![]()

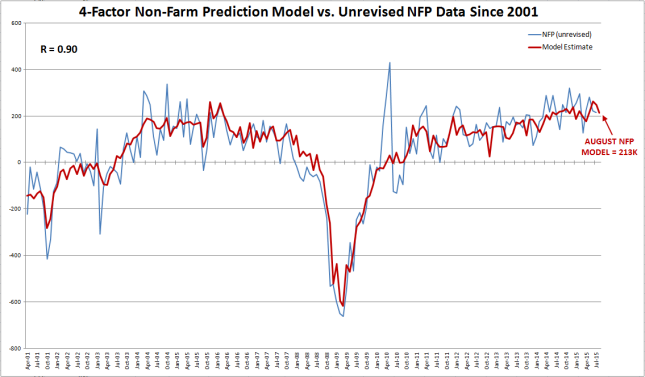

The August Non-Farm Payroll report will be released tomorrow at 8:30 ET (12:30 GMT, 1:30pm BST), with expectations centered on a headline print of 217k after last month’s as-expected 215k reading. My model suggests that the report could meet these expectations, with leading indicators suggesting an August headline NFP reading of 213K.

The model has been historically reliable, showing a correlation coefficient of 0.90 with the unrevised NFP headline figure dating back to 2001 (1.0 would show a perfect 100% correlation). As always, readers should note that past results are not necessarily indicative of future results.

Source: Bureau of Labor Statistics, FOREX.com

Relative to last month, most leading indicators for the non-farm payrolls report have deteriorated slightly. The lone bright (or maybe “modestly glowing”) spot this month was the ADP employment report, which edged up from an initial estimate of 185k last month to 190k this month. Meanwhile, both the Manufacturing and Non-Manufacturing PMI employment readings edged lower, to 51.2 and 56.0, respectively, though they both continue to show growth. Finally, initial jobless claims in the survey week came in at 277k, above last month’s historically low 255k reading, but still at a very low level, indicating relatively few new unemployed Americans.

Trading Implications

Unless you’re far-sighted, things generally become clearer as you get closer to them, but the Federal Reserve’s decision at this month’s highly-anticipated meeting has never been more murky: the central bank seems determined to raise interest rates, at least once, this year, but the latest round of market turmoil and ho-hum economic data has many traders betting on a more cautious Fed.

Therefore, an upside surprise in tomorrow’s jobs report could go a long way toward tipping the scales toward a rate hike ahead of the Fed’s colossal meeting in two weeks, whereas a disappointing report (especially accompanied by weak wage growth) would favor waiting until December or later. Three possible scenarios for this month’s NFP report, along with the likely market reaction, are shown below:

As always, traders should monitor both the overall quantity of jobs created as well as the quality of those jobs. To that end, the change in average hourly earnings could be just as critical as the headline jobs figure. A monthly increase of 0.1% or 0.2% in wages would likely leave many questions ahead of the Fed’s meeting, but a reading beyond that range may be the deciding factor for the central bank. Historically, USD/JPY has one of the most reliable reactions to payrolls data, so traders with a strong bias on the outcome of the report may want to consider trading that pair.

Though this type of model can provide an objective, data-driven forecast for the NFP report, experienced traders know that the U.S. labor market is notoriously difficult to predict and that all forecasts should be taken with a grain of salt. As always, tomorrow’s report may come in far above or below my model’s projection, so it’s absolutely essential to use stop losses and proper risk management in case we see an unexpected move. Finally, readers should note that stop loss orders may not necessarily limit losses in fast-moving markets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.