Silver

The dollar was unchanged or lower against the other G10 currencies, with the main outperformers being AUD, NZD and GBP.

The minor downtrend of the dollar continues, after yesterday’s worse-than-expected retail sales for January and the above-estimates jobless claims, and may extend since the market expects a slowdown in the US industrial production for January and a fall in the preliminary University of Michigan consumer sentiment for February, both coming out later in the day.

During the morning we had the preliminary GDP for Q4 from France, Germany, Italy and Eurozone as whole. French, German and Eurozone’s GDPs beat market expectations, while Italy’s figure came out in line with market estimates and above the rate for Q3. The euro reacted only on Germany’s release by an approximately 20-pips advance.

All the metals were higher with Platinum and silver taking the lead, as disappointing US economic data increased demand for haven assets.

It’s noticeable that the political turmoil in Italy is having no impact at all on the FX market. Last year, when the Italian government fell, it was considered a major risk to the Eurozone, but this year the change in PM is pretty much a non-event for FX. Indeed Italian stocks were outperforming the rest of the European market today, with Italy up 1% midday vs +0.5% for the Eurostoxx 50. It seems that far from increasing uncertainty, the change in government is seen as potentially beneficial for the Italian economy. That would explain the lack of negative impact on the euro.

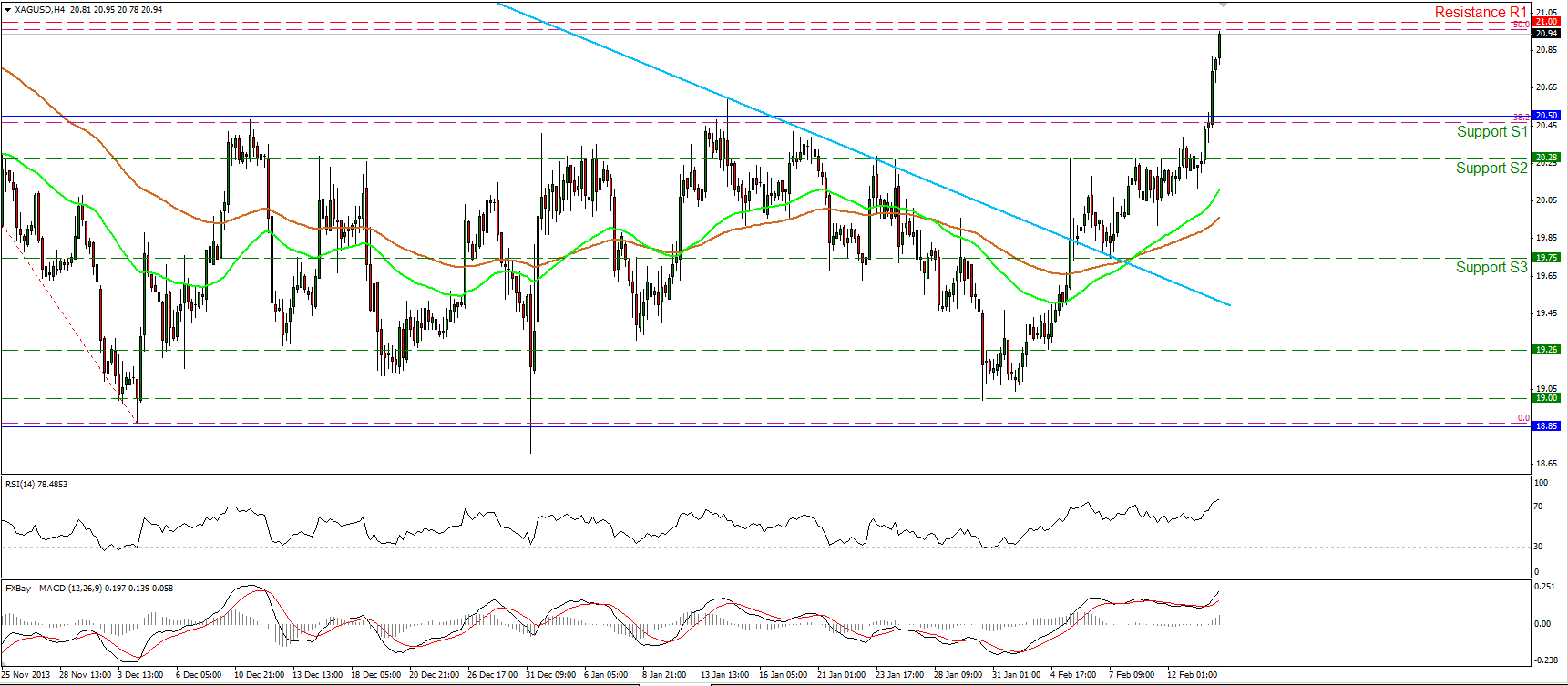

Silver escaped the sideways path that has been trading after bottoming on the 4th of December. The white metal violated the upper boundary of the trading range at 20.50 (S1) and is now ready to test the resistance of 21.00 (R1) which lies near the 50% Fibonacci retracement level of the 30th Oct.-3rd Dec. decline. A clear upward violation of that barrier may confirm a trend reversal and trigger extensions towards the 21.50 (R2) level, which is the 61.8% retracement level of the aforementioned decline and also coincides with the 161.8% extension level of the range’s width. However since the recent rally pushed the RSI into its overbought territory, I would expect some profit-taking in the near future before the bulls prevail again.

Support: 20.50 (S1), 20.28 (S2), 19.75 (S3)

Resistance: 21.00 (R1), 21.50 (R2), 23.00 (R3)

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.