![]()

The buck is one of the worst performers in the G10 so far this month, and is down more than 4% vs. the GBP, and 3% vs. the NOK and AUD. Even the EUR, which has been weighed down by the ECB’s QE programme and the ongoing Greek sovereign debt crisis, has managed to eke out more than 2% in gains vs. the greenback so far in May.

What is driving the dollar lower, and can it last?

US economic data continues to surprise on the downside, the Citibank economic surprise index for the US has slumped to a 3-year low, which could delay the timing of the first Fed rate hike.

On that note, the market has also pushed back expectations for when the Fed will raise rates; the market now expects only 30 basis points of tightening before the end of the year, which is a little over 1 hike. If we continue to see weak economic data then a rate hike could be priced out for 2014 altogether.

Momentum – the dollar has made a series of lower lows, and the downtrend continues to look entrenched. It has already fallen through key support including the 200-day sma and is below the daily Ichimoku cloud, suggesting that weakness in the buck could be here to stay.

The yield effect:

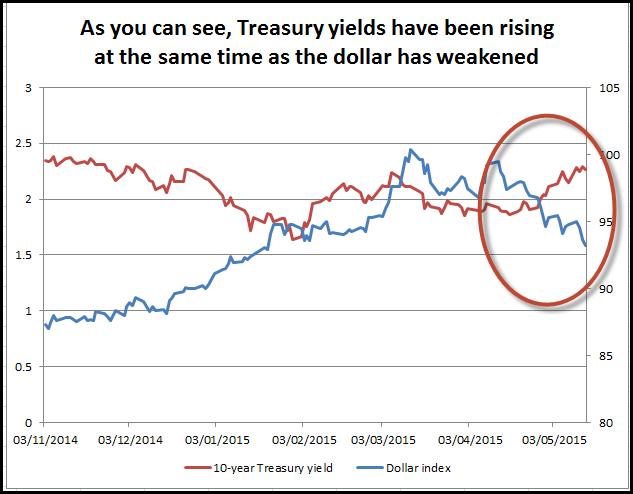

Interestingly, as you can see in figure 1, the dollar is selling off even though bond yields are rising. The 10-year Treasury yield is now at its highest level since November. Usually rising yields can lend support to a currency, but not so with the dollar. Why?

The dollar’s relationship with yields looks weak at best. It rose while Treasury yields were falling, and is falling as they rise.

If the rise in global DM bond yields is a sign that the global economy can avoid the scourge of deflation and is thus a collective sigh of relief, it would be natural for a safe haven like the dollar to weaken.

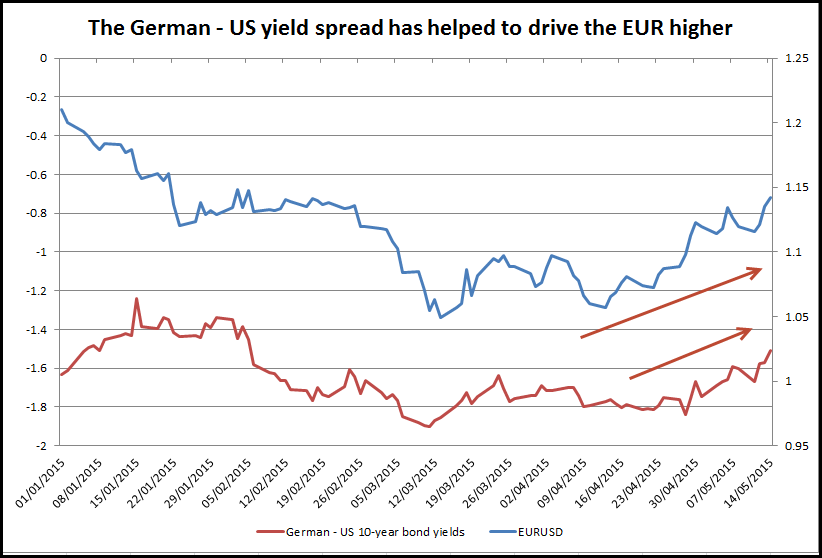

US yields may be rising, but they are rising faster elsewhere, for example in Germany, which is why the dollar cannot keep up. As you can see in figure 2.

Conclusions:

The dollar rally is on hold for now and has sold off some 7% since peaking in mid-March. This does not look like a mere pullback, if we continue to see weakness then it could be curtains for the dollar rally that the bulls were waiting so long for.

In the meantime, we would be cautious about looking for a reversal in the dollar at this stage, as the downtrend seems fairly entrenched. We think GBP could rally to 1.60 and beyond in the next week or so, and there may be further gains for EURUSD if we continue to see upward pressure on German bond yields. 1.1534, the high from end of Jan, is a critical level of resistance for EURUSD that opens the way for a return to 1.20.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.