![]()

The crude oil slump has continued for a fourth day in the case of WTI and second day for Brent. Both oil contracts have been weighed down by a sharp rally in the dollar which continues to exert strong pressure on commodities across the board. The greenback has now risen in seven out of the past eight trading sessions. Chiefly responsible for the stronger dollar has been the recent hawkish remarks from the Fed, and – to a lesser degree – a rebound in US macroeconomic data of late. Several Fed members including Chairwoman Janet Yellen have talked up the possibility of raising rates later this year, possibly at the FOMC’s September meeting. But for the dollar to extend its gains further in the near term, the market will probably need to see some more evidence that the economic recovery is really gathering momentum, enough to encourage the Fed to actually raise interest rate at some point this year. Unfortunately, there is not any US data scheduled for release today and the economic calendar for the remainder of the week looks fairly quiet. Therefore, the dollar bulls may decide to take profit on their positions and this could ease some pressure on commodities, at least in the short term anyway.

In the long-term, the price of crude oil will be determined by the actual supply and demand for the stuff. On the supply side of the equation, there is still no clear indication that the global oil glut will be reduced sufficiently enough to cause prices to get anywhere near the $100 level again anytime soon. Although US oil inventories have fallen for a third consecutive week now, this has been mainly due to seasonal factors: refineries tend to process more oil because of increased demand for gasoline owing to the US driving season, which is now underway and kicking into a higher gear. The recent upsurge in oil prices appear to have encouraged shale oil companies to slow down the process of reducing oil production; hence the oil rig count fell by only one last week, according to Baker Hughes. Should oil prices remain around these levels or increase further then production may increase accordingly and prevent the supply-demand imbalance to shrink. On top of this, Saudi Arabia and Iraq are already producing a lot more oil than is needed and there are reports that suggest the latter may flood the already-saturated market with more oil next month. What’s more, the potential full return of Iranian oil is another factor that is not yet priced in. It is also very unlikely that the OPEC will reverse its strategy of defending its market share at the cartel’s next meeting in a couple of weeks’ time and will probably make no changes to the current production quota of 30 million barrels per day (which is not only more than the required target but also a lot less than what the actual production levels have been for many months now). Against this backdrop, the long-term outlook for oil continues to look bleak.

Meanwhile in the very short-term, oil may find some support from the latest inventories reports. The American Petroleum Institute (API) will release its supply data at 16:30 ET (21:30 BMT), followed by the official numbers from the US Energy Information Administration (EIA) on Thursday at 11:00 ET (16:00 BST). These reports are delayed by one day because of the Memorial Day holiday on Monday.

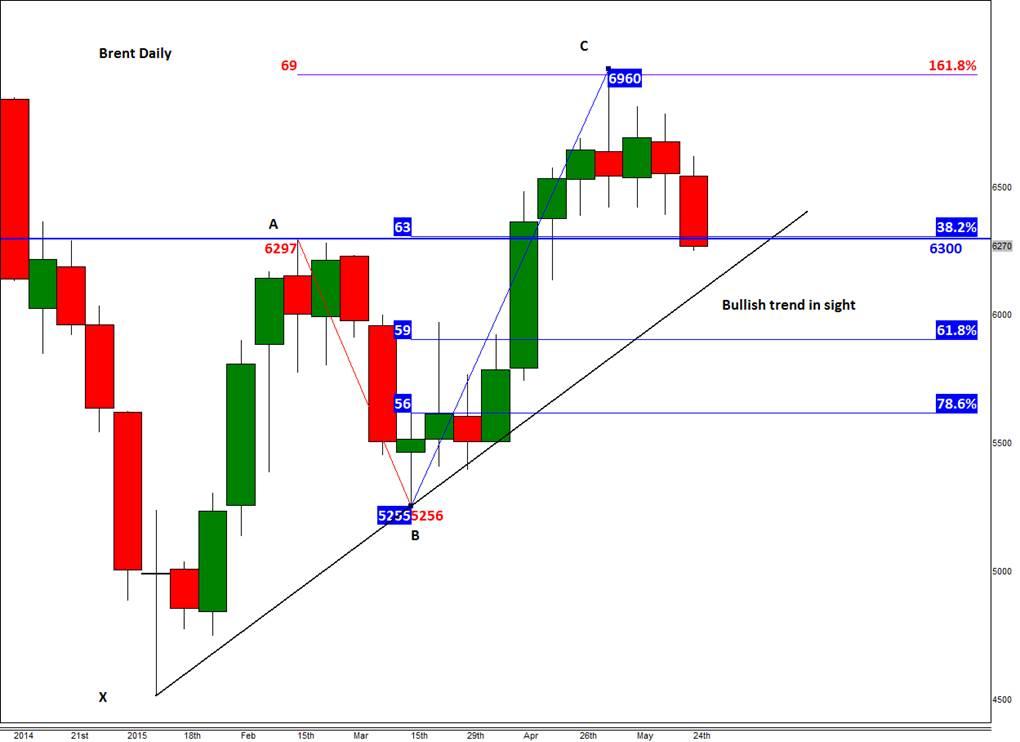

Ahead of the supply reports, the technical outlook for both oil contracts looks a bit shaky. WTI has broken below the $58 handle today, thus eroding the prior support range of $58.00-$58.50. A potential closing break below this range could pave the way for $56 or even $54 next. Brent meanwhile has broken below the key $63 handle. If it also ends the session below here then the bullish trend at just below $61.00 could be the next stop. A potential break below the trend line could then see oil drop to the 61.8% Fibonacci level of the upswing from March (point B) at $59.05. Oil bulls will want to see WTI hold above $58.50 and Brent above $63.00.

Figure 1:

Source: FOREX.com. Please note, this product is not available to US clients

Source: FOREX.com. Please note, this product is not available to US clients

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.