![]()

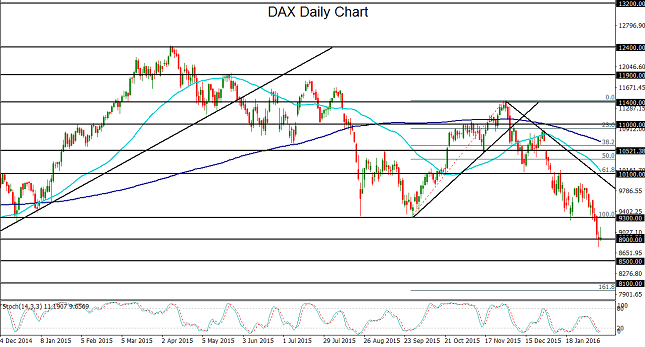

Germany’s DAX index broke down late last week below a major support level at 9300. That breakdown was especially significant because the 9300 level had previously held up effectively for more than 14 months – most recently in August, September, and then three weeks ago in late January.

Prior to that key support breakdown, Germany’s benchmark equity index had been falling in an increasingly bearish trend from the 11400-area highs back in the beginning of December. Last week’s breakdown below 9300 confirms a continuation of the medium-term downtrend from last April’s highs.

Contributing to the DAX’s woes have been a number of crucial factors, including consistently depressed crude oil prices along with slowing economic growth and financial market turmoil in China. To add onto this, the European banking sector has suffered major setbacks recently, and German industrial production was shown on Tuesday to have fallen by 1.2%, severely disappointing consensus expectations of a 0.2% increase.

These factors have helped to pressure the DAX below 8800 at one point this week, a level that has not been seen since late 2014. Having already hit its initial downside target at the 8900 support objective, the index could well have significantly further to fall in light of continuing global stock market volatility and pervasive economic growth concerns.

Technically, the DAX continues to display a bearish trend bias on both a short-term and medium-term basis. On any further extension of the current bearish momentum below the noted 8900 support, the next major downside target is at the key 8500 support objective, followed by the 8100 support level.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.