The latest economic numbers in Australia point to a stunted economy but there are also signs this could be the bottom. In FX trading on the US Thanksgiving holiday, the dollar didn't get any love as it was the laggard on the day as the yen led the way. Japan's Oct CPI rose 0.3% y/y, beating expectations of 0.2% and previous 0.0%.

Click To Enlarge

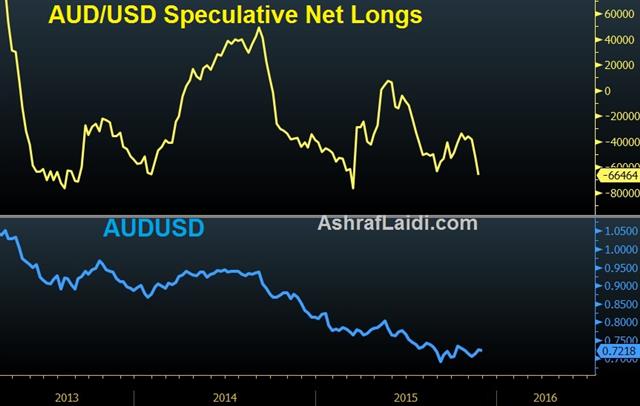

Yesterday's Australian capex numbers were the worst in 30 years of records. Private capital expenditures fell a whopping 9.2% compared to the -2.9% consensus. The immediate reaction was a 40-pip decline in AUD/USD but it's stabilized since.

That's two poor readings for Q3 ahead of the RBA decision on Tuesday and GDP on Wednesday. What's impressive is that the market hasn't shuddered despite such scary numbers. If the Aussie can make it past the RBA and GDP without another push lower, it's a good sign that the worst is behind for the Aussie.

China and commodity prices will continue to be factors to watch but barring surprisingly weak news, the soft hands have probably already exited Australia. Once Q3 is in the rearview mirror, the RBA may look towards the middle of next year and an improvement in the non-mining sector of the economy.

Note that that in Sept/Oct/Nov there has been a series of higher lows in AUD/USD. The employment report was probably a mirage but AUD has been hit by some terrible news including 6-year lows in copper prices and the never ending decline in iron ore. We often ask: If something can't fall on bad news, why should it fall at all?

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.