![]()

It’s a big week for the EUR as economic data and an ECB meeting all take place in the next few days. To kick things off, German inflation data was released earlier on Monday and suggests that the ECB’s QE programme is starting to reap rewards.

German CPI rose by 0.7% on an annualised basis in May, an 8-month high. This is significant for the region as a whole since Germany makes up nearly 30% of the overall Eurozone CPI index. Thus, when tomorrow’s CPI data is released the risk is to the upside. The market is expecting a reading of 0.2% for headline inflation in May, up from 0% in April, but after the German data earlier today market analysts may be scrambling to revise up their forecasts.

What does a stronger CPI reading mean?

Essentially, even if inflation for the Euro-area is above the 0.2% expected, prices will still be very low, and well below the ECB’s 2% target rate. However, it’s not only the absolute level of CPI that the ECB watches; it also monitors the rate of change. CPI has risen from a low of -0.6% in January and could rise above 0.2% a mere 5 months later. If we continue to see CPI rise at this pace then the ECB may start to question the longevity of its QE programme.

Since CPI has had a dampening impact on the EUR, anything that could limit its lifespan could trigger the opposite effect; hence a stronger CPI reading on Tuesday may boost the single currency. In recent weeks the EUR has moved on the back of expectations that the Fed is getting reading to raise interest rates; however on Monday the dovish President of the Boston Fed argued against a rate hike, saying that the US consumer may not be strong enough to withstand higher borrowing rates. This knocked the dollar, and EURUSD tested its 50-day sma resistance at 1.0969, before falling back below 1.09 on the back of stronger US manufacturing PMI.

The technical picture:

Overall, we continue to think that the longer term picture for EURUSD is weaker, although the fundamental developments this week, including the ECB meeting and Greek developments, may end up being EUR positive.

At the end of last week it looked like selling pressure on EURUSD had increased, however, after the comments from the Fed’s Rosengren earlier on Monday, the EUR selling temporarily slowed down. EURUSD is currently getting stuck at the 50-day sma even after the better than expected German CPI, as a stronger manufacturing ISM boosted the USD this afternoon. Thus, we may need a hefty inflation beat on Tuesday to get the EUR safely above this hurdle.

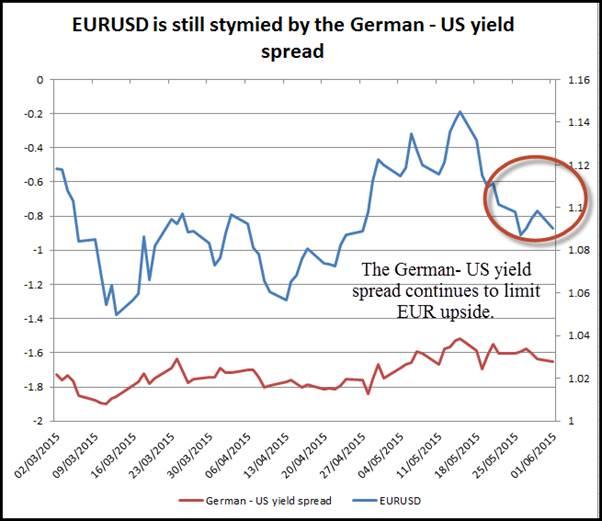

For us to start to get bullish on EURUSD in the short term we will need to get above 1.1006 – the high from 29th May, and then 1.1050 – a key resistance level that has stymied many a EUR bull. Above here opens the way to 1.1091 – the 100-day sma. If inflation misses expectations then we could see downward pressure build on EURUSD and we may fall back below 1.0868 – the low from last week. Overall, at this junction the bias seems to be to the downside for EURUSD, as not even the German inflation data could shift the yield bias away from the USD, as you can see in figure 1.

Figure 1:

Source: FOREX.com

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.