USD/NOK

The dollar was unchanged or lower against its G10 counterparts during the European morning, with the only exception being AUD. The greenback traded near its opening levels against SEK, EUR and GBP, while it depreciated against NOK, JPY, CAD and CHF.

The slowdown in China’s retail sales and industrial production for January hit brought back the risk-off picture as AUD is down again while JPY and CHF are picking up.

The data coming out this morning once again passed unnoticed. Sweden’s unemployment fell by a percentage point in February, but missed market expectations of a 2 ppt fall. SEK weakened at the release, but recovered within minutes to trade near its early morning levels. The ECB monthly bulletin held no surprises as it more or less repeated the same phrases that were in the latest policy statement.

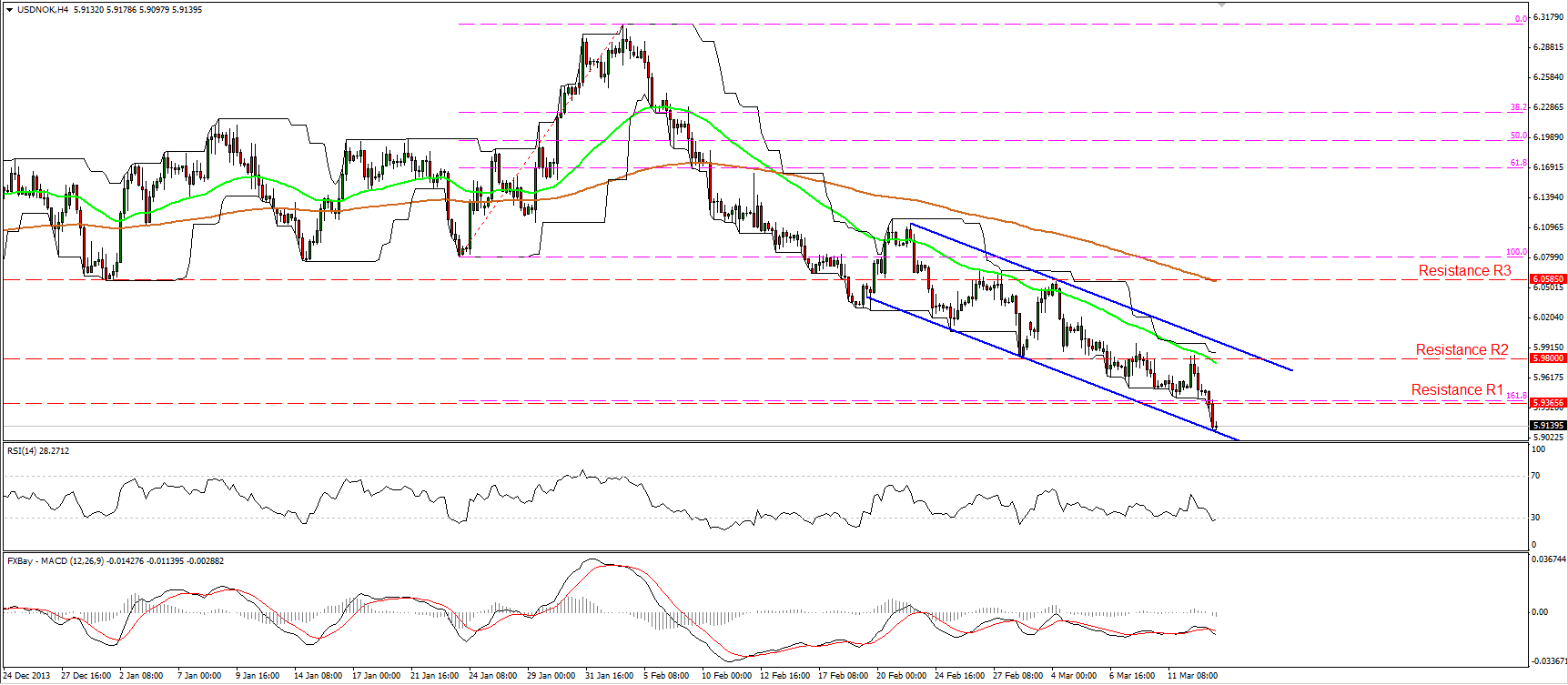

USD/NOK moved lower, breaking below the 5.9365 hurdle, which coincided with the 161.8% extension level of the 24th Jan – 04th Feb advance. I would expect the decline to continue in the near future and challenge the low of 5.8620 (S1), which coincides with the 200% extension. The MACD, already in a bearish territory crossed below its signal line, confirming the strengthening negative momentum. Nonetheless, the RSI seems ready to exit overbought conditions and since the rate is testing the lower bound of the downward sloping channel, a minor bounce before the bears prevail again cannot be ruled out. As long as the rate is trading within the blue downward sloping channel and below both the moving averages, I see a negative picture.

Support: 5.8620 (S1), 5.7330 (S2), 5.6615 (S3)

Resistance: 5.9365 (R1), 5.9800 (R2), 6.0565 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.