![]()

The timing of interest rate moves from the world’s major central banks is likely to be the key driver of financial markets in the coming months. This could have particular significance for the FX market due to the importance of yields on the value of currencies.

GBPUSD could be significantly influenced by the timing of rate hikes from the Federal Reserve in the US and the Bank of England in the UK. This is because the UK and the US are expected to be the first of the major central banks to hike interest rates in the coming months. The crucial question for GBPUSD is who will hike first?

In recent weeks the prospect of a rate hike in the US has been pushed back. Earlier this year there had been a chance that rates could rise in June, however, after a spate of weak US economic data this has been virtually eradicated with less than 5 basis points of tightening now priced in for July. The market is expecting 30 basis points of tightening by December 2015, which is the equivalent of 1 25 bp hike.

Last week’s BOE Inflation Report suggests that the Bank of England is expecting to make its first rate hike in mid-2016, which would leave the Fed in pole position to hike rates first. This has been supported by recent econoimic data. After a spate of bad reports, the US economy is showing signs of strength, for example housing starts rose to their highest level since 2007 and employment remains strong. In contrast, the UK economy fell into deflation last month, which could delay a potential rate hike from the BOE.

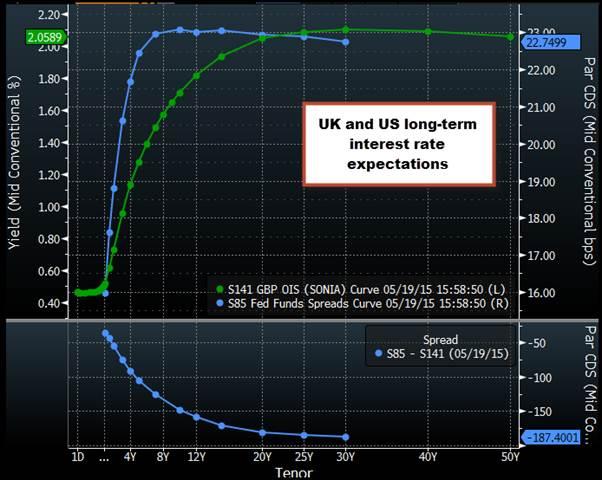

As you can see in the chart below, which shows US and UK interest rate expectations, using Fed Funds (blue line) and Sonia (green line) curves as a proxy for market expecations of US and UK interest rates respectively, the Fed Funds curve is steeper than the Sonia curve, suggesting that the market expects the US to hike first and for US interest rates to peak before rates in the UK.

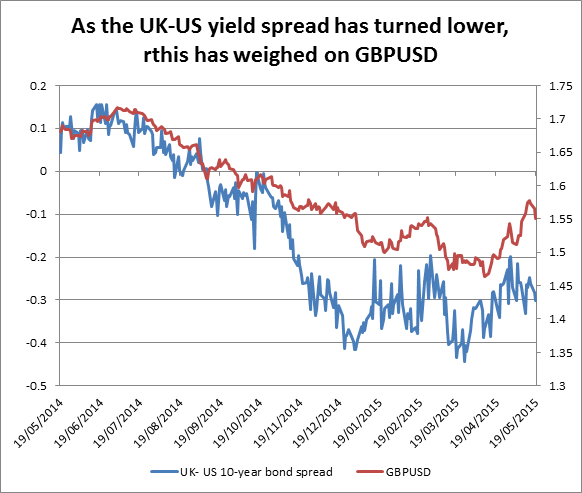

This is significant for GBPUSD. As you can see in figure 2, the 10-year spread between UK and US bond yields has turned south after moving higher in the past month, which has weighed on GBPUSD. One reason why the spread has moved further into negative territory - where US yields are outpacing UK yields - is because of the recent weakness in UK data, particularly on the inflation front. It is also a reflection of growing expectations that the Fed will hike before the BOE.

Takeaway:

- The timing of the next Fed and BOE rate hike is crucial for markets in the coming months, particularly for GBPUSD.

- Right now the market expects the Fed to hike before the UK, and for US rates to peak before UK rates.

- This could weigh on GBPUSD going forward, as the yield spread has moved deeper into negative territory.

- The technical signals are negative for GBPUSD after it fell through its 200-day sma. This opens the way to 1.5150 – the 100-day sma.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.