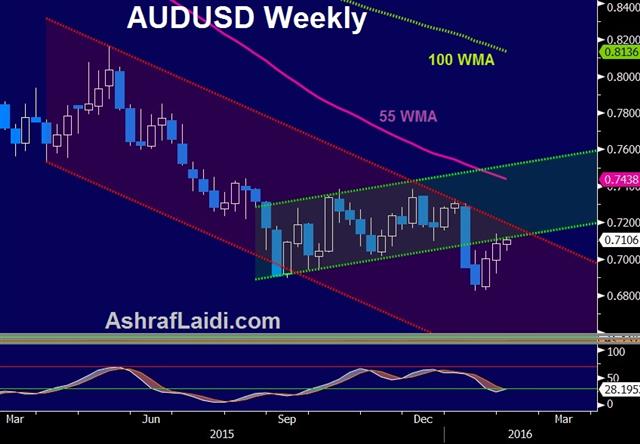

The Fed has suddenly rediscovered its data dependency as part of a slow walk-down from a March hike. The pound leaped higher on Monday while the US dollar lagged. The Australian dollar now moves into focus with the RBA up next.

Click To Enlarge

The Fed won't hike in March so officials are now working to re-establish credibility. Officials have suddenly rediscovered data dependency, which was something that didn't seem to matter when inflation was low and commodities falling in the weeks leading up to the December FOMC.

Less than a month ago the Fed's Fischer was talking about 'something in the ballpark' of four hikes this year. On Monday he said hiking four times was just one number that has been bandied about. He said inflation might be lower and that the Fed is data dependent.

It wasn't overtly dovish but the market senses the shift in rhetoric that will continue at next week's Humphrey Hawkins. The result was a broad slump in the US dollar.

Cable took advantage in a rally as high as 1.4448. That's nearly 300 pips from the low late on Friday and breaks above a recent series of highs to the best level in two weeks.

Most surprising was the Canadian dollar as it gained a half cent despite a 6% drop in oil prices. Flows may have been a factor to start the month because that divergence can't continue.

The commodity currency in focus in the hours ahead is the Australian dollar with the RBA due at 0330 GMT. Expectations for a change in policy are very low so the focus will be on rhetoric. Jobs growth and business sentiment have been resilient, as has the domestic economy on the whole. Stevens likely wants to preserve a dovish outlook, so expect him to emphasize risks from abroad. That likely won't be enough to hurt the Australian dollar and if he takes a more constructive outlook, AUD could rally.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.