![]()

The GBP/USD fell sharply in the immediate aftermath of the UK GDP data, before bouncing back equally strongly to trade above the day’s earlier highs. The ONS reported that the UK economy grew only by 0.3% in the first quarter as opposed to 0.5% expected, held back by a 1.6% drop in construction output. Industrial output also fell slightly (-0.1%) while the key services sector expanded by half a per cent. On an annualised basis, the economy expanded by 2.4% when a growth rate of 2.6% was expected. This was sharply lower than 3% recorded in Q4 and was the weakest pace of growth since the fourth quarter of 2012. Overall, the data does not bode well for David Cameron and his Conservative party who has made the economic recovery the focal point of the election campaign. The slump in construction output is also something that will come under scrutiny because of the London housing crisis. But it should be noted that this was the preliminary estimate and so we may see some revisions in the subsequent estimates of GDP. Still, investors may be underestimating the risks of a potential hung parliament.

Although the GBP fell across the board on the back of the UK data, it has since bounced back. Against the dollar, it bounced sharply off the key 1.5175/85 support level. Traders are perhaps awaiting data from the US before making a conclusive decision on direction. Although the CB consumer confidence, expected at 15:00 BST, will be closely watched, the main fundamental events from the world’s largest economy will take place tomorrow. Not only will we have the advance US first quarter GDP estimate then, but the latest policy statement from the Federal Reserve, too. With the GBP/USD bouncing back despite the UK data miss, it suggests that the market may be expecting to see a particularly dovish FOMC statement tomorrow. To some degree, the market may be correct to expect this as most of the US data in Q1 disappointed expectations. However, the Fed has a tendency to discount soft patch in data as temporary. If the Fed does that again then it may inadvertently send out a more hawkish – or less dovish – signal to the market. Thus the risk is that contrary to the growing expectations, the dollar may actually find some good support tomorrow evening.

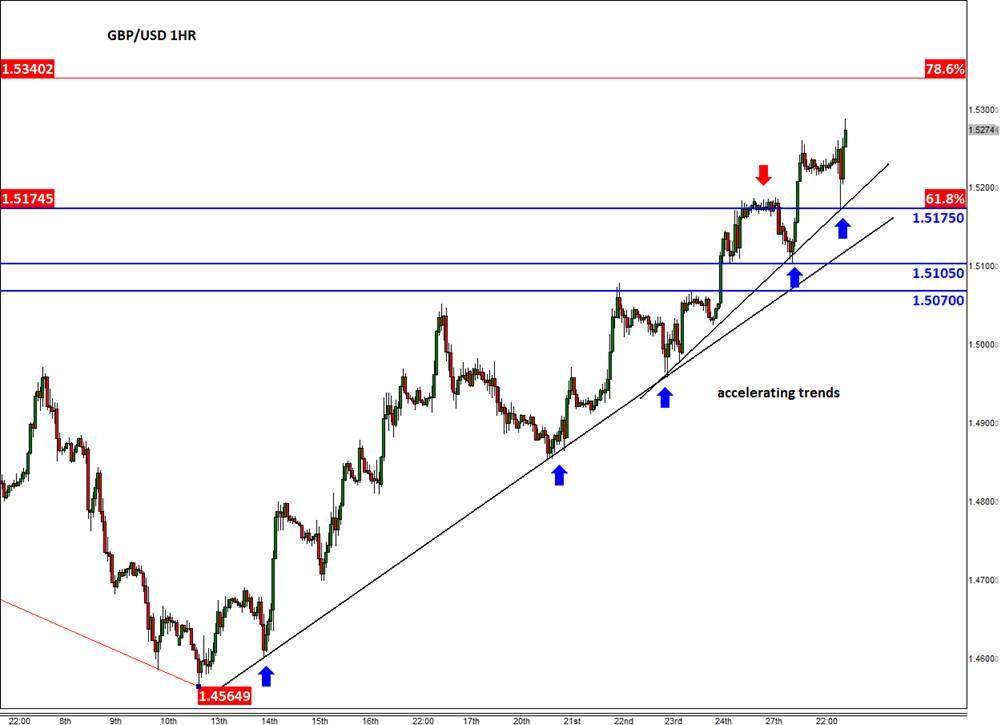

As mentioned, the GBP/USD currency pair has bounced back strongly off 1.5175/85. As can be seen on the 1-hour chart, this level was formerly resistance and so it has now turned into support: a typical reaction in the bull market. Indeed, the Cable has already broken several key resistances in the past and the most notable one was the 1.50 handle last week. A short-term bullish trend line has been established as a result. The GBP/USD has also taken out a much longer-term bearish trend, too, which is another bullish outcome (see the daily chart). As things stand, therefore, the path of least resistance is to the upside for the Cable. As such, we wouldn’t be surprised if it goes on to reach, and potentially surpass, the next major resistance at 1.5500. The near-term bias would remain bullish unless we start to see the breakdown of a few support levels such as that 1.5175/85 area.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.