We take a closer look at the US oil supply story today after a $2 whipsaw on crude prices as Hurricane Joakim approaches New York. The Canadian dollar got a boost from crude and was the top performer while CHF lagged. Australian retail sales are next.

Forecasts showing Joakim headed towards New York harbor early next week boosted crude early in the day and then new forecasts showing it moving further North reversed the trade. The oil market has a history of kneejerk reactions to temporary supply disruptions from storms but they should be used as opportunities to sell because the dynamics of the US market have changed.

A decade ago, much more of US oil was imported via the Gulf of Mexico, which is always vulnerable to hurricanes. There is a heavy offshore drilling presence there as well. But two factors have made the US oil market far less vulnerable to what happens in the ocean. 1) The rise of Canadian oil exports 2) The explosion of US shale. Storms have virtually zero impact on that production so for the foreseeable future, Hurricane-driven spikes will be opportunities to sell. Premium subscribers will obtain a special pre-NFP edition of the Premium Video at about 21:00 EDT (02:200 BST) to go through selected strategies, existing and new trades.

Click To Enlarge

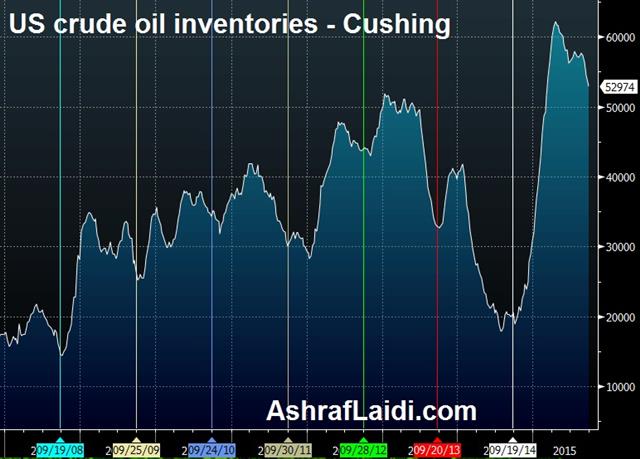

In the bigger picture, US oil storage supplies are virtually overflowing. This is the time of year that US oil supplies at the main hub in Cushing usually trough. As we head into October, refineries shut down for maintenance and to transition to more heating oil and less gasoline. But current supplies at Cushing exceed any pre-2015 point for the past 15 years.

Storage capacity will be maxed out in the coming months and crude will be dumped onto the market at any price. That has severe negative implications for the Canadian dollar and the latest bounce may prove an opportunity to sell.

In the short term, it's the Australian dollar in focus with retail sales at 0130 GMT and expected to rise 0.4%. Interestingly, October is seasonally the best month of the year for the Australian dollar and one of the worst for CAD.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.