![]()

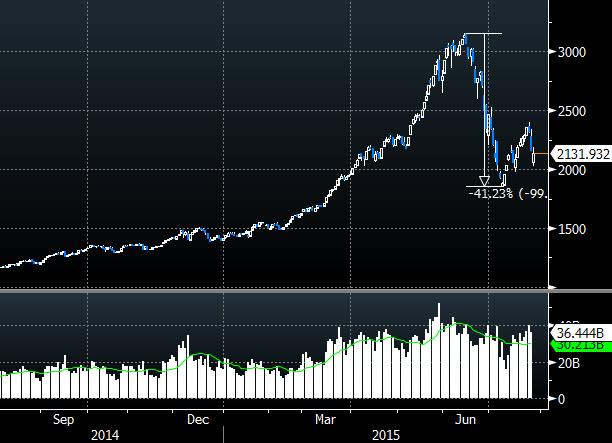

It has been a horrid start to the week for China’s equity markets as the market doubts the ability of Beijing to prevent a rout. The Shanghai Composite recorded its second largest sell-off in history on Monday, despite recent moves from Beijing to prevent such an event from happening. The index fell a staggering 8.5%, its sharpest slide since February 2007 when it fell around 8.8%, as leveraged retail investors fled the volatile market.

The sell-off raises a lot of questions about the ability of Beijing to calm the market. It used everything from conventional monetary policy to actually baring selling by large corporates; the response has also included a ban on short selling and loans to brokerages from the PBoC. However, these measures haven’t been as effective as Beijing would have liked and have caused some capital to leave the markets, largely due to the increased risks associated with investing in manipulated markets.

The sell-off continued today, with the Shanghai Composite down over 5% at one stage before briefly crawling its way all the back to the black. Some market commentators are attributing the bounce back to PBoC-backed funds buying big. Yet, there’s still a huge amount of leveraged and scared capital in the market which could easily run for the exit once more, despite Beijing’s best efforts to prevent it leaving.

From a technical perspective, the Shanghai Composite is nearing support around 2,000, a break of which could see price test this month’s low around 1,865. On the upside, there’s a lot of room between price action and some resistance around 2,400 and then 2,500. In any event, we’re expecting a wild ride for China’s equity markets.

Shanghai Composite

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.