![]()

It’s been a tale of two halves this morning, first off the market was spooked by a global stock market sell-off that saw stocks plunge to their lowest level in months, and some EM currencies drop to fresh record lows. This move was initially exacerbated by the very weak reading of Chinese PMI for August. This was a flash estimate that saw the Chinese manufacturing index plunge to its lowest level since the peak of the financial crisis in 2009.

So what is driving this move lower, and is it justified?

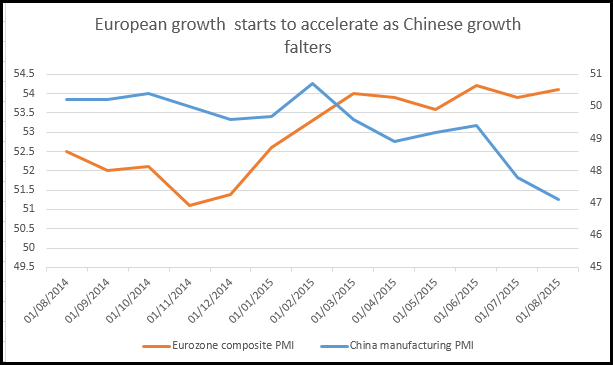

Global growth fears are the chief concern for the market right now. If China catches a cold the higher risk markets like stocks and EM FX are assuming that the rest of the world will catch a cold. However, earlier this morning we had European PMI data, which surprised to the upside. Germany led the surge higher, posting its highest composite PMI reading since April, which pushed the overall Eurozone reading to 54.1, a notch lower than its highest reading of 54.2.

Interestingly, China’s growth slowdown has yet to impact Europe’s recovery story, the UK is also growing at a decent rate and the US is still producing jobs at a 200k per month pace. So why isn’t strong growth in important developed markets cancelling out, or at least neutralising, the negative impact from China?

The reason, in our view, is that the market cannot balance this dichotomy to global growth. On the one hand, a weak Chinese economy could weigh on commodity demand and also throw into doubt the strength of Chinese consumption, which could hurt key export economies like Japan, Australia and other emerging markets. On the other hand, a strong developed economy, particularly in the US, UK, and Europe, could make the prospect of central bank tightening a reality in the coming months.

A toxic mix…

This mixture of Chinese demand slowing, combined with potential central bank tightening in the US and UK, is proving to be a toxic mix for financial markets, but will it be as bad as it was in 2008/09?

We think not for a few reasons, firstly this market turmoil has reduced the chances of a rate hike from the Fed, the Fed Funds futures market is now pricing in a mere 32% chance of a hike next month. Secondly, China has the money to add some stimulus to its economy and make up for the liquidity shortfall even if the Fed does go ahead and hike some-time this year.

If there is one thing that markets like it is liquidity. With the Fed remaining tight lipped on the prospect of a rate hike in the next few weeks, the markets are likely to focus on China and the prospect of more stimulus. Watch out for any injection of stimulus this weekend (China tends to make policy changes at the weekend), they could cut interest rates or even do something more radical such as announce a new stimulus programme. We doubt that China will choose to de-value its currency again, after the turmoil of last week’s de-val, which caused a panic in global markets.

If China does inject some stimulus to its economy then we could see risky assets stage a strong rebound at the start of next week, if it fails to act then we could see a continuation of the decline. So, events in the next 48 hours could determine the tone of markets at the start of next week.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.