AUD/USD

The dollar traded mixed against its G10 counterparts during the European morning Tuesday. It was higher against CHF, EUR and NZD, in that order, while it was lower against NOK and AUD. The greenback traded nearly unchanged against SEK, GBP, JPY and CAD.

Aussie gained during the European morning, after Reserve Bank of Australia Governor Glenn Stevens said he is pleased with the current monetary policy. Nevertheless, he added that if at some point there is more that can reasonably be done, they will do that. The top central banker did not say anything directly about the currency. In his comments earlier this month, Gov. Stevens declared that the Aussie was “overvalued, and not by just cents”. The comment was made a few days after the Bank maintained its key interest rate unchanged at 2.50%.

European stock markets rebounded as Ukraine’s pro-Russian separatists handed over the plane’s black boxes to Malaysian authorities and some of the victims’ bodies were making their way to the Netherlands. The recent developments reduced markets anxiety and lifted shares in Europe. The German DAX and the French CAC indices jumped approximately 0.90% from Monday’s closing level. Focus now turns to the outcome of the European Union foreign ministers meeting on discussions over further sanctions against Russia. Russia’s Security Council is also due to meet.

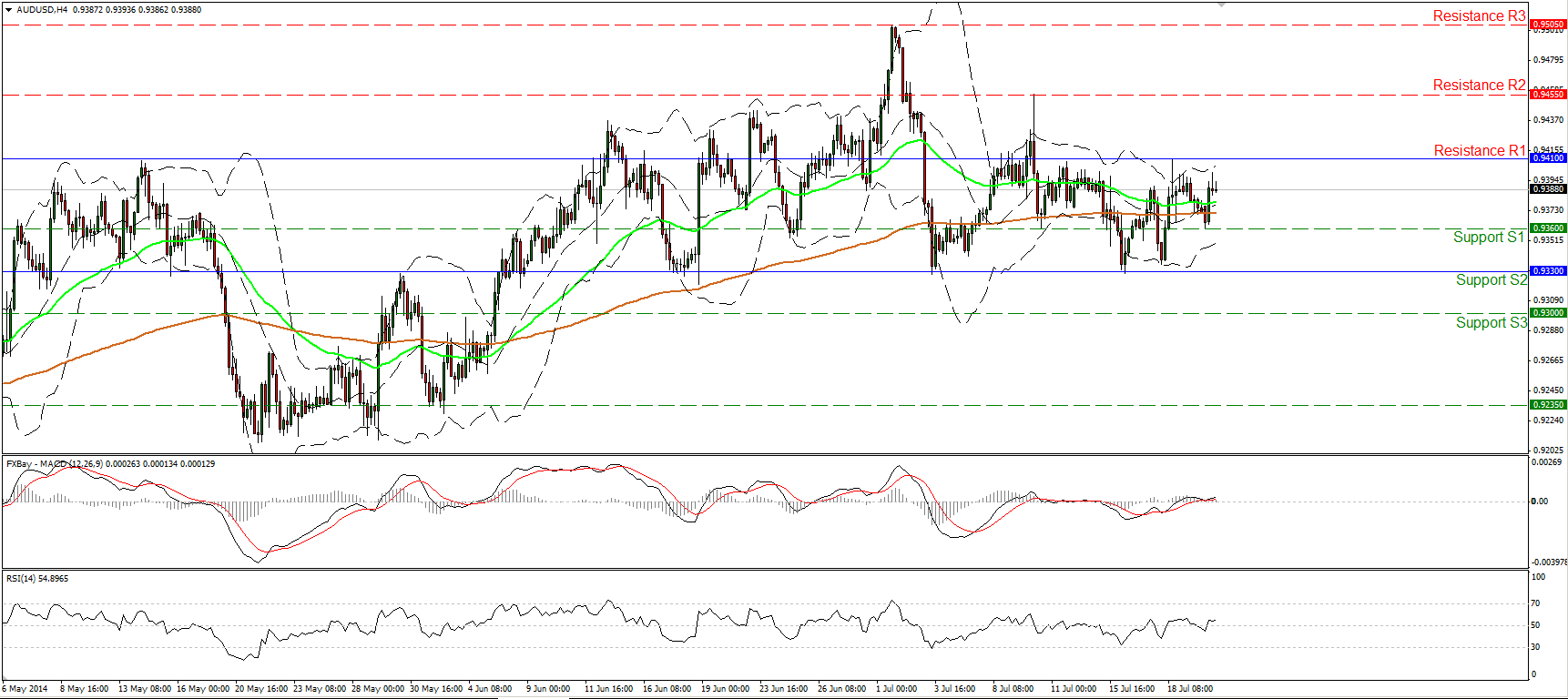

AUD/USD moved higher during the European morning, extending its overnight rally. During the Asian morning, the pair rebounded from 0.9360 (S1) and at the time of writing is heading towards the resistance zone of 0.9410 (R1). The RSI moved above its 50 line, while the MACD rebounded from its zero line, confirming the recent positive momentum. Nonetheless, I would consider the overall near-term path of AUD/USD to be to the sideways, since the price oscillates between the barriers of 0.9330 (S2) and 0.9410 (R1), with no clear trending structure identifiable. A clear move above the 0.9410 (R1) bar is likely to signal an upside exit and see as a first target the next resistance at 0.9455 (R2). On the other hand, only a clear dip below the strong obstacle of 0.9330 (S2) could flip the picture negative. Both the moving averages are pointing sideways, while on the daily chart, both our momentum studies lie near their neutral levels. This confirms the trendless mode of the currency pair and corroborates my neutral stance.

Support: 0.9360 (S1), 0.9330 (S2), 0.9300 (S3)

Resistance: 0.9410 (R1), 0.9455 (R2), 0.9505 (R3)

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.