GBP/JPY

- The dollar traded unchanged or higher against most of the other G10 currencies during a quiet morning in Europe. The only currency that managed to outperform USD was CAD, while the main losers were GBP, JPY and AUD with the former depreciating the most. The pound fell against the dollar despite moderately GBP-positive news from the Rightmove house price index, which showed an acceleration in UK house prices in February. GBP seems to have hit some squaring of long positions after ending last week as the biggest gainer.

- JPY was the second loser in line, as Nikkei closed the Asian day up 0.6% and all the European stock indices are trading above their opening levels, showing that risk appetite has returned to the markets.

- The only economic data release was Italy’s current account balance. The surplus declined to EUR 1848mn in December from 2828mn in November, but this has no impact on the euro.

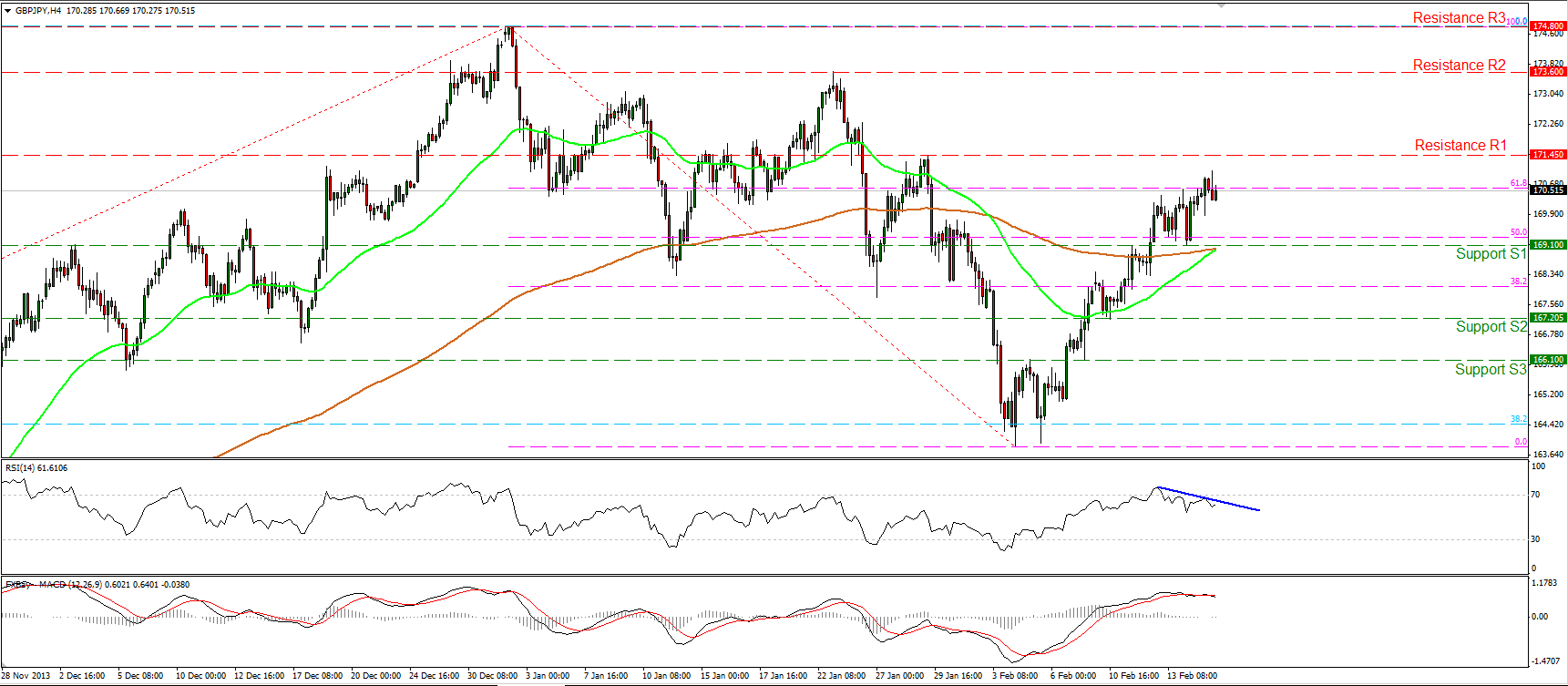

- GBP/JPY consolidated near the 61.8% Fibonacci retracement level of the 2nd Jan. - 4th Feb. decline. A clear break above that level followed by a violation of the resistance at 171.45 (R1) may argue that the aforementioned decline has bottomed and it was nothing more than a 38.2% retracement of the 7th Aug. - 2nd Jan. uptrend. However, negative divergence is identified between the RSI and the price action, while the MACD although in a bullish territory, crossed below its trigger line. This shows decelerating positive momentum and increases the probabilities for a downward corrective wave in the near future.

- Support: 169.10 (S1), 167.20 (S2), 166.10 (S3)

- Resistance: 171.45 (R1), 173.60 (R2), 174.80 (R3)

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.