Is it finally catching up with GBP? The British pound defied gravity during most of the week, shrugging disappointing figures on inflation, retail sales and the CBI trend survey. A somewhat hawkish speech by BoE MPC member Ben Broadbent on Wednesday may have been among the causes behind the gains. The pound even managed to rally against the US dollar on Tuesday and Wednesday ahead of an expectedly hawkish set of FOMC minutes. Eventually, GBP saw the peak on Thursday evening with GBPUSD giving up at the near confluence of the 55-DMA and 200-DMAs at $1.5312 and $1.5336. Unfortunately, our short GBPUSD trade in the Premium Insights (opened on Nov 6) was stopped out at $1.5330, only 6 pips below the high of the week. After that, GBPUSD shed 1.5 cent to settle near $1.5200.

Click To Enlarge

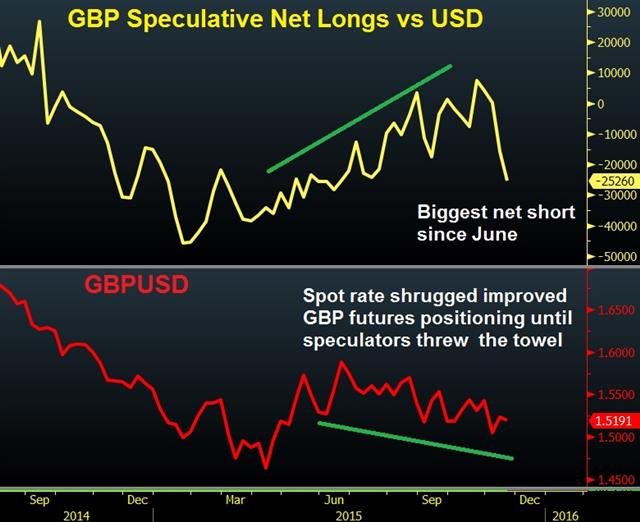

The latest figures from speculative futures' commitment report show sentiment continued to worsen in the week ending on Tuesday, following the 8,500% collapse (from 188 net long contracts to 8,488 net shorts) in the aftermath of aggressive downgrade in the BoE's quarterly inflation report. More interestingly, note the clear divergence between the steadily improved futures positioning since April and the downtrend in the GBPUSD spot rate since late June, which extended until the last two weeks. And just as GBPUSD seemed to mount its own positive divergence, Friday's sell-off happens.

Fortunately, we had two additional shorts in GBP, one of which, was locked in at a gain, the other allowed to progress. As for GBPUSD, a new note/trade will be issued for our Premium Insights subscribers ahead of Tuesday's inflation report testimony by governor Carney and chief Economist Haldane. Stay tuned.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.