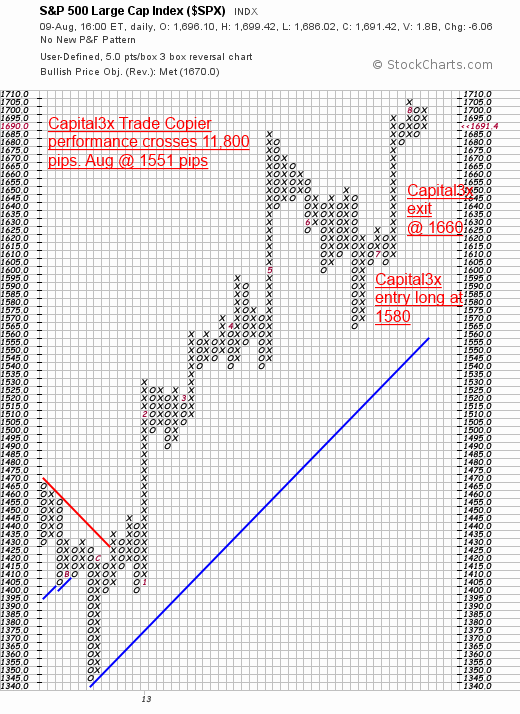

The US equity markets have shot up to all time highs. To us it makes no difference whether it goes to 2000 or 5000 or 1000. Either ways we will be ready as prices confirm a bullish or a bearish break. Currently there is no pattern. However that will change if price dip below 1680 which will trigger a triple bottom breakdown with targets at 1620 levels.

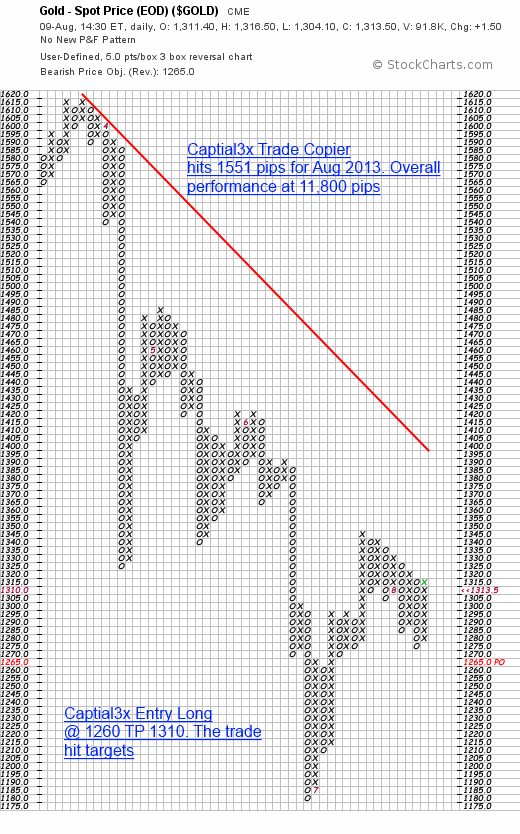

Gold is also confirming a major coil at 1320. We favor the upside though there is no definite confirmation yet. However a break of 1340 will be your signal for a bullish move. Targets will be updated as and when the break happens. Be present in the Live trade room as Gold charts are closely likely to US dollar index.

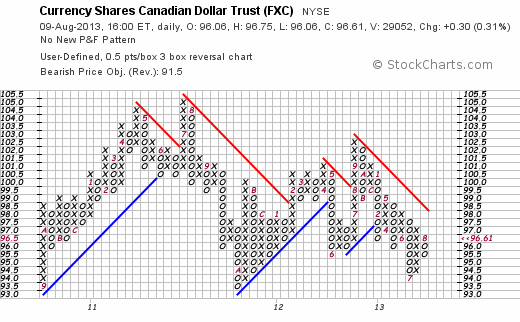

The Canadian Dollar is also coiling at 96 having lost the desire for a move to 91.

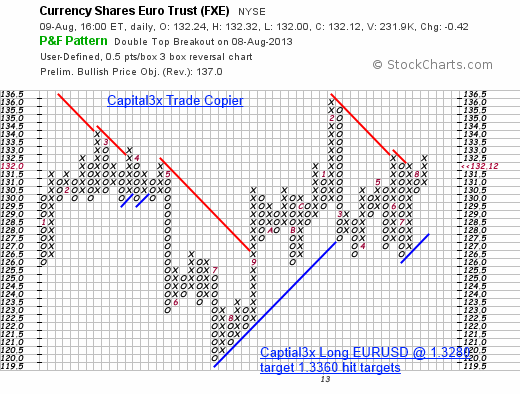

The Euro index is the major breakout target. On friday it posted a fresh double top breakout with next target at 137 which is over 400 pips away. However as you would have noticed, in between lies the 1.3440 which is a monthly confluence of moving averages and hence heavy resistance expected which could through the index back to 1.32 before a go for 137 levels.

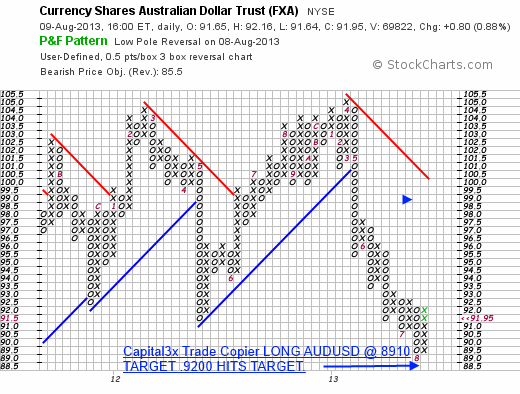

The Australian dollar has posted a low pole reversal and hence has put all the bears on notice.

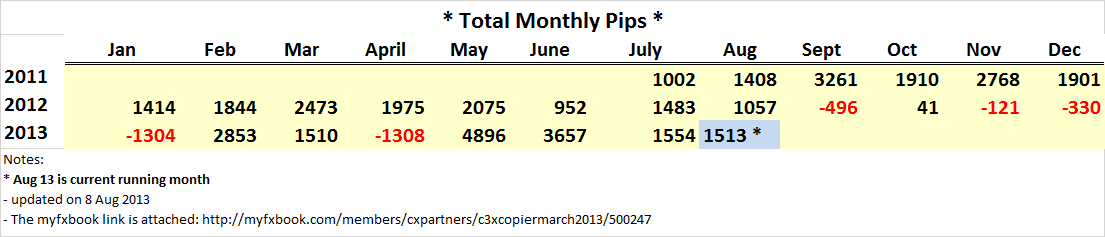

Capital3x forex signals performance

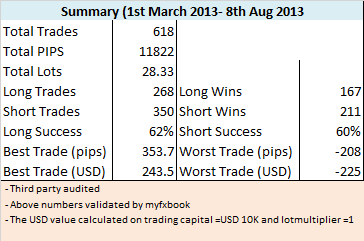

Capital3x forex signals have led the industry with the forex managed account closing +1500 pips in August 2013. The performance comes at a 82% success hit which is the highest in the forex hedge fund industry.

Capital3x forex signals have led the industry with the forex managed account closing +1500 pips in August 2013. The performance comes at a 82% success hit which is the highest in the forex hedge fund industry.  Overall performance for 2013 has already crossed 11,000 pips and in dollar terms has crossed a return of 50%. The returns vary with trading capital and leverage. All signals are automated and hence well monitored and controlled.

Overall performance for 2013 has already crossed 11,000 pips and in dollar terms has crossed a return of 50%. The returns vary with trading capital and leverage. All signals are automated and hence well monitored and controlled.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.