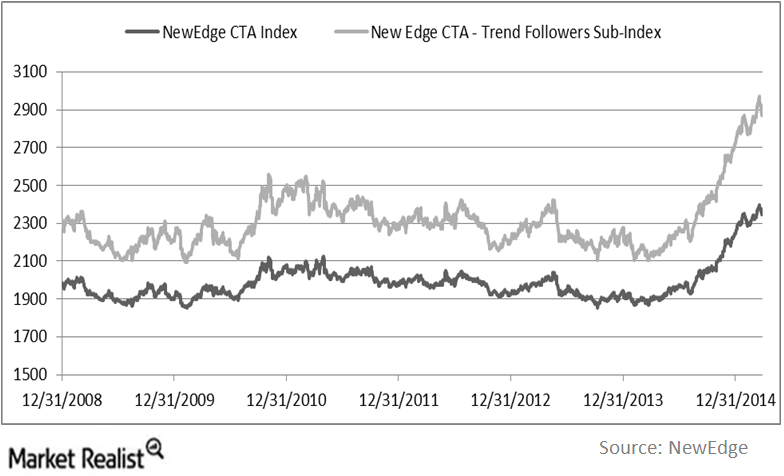

During trend following markets, it may be worthwhile to look at CTA (hedge funds) who follow trend following strategies. We use the NewEdge published trend indicator. Hedge fund observers understand that performance can be as cyclical as the markets themselves. The key driver of fund performance is rarely just skill. It’s driven by market conditions benefiting one type of strategy over another. Their performance also serves as an indicator. It reflects whether the market is changing. It also reflects the types of strategies that have the best chance of continuing to work. Capital3x Trade Copier has closed 117% return and is consistently outrunning market. This proves that trend following strategies will benefit traders.

Understanding CTAs

CTAs are generally thought of as systematic, quantitative funds that employ a lot of PhDs and data scientist types. No matter how well these guys map out markets, their “alpha” turns positive when strong directional trends develop. This is what allows them to systematically employ market making strategies that turn “easy” profit by adding liquidity at mathematically predetermined bid-ask levels. This is also what allows their trend following systems to work. They’re highly quantitative funds that perform best when trends are strongest to either the upside or downside. They’re able to participate in many different types of markets including global equity indices, commodities, and fixed income—the list goes on. It’s important to notice that their performance waned after 2009. This was primarily due to quick shifts in trends. The marketplace was finding an equilibrium after the Great Recession.

Global trends

Post 2012, Global trends have picked up and established. Infact in 2014/2015 global trends are at their strongest—whether the trends are positive or negative. Strong trend die hard. Strong triggers are needed to stop such trends. Currently there is nothing that can stop this trend. The likelihood of continuation is high. What can stop it? Will global central banks suddenly stop easing? Will commodities suddenly revert in a meaningful way? Will Putin and Greece announce that they’re Buddhist?

Current trends have been dominated by global easing. It pushed the dollar higher, but at maximum velocity. In turn, this poured fuel on the oversupplied commodity markets’ fire. It pushed them even lower. This continues to place a cap on inflation. Since the Fed is closely watching inflation as a signal to raise rates, current monetary policy will be here for a bit longer. Meanwhile, central banks around the world are easing at unprecedented levels. They’re all hoping for the same thing—an American style boost to their economy.

The effect of these prolonged policies and macro trends will continue to determine clear winners and losers. There will be some elements of risk sprinkled in. Mainly, this will involve geopolitical risks coming from Greece, Russia, and the Middle East.

Conclusion

Our clients will take cue from this and continue to invest in trend following strategies. We believe strong trends die hard and therefore there may be steam left in the current trends established.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.