![]()

The afternoon session of North American trade was dominated by the will of the Federal Reserve who wasn’t quite as pessimistic about the US economy as many had expected. The combination of pretty awful employment figures last month and a slow growth quarter to start out 2015 were pretty fresh in the minds of everyone who watched the Fed’s statement unfold, but the Fed passed those concerns off as largely transitory due to weather and low energy prices. They expect inflation to return toward 2% in the medium term, and they didn’t mention anything in regards to timing for an interest rate hike. While you couldn’t outright classify this statement as hawkish, it certainly wasn’t doom and gloom inducing either, which is a victory for the beaten down USD bulls.

The question that remains to be answered after this statement is if those same beaten down USD bulls can take back control. Not mentioning anything about hiking or not hiking rates specifically removes a dovish comment from the last statement where they said, “…an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting.” Notice they didn’t say anything about a June hike being unlikely this time around; it’s kind of an “addition by subtraction” type of hawkish statement, if you will.

That being said, the chances of a June rate hike are still a long shot, but not completely dead. Considering the Fed mentioned that they expect inflation to rise in the medium term, and we have two more Non-Farm Payroll releases before the next Fed meeting, it’s conceivable a hike could happen. After all, they did say they would raise rates if they “are reasonably confident that inflation will move back to its 2 percent objective over the medium term” (which they already stated they are from earlier in the statement) and “has seen further improvement in the labor market” (which could come from two good NFP’s).

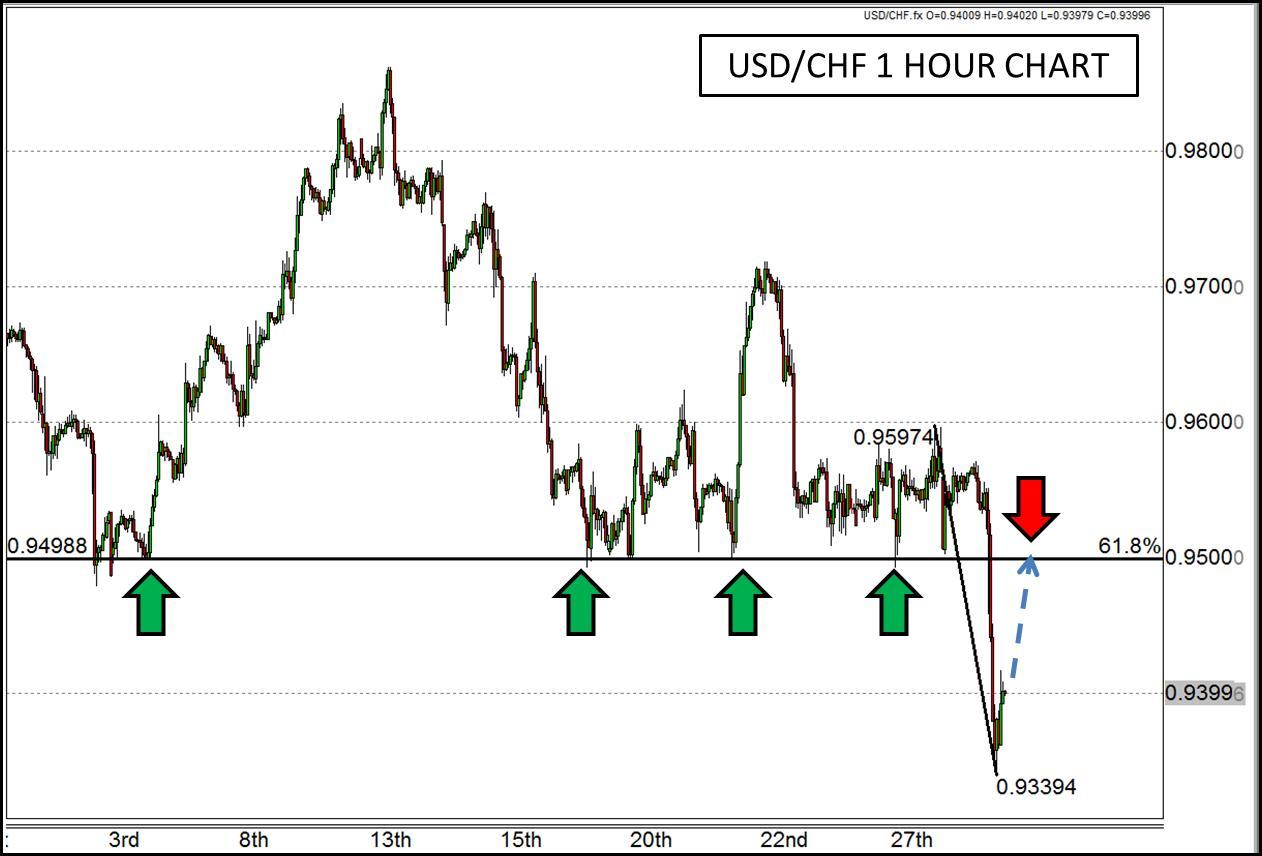

Given the potential for sooner than anticipated action from the Fed, the USD could go back to being the king of the hill, and at least in the near term, the USD/CHF is setting up for a potential recovery up to some intriguing resistance levels. The convincing break through 0.95 this morning kicked the USD while it was down and may have been a little overzealous in the process. A USD rally could bring this pair back to that same level which corresponds to previous support as well as a 61.8% Fibonacci retracement from this week’s high to low. While the world’s reserve currency may not be back to king dollar status quite yet, it may be able to at least start to get the ball rolling in the USD/CHF.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.