Sharing todays charts and setups with trading subscribers of fxstreet. The update was sent at 4 pm GMT so consider charts and timing on the chart in that perspective.

Welcome back to our daily analysis and charts. Given am watching the markets and after a run like the one we have had over the last 10 days, it is highly prudent to take your mind off and give it the rest it needs.

Please continue monitoring the myfxbook link of the trade copier which is also a replica of the tradesheet. MYFXBOOK Capital3x

Todays charts

EURAUD is running into 200 SMA at 1.2873. There is a high probablity of reversal at 1.2873. So keep a stop at 1.2880 and short EURAUD for 1.2802. It is difficult to trade on the long side given the next resistance level is at 1.2906 which is the upper BB of 100 SMA. But technically the vortex and stochastics are bullish which is always the case when a pair is at a reversal point.

AUDUSD is below the lower BB of the 100 DMA. This is under normal circumstances an extremely great setup to be short but I would like to see some more tests inside of the bands to 1.0240 and see if this move is for real. The point and figure charts have a target at 99 which corresponds to 1.00 for AUDUSD so we are on course here.

ES 60 min charts is interesting. The 50 SMA is bending down at 1493. A clear will take it flying to 1501 100 SMA. The Netline sell is at 1491 thus break below will mean test of 1480. This is a triangle consolidation and can break either ways. I favor 1509 which is the 200 SMA.

ES 60 min charts is interesting. The 50 SMA is bending down at 1493. A clear will take it flying to 1501 100 SMA. The Netline sell is at 1491 thus break below will mean test of 1480. This is a triangle consolidation and can break either ways. I favor 1509 which is the 200 SMA.

USDJPY is making a floor so expect a move soon mostly likely higher if 91 holds. The level on

upside is 92.21 (50 SMA ) and 92.82 100 sma. The pair has no momeuntum which means you can wait for a break of 92.2 to load longs.

EURUSD is showing signs of break of 50 sma at 1.31 with next target of .3145. Do not jump in yet. That 50 sma was bending down which means the prices will be attracted to it with frequent dips below so if you are scalp trader then wait for 1.3090 to go long with stops under 1.3068 net line and 25 sma.

EURUSD is in a strong downtrend on the daily. It will take time and effort to regain 1.3395 again which is the level needed for regain bullish pressure. The stochastics are bearish while vortex has a bearish crossover since 1.3286. The 50 DMA is at 1.3290 and the 100 DMA is at 1.315

DX 60 charts are set to test 81.609 which will coincide with eurusd testing 1.3150 The dollar index is still strongly bullish on daily charts but on intra day basis you have a nice scalp setup.

DX Daily has the upper BB at 81.412. Be careful of this level as it is the upward bending BB of the 100 DMA.If the dollar index does retraces to 81.4 then consider being long with decent positions. I suspect the level on EURUSD will be 1.317/80. If the dollar hyper bull run is set to continue to 84 and 87 as shown by P&f charts then dx will have to deflect of the upper BB.

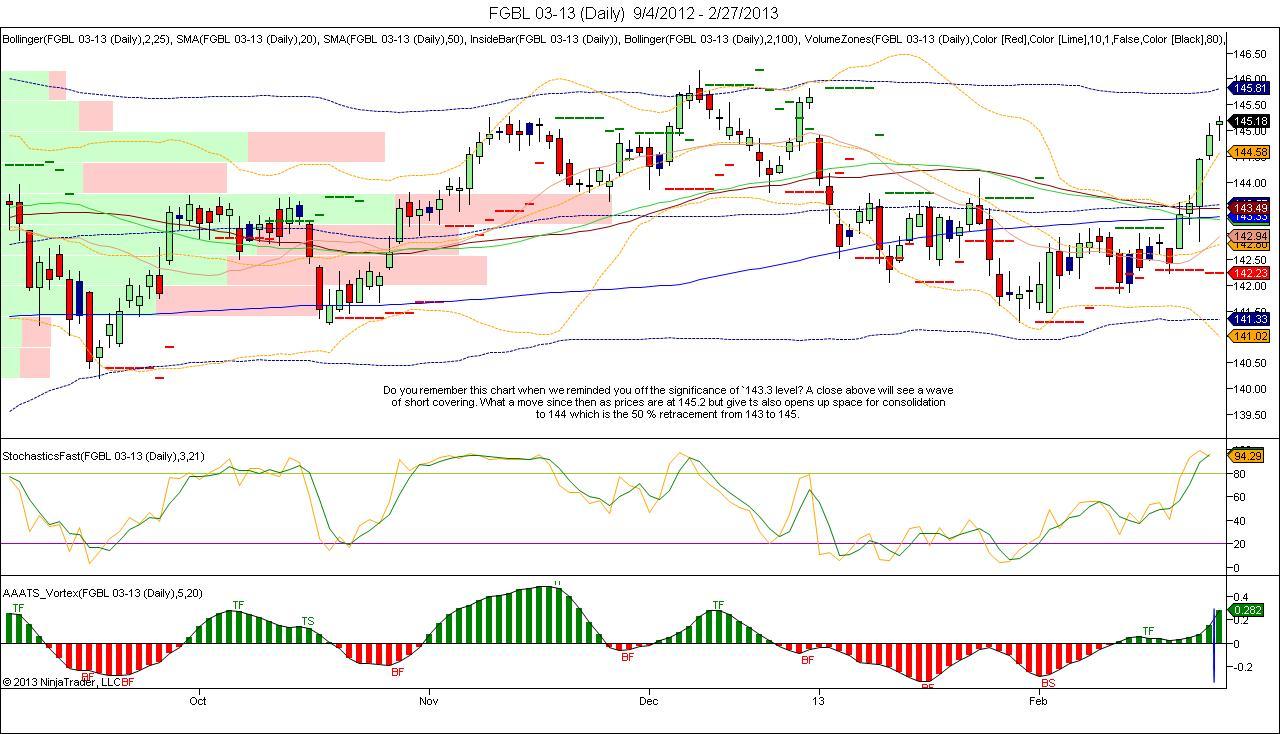

Do you remember this chart when we reminded you off the significance of `143.3 level? A close above will see a wave of short covering. What a move since then as prices are at 145.2 but give ts also opens up space for consolidation to 144 which is the 50 % retracement from 143 to 145. Currently there are no setups to trade the bunds.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.