![]()

WTI crude oil managed to bounce off its worst levels following the publication of the latest crude stockpiles report from the US Energy Information Admiration (EIA), but remained in the red and was on course to end lower for a fifth day. Prior to the release of the EIA report, traders were evidently expecting to see a “bad” number because the American Petroleum Institute’s (API) data last night had indicated that inventories had climbed by 1.3 million barrels last week. The consensus expectations for the EIA number were not overly optimistic either, calling for a decrease of only 1.5 million barrels. However the actual number surprised as it showed, first and foremost, a drawdown, and a relatively sharp one at that: 2.8 million barrels. This was thus the fourth consecutive decline in as many weeks. During this period, oil stocks have been reduced by 11.6 million barrels. The drawdown of 3.3 million barrels in gasoline stocks also surprised but this was somewhat less than the decline reported by the API (3.6 million barrels). So overall it was a bit of a mixed-bag to slightly positive oil report. But for WTI to recover meaningfully, we will need to see further sharp decreases in stockpiles for they still remain near historic high levels.

Preventing oil from staging a more profound recovery was undoubtedly the stronger dollar, which continues to weigh on commodities across the board. The US currency remained in demand after pending home sales jumped by 3.4% in April – much better than 0.8% expected – although it pared its gains as the session wore on. The greenback is beginning to look a little bit overstretched in the short term, so a pullback could be on the cards. If seen, this could provide a respite for buck-denominated commodities in the short term. In the long term however, the dollar could appreciate significantly as the US Federal Reserve looks set to embark on a rate hiking cycle from as early as September.

Despite the sharper than expected drawdown in US oil stocks, the Brent-WTI spread rose back to above $5, having collapsed to a mid-April low of about $4.50 yesterday. Still, this is considerably lower than just a few months ago when the gap was about double this figure. Evidently, traders are surprised by the resilience of US oil, while at the same time they have grown bearish on Brent because of the continued rise in OPEC output. Saudi and Iraq are already producing more oil than is needed and soon Iran could join them if its sanctions are eased further or removed completely. On top of this, oil demand from China could ease if its economy cools down even more. Thus, there is a chance that the price gap may get eliminated completely or even reverse. That said, it is highly unlikely for WTI to trade at a premium over Brent for a sustainable period of time. After all, if US oil stabilises around the current levels then there will be no incentive for shale producers to scale back operations more than they already have. This may mean therefore that the excessive US oil surplus will remain in place for the foreseeable future and thus absorb any small positive demand shocks.

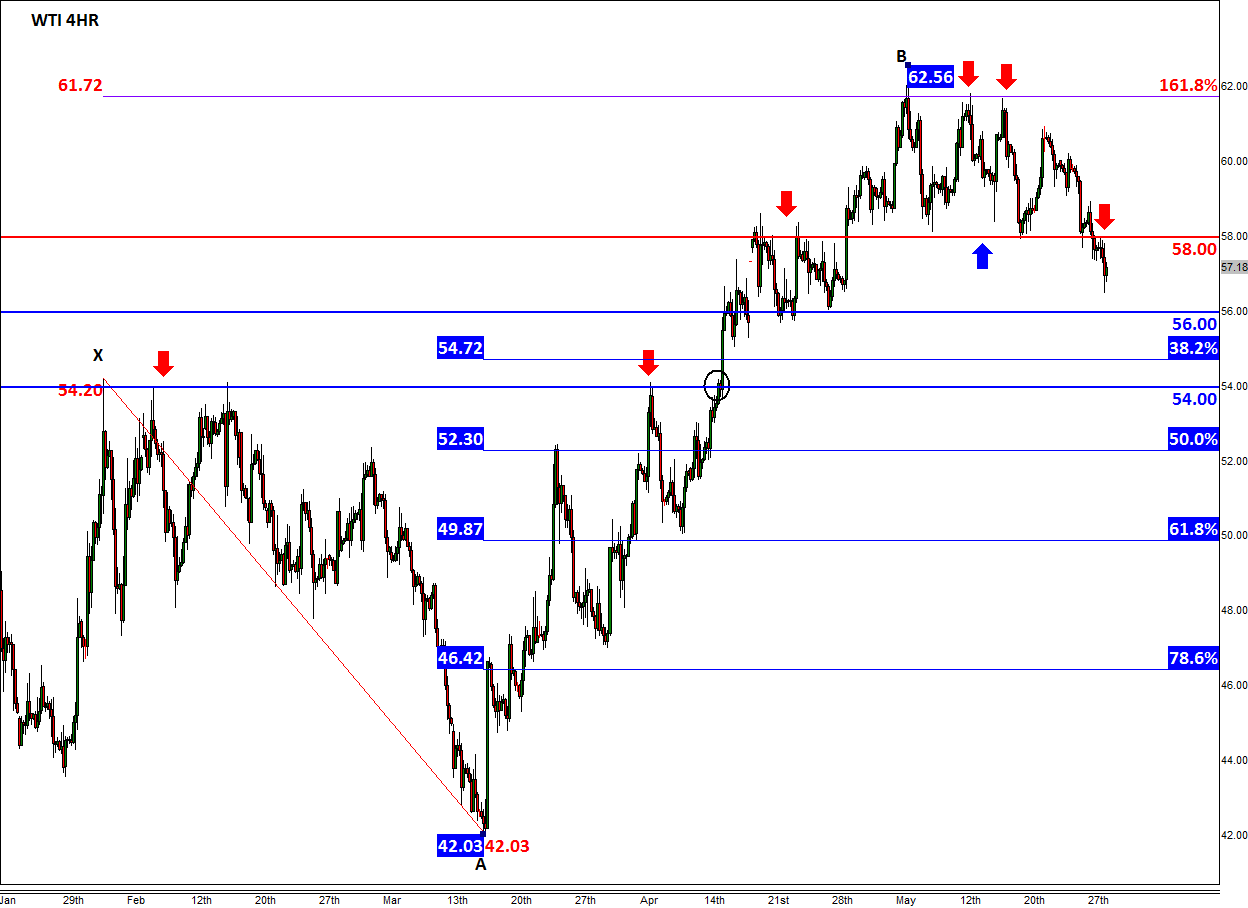

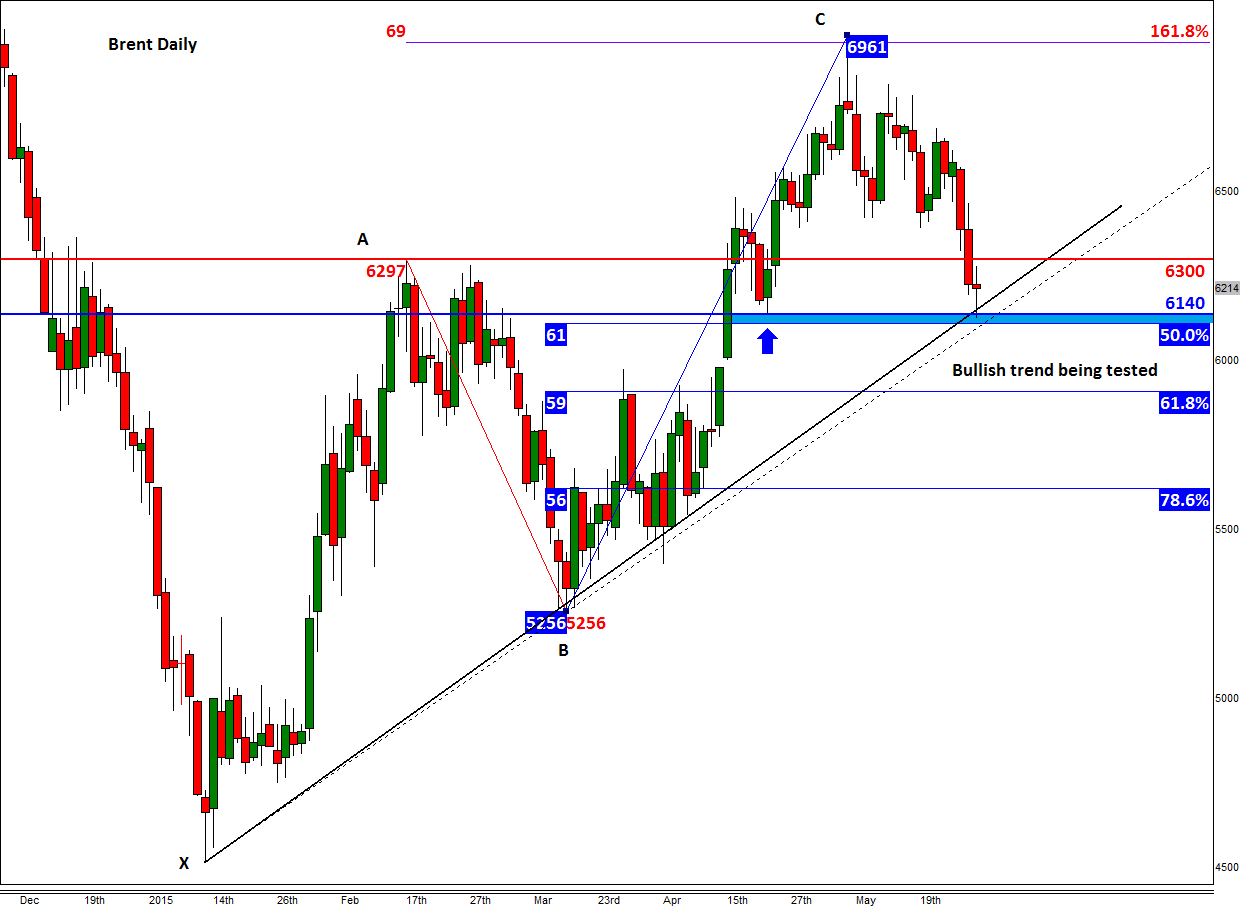

From a technical point of view, WTI remains in danger of collapsing towards support levels at $56 or $54.00, now that $58.00 is taken out decisively. The latter is the key resistance level to watch going forward; our short term bias remains bearish while below here. Brent is now testing its bullish trend line around $61 – it has already bounced off this area. A potential break below the trend line could expose the 61.8% Fibonacci level at $59 for a test.

Figure 1:

Source: FOREX.com. Please note, this product is not available to US clients

Figure 2:

Source: FOREX.com. Please note, this product is not available to US clients

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.