USD/NOK

The greenback traded mixed against the other G10 currencies during the morning in Europe. It was higher against SEK, EUR and CHF, while it depreciated against NOK, NZD and GBP. It remained near its opening levels against JPY, AUD and CAD.

Today, the Norges Bank decided to keep its benchmark rate unchanged at 1.5% as expected by all 18 economist surveyed by Bloomberg. NOK strengthened nonetheless as the Bank maintained its forecast that it will start raising its key rate gradually after summer 2015 and said that projections for the Norwegian economy show that growth will pick up somewhat further ahead.

NZD was the second-best gainer as the country’s trade surplus rose to NZD 818mn in February, beating market estimates of NZD 600mn.

Sterling was among the winners, after retail sales excluding auto rose 1.8% mom in February, beating market expectations of +0.3% mom. This reassures investors that the consumer demand driving UK growth has not yet run out of steam by any means. There have been concerns that consumer demand would start to slow down as incomes aren’t growing as much as spending is. The fact that retail sales increased so much when the rainfall in some parts of the country was almost 2.5 times the monthly average makes the figure even more impressive.

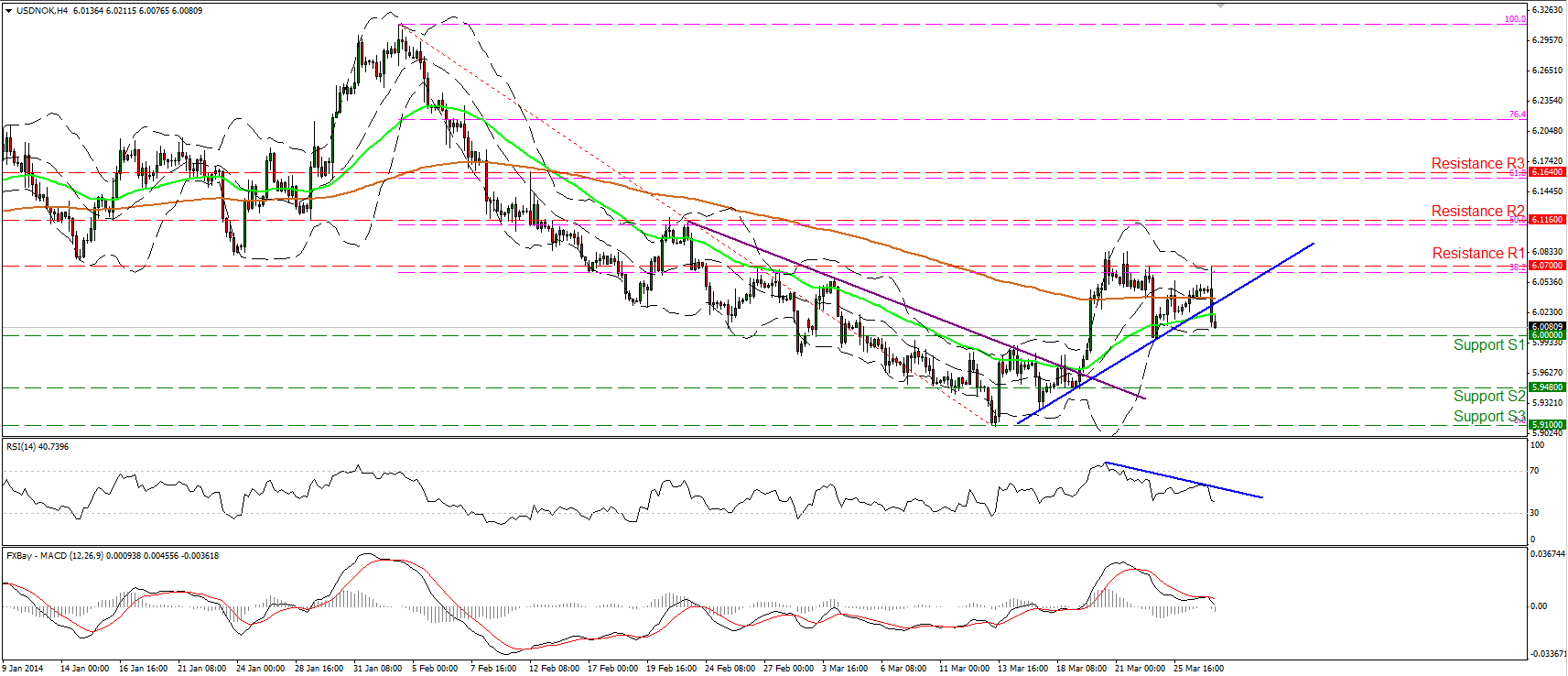

USD/NOK fell below its blue support line during the European morning after finding resistance at the 6.0700 (R1) bar, near the 38.2% retracement level of the 4th Feb – 13th March downtrend. The pair is now heading towards the key support barrier of 6.0000 (S1), where a clear dip may signal the completion of a failure swing and target the next hurdle at 5.9480 (S2). The RSI follows a downward path, while the MACD lies below its trigger line and is heading towards its zero line, where a dip will confirm the negative momentum of the price action.

Support: 6.0000 (S1), 5.9480 (S2), 5.9100 (S3)

Resistance: 6.0700 (R1), 6.1160 (R2), 6.1640 (R3)

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.