![]()

In a holiday-shortened week, the US economy is generating quite a few headlines to chew over during the 4th July celebrations. The first is the state of the US labour market. Although the economy created more than 200k jobs for the second consecutive month, the fourth +200k reading this year, there were a couple of things that may sound a word of warning.

Watch for downward revisions:Firstly, the two month payroll net revision saw payrolls get trimmed by 60k, suggesting that the economy is not as good as it looked earlier in Q2. Second, June tends to be the month when payrolls are more likely to be downwardly revised, so there is a chance that the jobs rate was weaker than the headline figure suggested. Third, is the much talked about drop in wages, and last is the fall in the participation rate.

The unemployment rate illusion

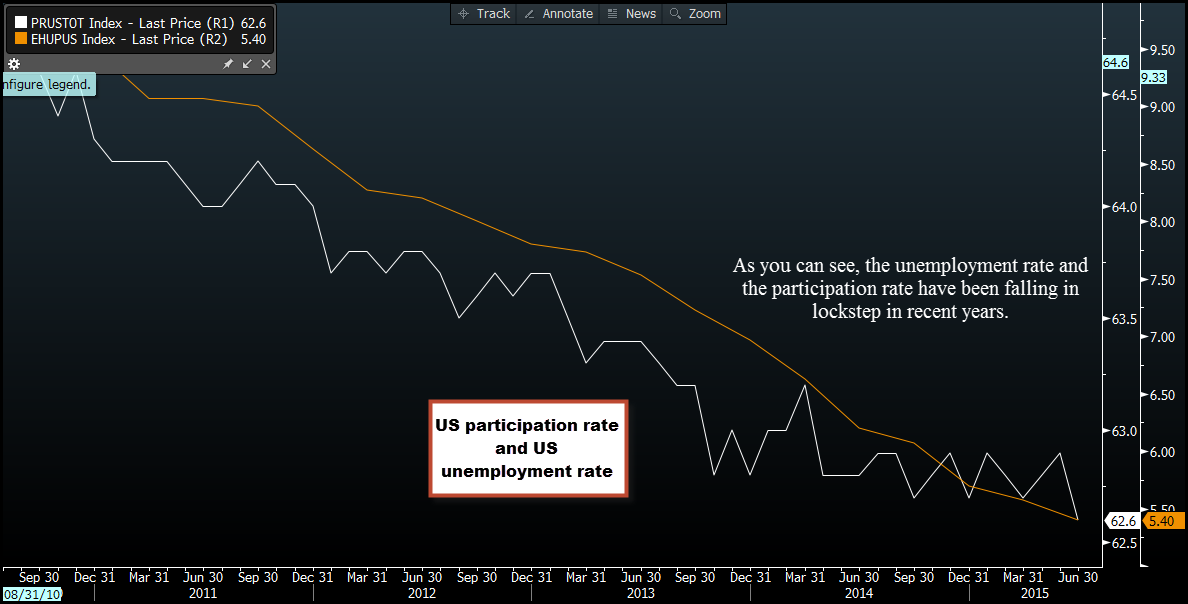

This final point is worth considering. Although the US unemployment rate fell 0.2% to 5.3%, its lowest level for 7 years, the labour force participation rate fell at a faster rate of 0.3% last month to 62.6%, the lowest level since 1977. This means that the number of working age Americans not in the labour force is close to a 40-year high. Sure, some of this can be explained by baby boomers retiring earlier and an older population, but some of it is down to disheartened Americans dropping out of the workforce entirely and no longer even looking for a job.

When the participation rate falls at a faster rate than unemployment it is worth worrying about. This means that the unemployment rate could be artificially reduced – as people drop out of the search for work there are fewer people technically unemployed, making the official rate look better yet some of those people don’t actually have jobs. Maybe the US labour market is not as robust as some had expected.

Where’s wage growth?

One sign that the labour market may not be as strong as the headline figure suggests is wage data. The last time that the unemployment rate was this low wage growth was in the 7-10% per annum range. During this economic cycle, wages are fairly stagnant – only 2% per year – which could limit growth in a consumer-led economy like the US.

This is one reason why rating agency Fitch said earlier on Thursday that the US economy is unlikely to sustain 3% GDP growth in 2016-17. Thus, the US economy may need to get used to a prolonged period of mediocre growth…

Overall, these holes in the labour force are important in the long-term; one of the Fed’s two mandates is to maintain full employment. If the unemployment rate is not telling the whole truth then the Fed may disregard it from their discussion on interest rates, which could ultimately delay their plans to raise interest rates.

Could dollar weakness be here to stay?

The first thing is that rates could stay lower for longer, the second is that the much-anticipated dollar rally from last year could take longer to reappear and may be more shallow than initially thought. A weaker dollar could also have ramifications for stocks and commodity prices as the buck can have an inverse correlation to both of these asset classes. However, a weaker dollar may not be universally good for stock markets as a weaker US economic outlook could also keep the lid on US stocks and global equities with an export focus.

Takeaway:

- The US unemployment rate may be overstating US labour market strength.

- The falling participation rate is concerning, and could be artificially lowering the unemployment rate.

- Rating agency Fitch cut its US growth forecast for this year and does not think that the economy can grow at greater than 3% next year.

- A weaker than expected labour market outlook could keep the Fed on hold for longer than currently expected.

- This could also limit dollar strength, with big ramifications for global financial markets.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.