We chart forex pairs like USDJPY and AUDJPY and provide the reasons for trades. Other pairs being analysed today are:

EURUSD,EURJPY, GBPUSD, GBPJPY.

Our clients have always been at an advantage as we provide high quality analysis from the world of intermarket. Our trade copier performance over the last 1 year speaks about our analysis and its importantance for traders.

Dollar Index

Dollar Index may finally be exhausting its mega uptrend which began in Aug 2014. The weekly charts indicate a bearish reversal with the prices next targeting 95.2.

DXY weekly

The weekly trends have a large bearish reversal (which often precedes large trend tops). The US inflation is still low with chances of breaking into shallow dis-inflationary zone. US inflation is still below the Fed’s target

The above chart compares the PCE total versus the PCE core—it excludes volatile food and energy costs. The Fed’ target inflation rate is 2%. It tracks inflation through the PCEPI. As of January 2015, the core personal consumption index was 1.3%. The total personal consumption index was 0.2%.

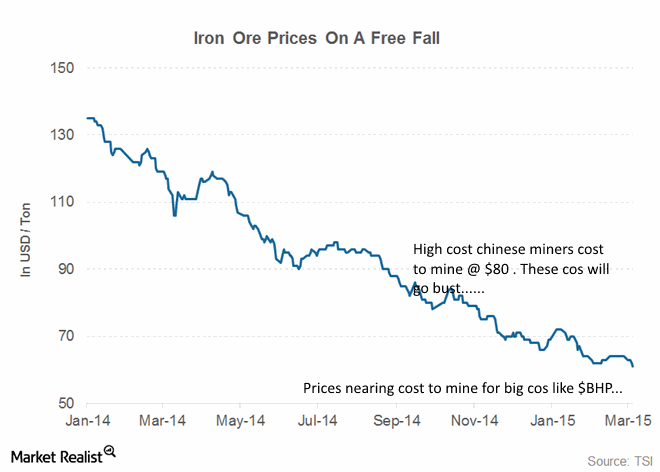

OIL

Oil has broken below $50 and is sitting comfortably with no signs of a bounce. This suggests that price may dip to $40 as well but the speed of fall may now extend over months. The fall in oil prices will start having larger repercussions in the economy as oil cos start squeezing wages and letting people go thus raising unemployment.

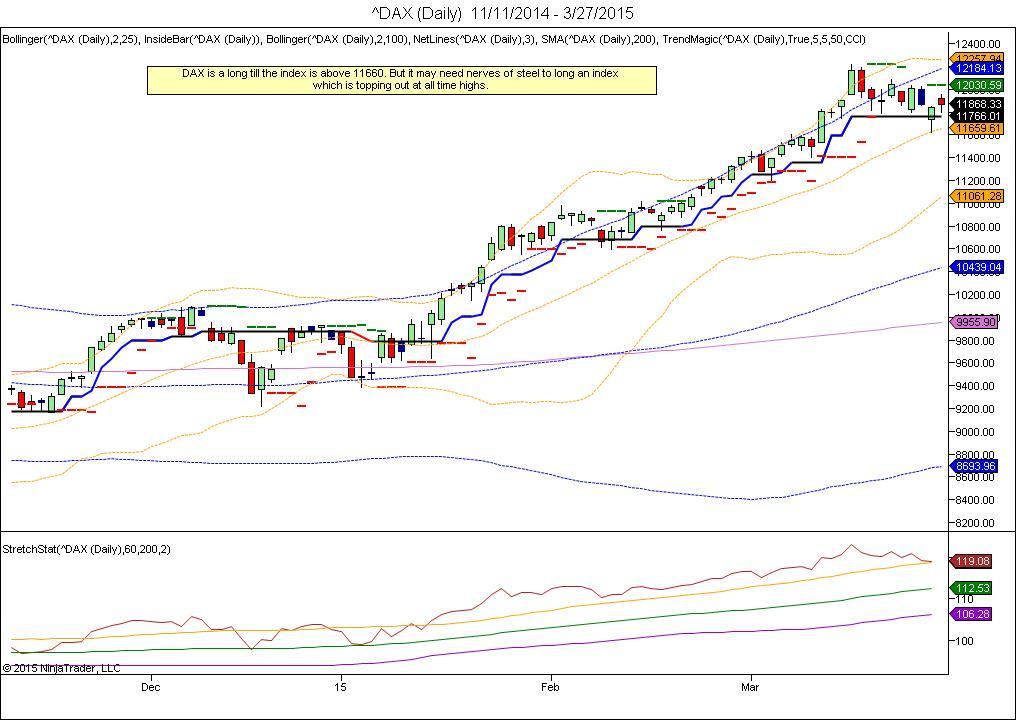

DAX

DAX is a long till the index is above 11660. But it may need nerves of steel to long an index which is topping out at all time highs. The ECB QE may start having a bullish effect on the DAX.

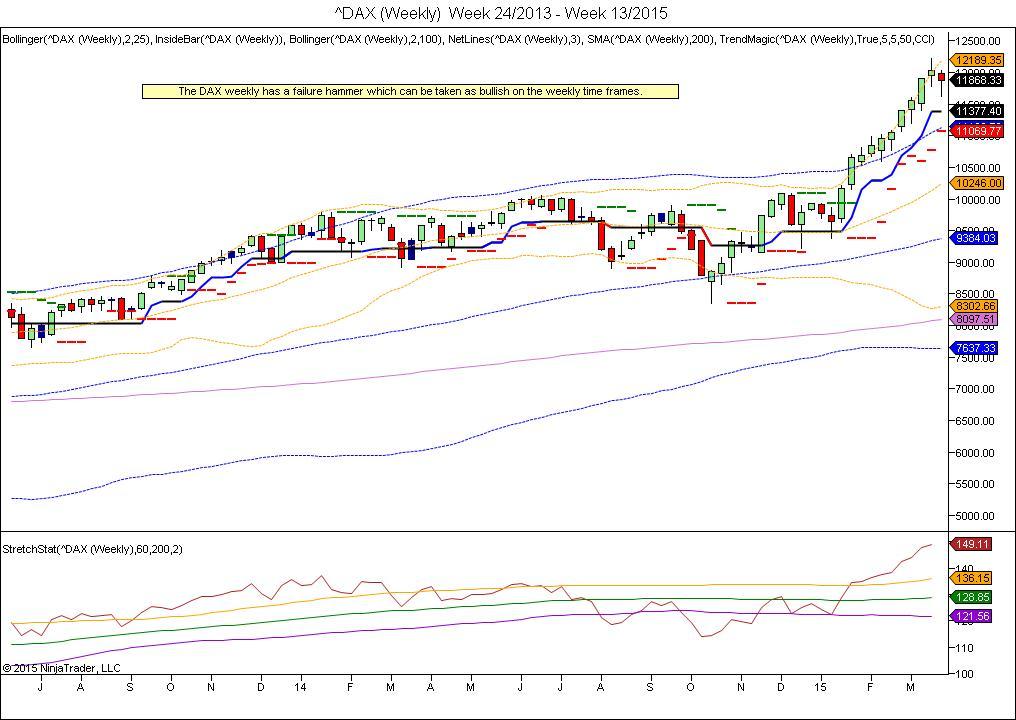

DAX Weekly

The DAX weekly has a failure hammer which can be taken as bullish on the weekly time frames.

Forex Analysis

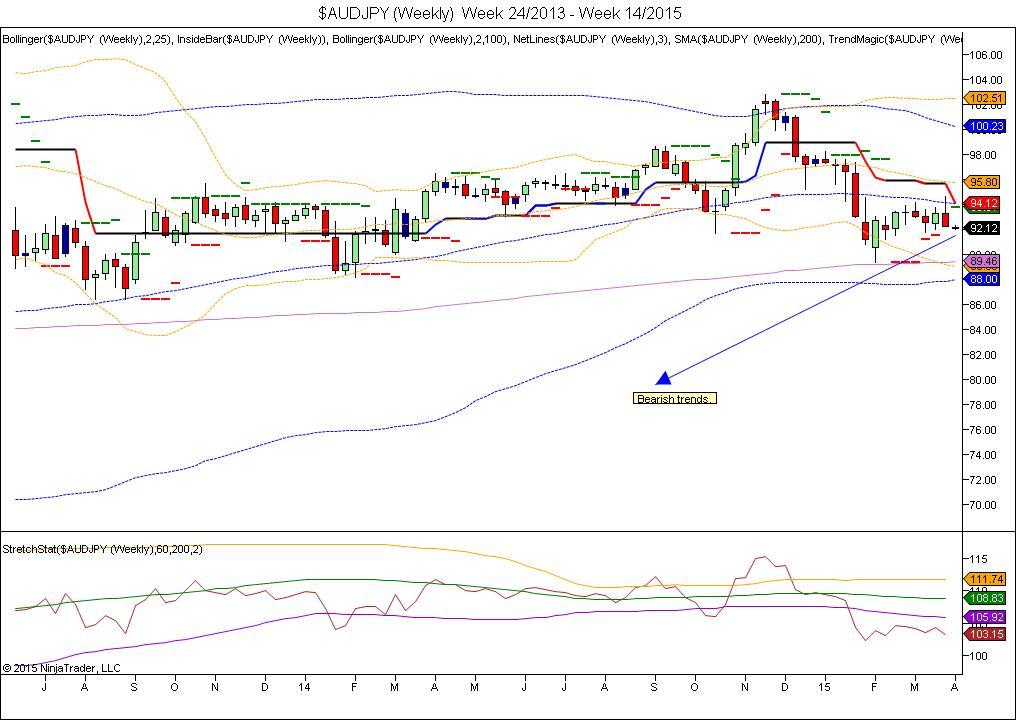

AUDJPY WEEKLY

AUDJPY weekly is in strong downtrend with initial target at 89.5. That is over 250 pips and we suggest to start entering shorts at 92.1 onwards down to 91.5 with stops at 93.1

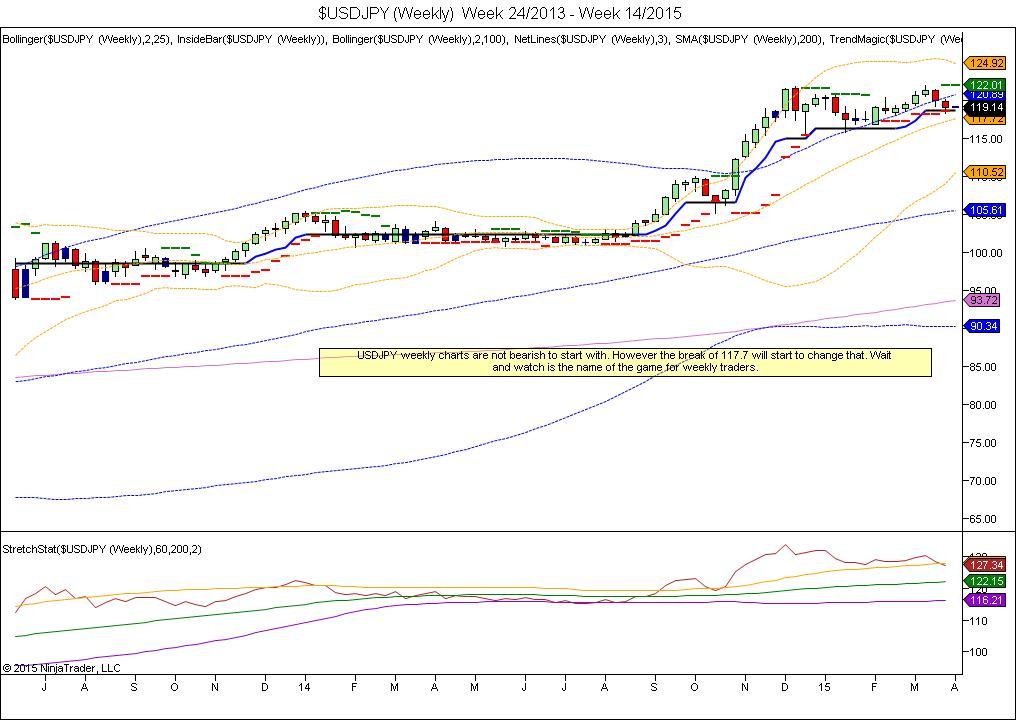

USDJPY weekly

USDJPY weekly charts are not bearish to start with. However the break of 117.7 will start to change that. Wait and watch is the name of the game for weekly traders.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.