The Fed squandered much of its hawkish rhetoric Wednesday and market participants continue to ask 'why?' (as they sell the US dollar). If you look at the recent turns in markets many of them can be traced back to late February. It's no coincidence that's when G20 leaders met in China. GBPUSD was stopped out and EURUSD was closed at a profit, leaving us with 4 Premium trades in progress.

Click To Enlarge

We take a closer look at the events since the G20 ahead of a relatively quiet end-of-week session in Asia-Pacific trading.

The day after the G20 meetings China lowered the RRR by 50 basis points in a surprise move. The government followed that up by loosening property lending and creating a TARP-like program to buy bad loans. Shortly afterwards the ECB unveiled a larger stimulus package than almost anyone expected. The RBNZ surprised with a rate cut and now the Fed has abandoned any pretense of hawkishness. Next week the Canadian government will announce a major stimulative budget

The idea that G20 leaders sat down and decided to do more isn't a conspiracy. Ideas like that are what meetings like the G20 are for.

Alone, each central bank decision can be justified but a pattern is forming and it's one we will continue to monitor.

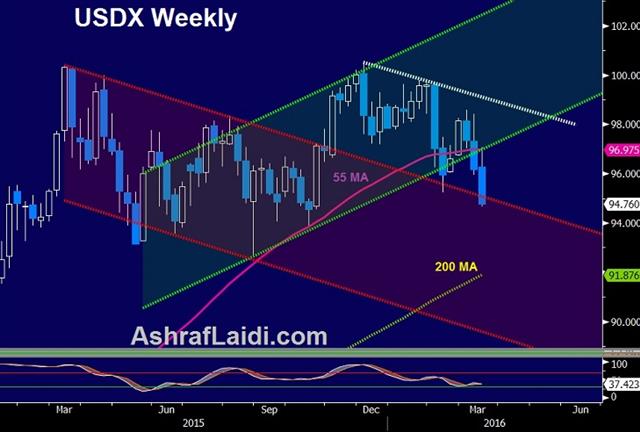

In the shorter-term, the market continues to reel from the Fed decision. The US dollar slumped across the board and only stabilized after USD/JPY fell to a 15-month low of 110.75 and then abruptly jumped to 112.00. There was talk of intervention but a newswire source said Japanese officials had only called around to try and figure out what happened.

US economic data modestly positive. Jobless claims and JOLTS posted a slight beat while the Philly Fed was strong at +12.4 vs -1.7 expected.

Looking ahead, data on Chinese property prices are due at 0130 GMT. It's followed at 0530 GMT by Japanese department store sales. A speech from the RBA's Luci Ellis stuck to regulatory policy and did not touch on monetary policy or the Aussie.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.