![]()

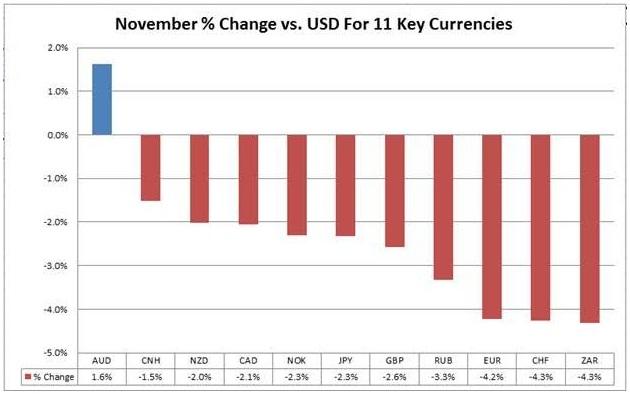

For anyone trading FX through the month of November, the most obvious theme was the resurgence of the US dollar bullish trend. This move was driven almost exclusively by increasing expectations that the Federal Reserve would raise interest rates at its upcoming December meeting, and throughout the month, economic data continually reinforced this view.

The dollar’s explosive November started out with the blowout October NFP report, which showed 271k new jobs created, carried through last week’s solid GDP reading, and was supported by hawkish Fedspeak throughout, to the point that Fed Funds futures traders are now pricing in a 78% probability that the FOMC hikes interest rates in two weeks. While we believe that the dollar’s rally could stretch further in the run-up to the Federal Reserve’s highly-anticipated meeting on December 16, the greenback may struggle in the latter half of the month with the most obvious bullish catalyst behind us and generally slow holiday trading conditions.

Meanwhile, one development that caught a lot of traders off guard last month was the surprise rally in the Australian dollar against all the other major currencies, including the dollar. Even before last night’s optimistic economic assessment by the RBA and solid PMI figures out of China, the Aussie was supported by decent data. The highlight of the month was no doubt the stellar mid-month labor market report, which drove unemployment rate from 6.2% to 5.9% Down Under.

Heading into the month, many analysts assumed that the RBA would be forced to cut interest rates before 2016, but after the raft of strong economic data, some are now suggesting that the RBA’s next move may be to hike interest rates, an inconceivable notion five weeks ago. The Australian dollar’s outperformance last month shows that it’s not the absolute position of central bank policy that drives currency values, rather how the expectations for monetary policy evolve relative to the market’s expectations.

With the Aussie peeking out above a 14-month bearish trend line off the September 2014 highs up at .9400, we could see more short-term strength in the Aussie moving forward, especially if China’s economy shows signs of accelerating once again and/or the price of industrial metals bounces.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.