rate continued its plunge today, crushing two support hurdles in a row and at the time of writing it is trading slightly below the 2.0930 (R1) bar. I would expect the pair to continue its crazy tumble and reach the support zone of 2.0775 (S1), in the close future. The MACD lies within its bearish territory and below its signal line, amplifying the case for the continuation of the decline. I would ignore the oversold reading of RSI, as the indicator remains within the extreme zone since yesterday and could stay there for an extended period of time. I would see the low reading of RSI as strong bearish momentum for now. Furthermore, the 50-period moving average dipped below the 200-period moving average, adding to the negative picture of USD/TRY.

Support: 2.0775 (S1), 2.0745 (S2), 2.0645 (S3)

Resistance: 2.0930 (R1), 2.1015 (R2), 2.1135 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.