![]()

As we end May in a rather rainy and blustery fashion here in London, the dollar is having a bad end to the trading month. The latest economic data hasn’t helped things; the US economy shrank 0.7% in the first quarter. Although this was less than the -0.9% decline expected, it suggests that the US economy is still under the first-quarter weather-related curse that we saw last year.

The immediate rush to safe havens saw Treasury yields fall and the dollar to back away from recent highs, however, not even this data is enough to dislodge the dollar’s pole position in the G10 FX space for this month.

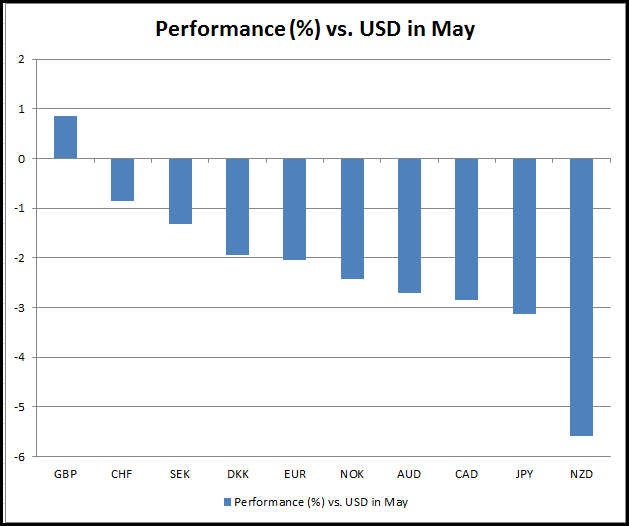

As you can see below, the dollar managed to outpace all of its G10 peers, with NZD suffering the most, dropping some 5.56% to a five-year low vs. the USD, while the JPY fell more than 3%, sending USDJPY to its highest level for 12 years. The pound managed to eke out a gain vs. the USD this month, highlighting how powerful a win for the Conservatives was for sterling.

But, after such a strong performance it is natural to see a bit of dollar short-covering as we move into June, this has been exacerbated by the US GDP data. However, we continue to think that the USD may continue to strengthen for a few reasons:

The Fed seems willing to look through a period of weather-related GDP weakness, and may still raise rates in 2H 2015.

US 2-year Treasury yields are still only 60 basis points, surely this will have to move higher if we get more “hawkish” Fed rhetoric, which could add to the dollar’s attractiveness?

The rest of the G10 are unlikely to hike ahead of the Fed, which should give the USD the yield advantage for some time to come.

How to trade the USD:

We think that EURUSD could prove tricky in the next few days/ weeks, as a “kicking the can down the road” solution to the Greek problem, thus averting imminent bankruptcy, could trigger a relief rally in the single currency.

As you should be able to see in figure 1, dollar strength seems fairly well entrenched and may continue into June. We believe the buck has the potential for further gains vs. the NZD (where the 2010 low at 0.6560 is now key support), and the JPY (where the next key level of resistance for USDJPY is 136.50 – the high from 2002). The pound also looks fragile, especially in light of a potential austerity-led slowdown in growth for the next few years, 1.5155 – a cluster of daily smas could act as key support next week.

Takeaway:

The dollar has triumphed vs. its G10 peers in May.

Although the pound managed to eke out a gain vs. the buck, it has lost steam in recent weeks.

The dollar starts June in a strong position; however, it may struggle vs. the EUR if we get a last minute Greece deal.

We believe the dollar may have further to go vs. the JPY and NZD after breaking through multi-year barriers that could open the way to further strength in the coming days.

The dollar is King for May, and we believe that it can last into June, although gains may not be as broad-based as this month.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.