BP Plc

The dollar traded unchanged against most of its G10 peers during the European morning Tuesday.

The New Zealand dollar was the only G10 currency to lose against the dollar, after the country’s biggest dairy exporter reduced its forecast milk price for the 2014/15 season. The drop in price from last season will reduce the collective income of New Zealand dairy farmers by around 1.9% of GDP. Kiwi dropped approximately 0.40% against dollar after the announcement to trade at midday in Europe at levels last seen 10th of June. NZD/USD hit 0.8555 and moved lower. I would expect the decline to test the support barrier of 0.8478 in the near future, marked by the lows of the 9th of June.

BP Plc announced its financial results for Q2 2014. Profits were approximately 34% higher than the same period last year and up 13% from Q1 2014. The company warned however that "if further international sanctions are imposed on Rosneft or new sanctions are imposed on Russia, this could have a material adverse impact on our financial position and results of operations". BP is one of the largest foreign investors in Russia through its 19.75% stake in Russian state oil company Rosneft, one of the entities that is the target of sanctions.

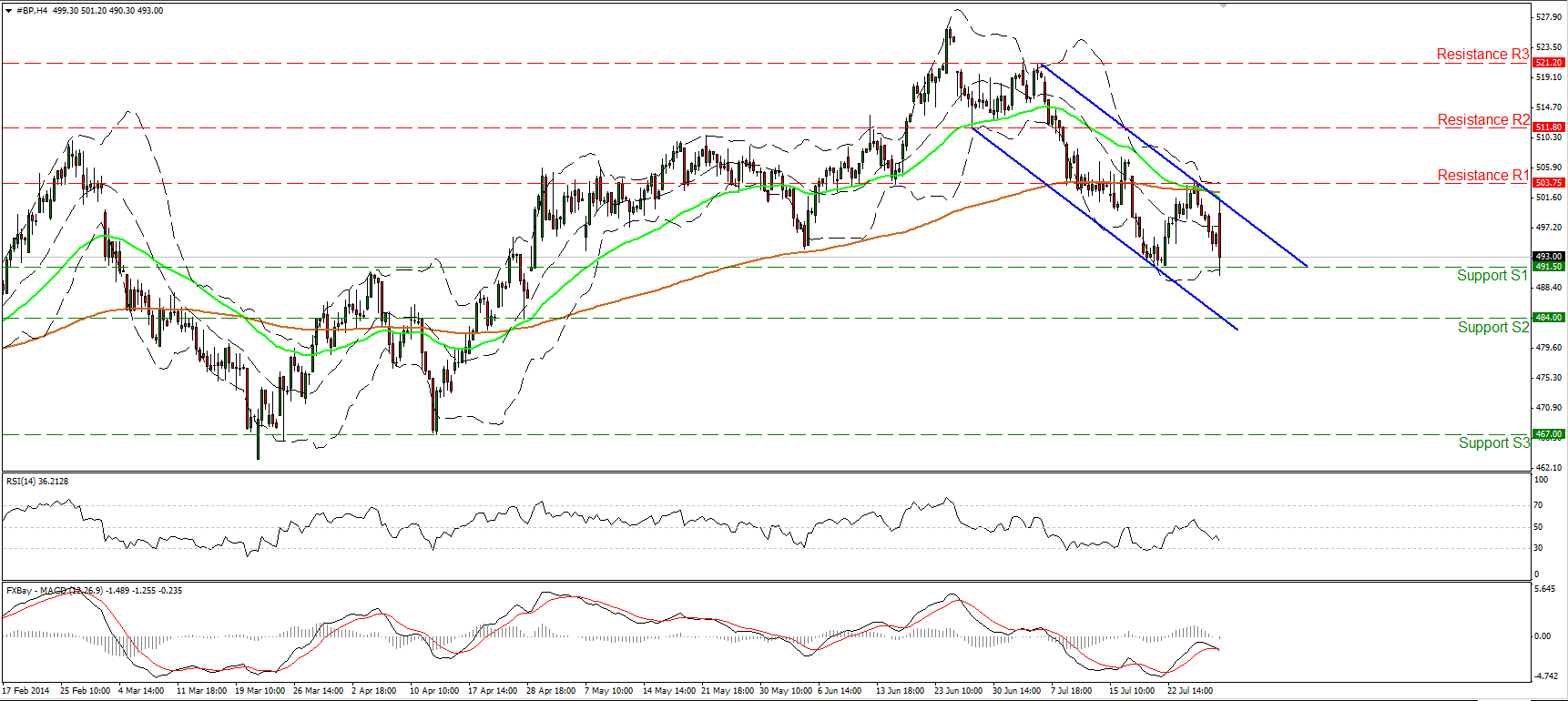

BP shares were down about 0.9% at midday. The decline was halted near the previous low at 491.50 (S1) and the price rebounded somewhat. From a technical point of view, the price has the necessary momentum to move below that barrier, since the RSI lies below 50 and has further to go before signaling oversold conditions, while the MACD, already negative, edged below its signal line. A clear move below 491.50 (S1) could trigger further extensions to target the next support at 484.00 (S2), first. As long as the price is printing lower peaks and lower troughs within the blue downside channel, I consider the near-term path to be to the downside. Moreover, the 50-period moving average fell below the 200-period one, adding to the negative picture of the stock. In the bigger picture, a weekly close below 491.50 (S1) could signal the completion of a possible head and shoulders formation on the daily chart and could reverse the overall longer-term uptrend. The daily MACD remains below both its trigger and zero lines, while the 14-RSI hit its 50 line and moved lower, corroborating my negative stance.

Support: 491.50 (S1), 484.00 (S2), 467.00 (S3).

Resistance: 503.75 (R1), 511.80 (R2), 521.20 (R3).

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.