![]()

This weekend’s (g)referendum is going to be a close call, with some opinion polls giving the No vote only a marginal lead, and others saying that it is too close to call. Since this Sunday’s vote is likely to dominate trading action at the start of this week, and since it is the 4th July Independence Day holiday and we won’t send out our usual week ahead, it’s worth examining this vote more closely from a macro and a markets perspective.

What to expect from this weekend’s referendum:

The Greek public are being asked to vote on whether or not they accept the proposals offered by Greece’s creditors on June 26. This requires the electorate to do their homework and know exactly what the proposals offered by the European authorities actually are. I’m willing to risk saying that the majority of the electorate may not know the exact details of the proposals when they go to vote on Sunday, which is why the media is portraying this vote as a referendum on Greek EU membership.

If the Greek people vote Yes to the proposals then Athens will get the money it needs from another bailout, and thus stay in the currency bloc. If it votes No then European creditors have signalled that negotiations will cease and Greece could lose membership of the union.

Syriza banking on a softening in the European stance

The current government is campaigning for the Greek people to vote no to the proposals, saying that if they vote no then Varafoukis and co from the Greek finance ministry can pressure the European authorities into giving Athens a less onerous deal. They are assuming that the European authorities will eventually buckle to stop the break-up of the currency bloc. However, the political opposition heading the Yes campaign argue that European authorities will not buckle and Greece will have to leave the currency bloc if they don’t agree to the proposals in order to receive another bailout.

The political stakes are high. The ruling Syriza government and cheerleader for the No campaign, are likely to lose power in the event that the Yes campaign win. On balance we think that the European authorities will not give in to Syriza demands and the Yes camp is likely to win. Our view is based on the fact that the majority of Greek people want to remain inside the Eurozone and the Greek public may be worn down by the liquidity crunch since the banks were shuttered and capital controls imposed at the start of this week.

We believe that a win for the Yes campaign, and the ousting of the controversial Greek government, would be the most risk-positive outcome from this referendum, while a vote for the No campaign could trigger a panic in the market as the prospect of a Grexit starts to sap risk sentiment.

Greferendum and the market impact:

At this stage the outcome of Sunday’s vote is highly uncertain. We prefer to put together two scenarios to help traders try to make sense of the Greek vote.

A win for the Yes campaign:

This would be the most risk-positive outcome for the markets.

We could see global stocks and risky FX - including the AUD and NZD - rally, while safe havens like the yen, USD and Treasury yields sell off.

We would expect Italian and Spanish spreads with German bonds to narrow over the medium-term.

If these spreads narrow then we could see European stocks rally over the medium-term.

A win for the no campaign:

This would be risk negative and we would expect stocks and risky FX to sell off, while safe havens may rally.

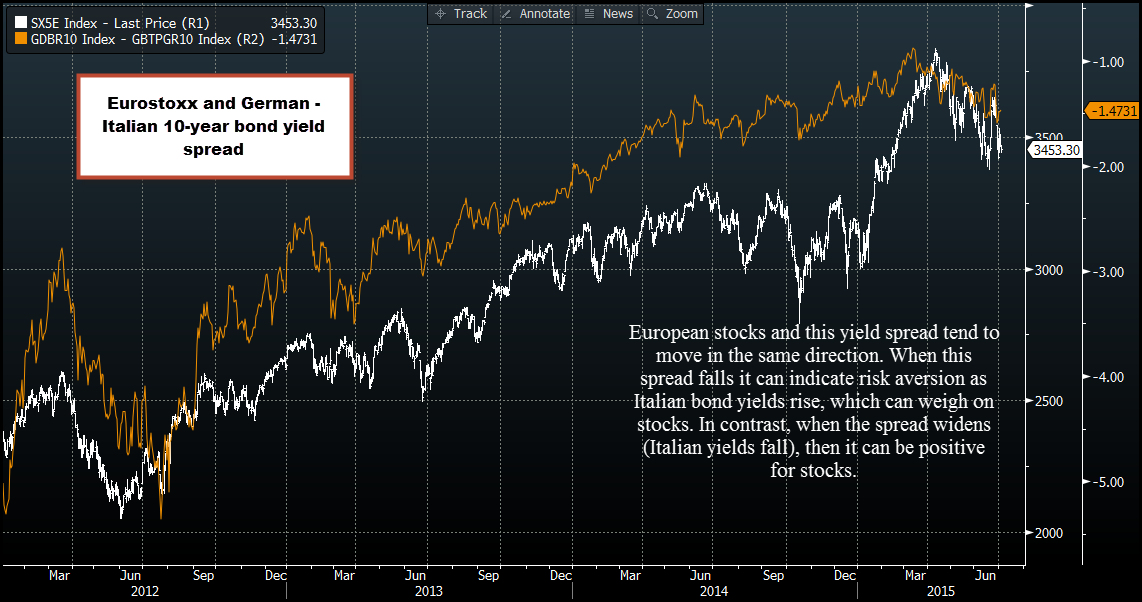

We would expect Italian and Spanish bond yields to rise substantially, which could weigh heavily on European stocks, which tend to move in the inverse direction of yields (see chart below).

Other things to consider:

The ECB is still funding Greek banks, however it is meeting on Monday to discuss ELA funding for Greece and if there is a win for the No camp then we could see funding for Greece’s banks get pulled, which could be the final nail in the coffin for the financial sector, in our view.

Whatever the outcome of this referendum the Greek economy is likely to suffer this year. There is apparently only EUR 500 mn of deposits left in the Greek banking system, without a fully functioning financial sector it will be hard for businesses to grow, or even sustain current orders, and Greece could see its current recession deepen even further in the second half of this year.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.