![]()

The North American trading session has been quite a ride so far this morning as news is beginning to break out of Europe in regard to the Greek situation. A Greek government official let it leak that discussions were going well, which encouraged investors to stock up on their EUR positions driving the EUR/USD up to 1.08. US data releases were likely helping the popular currency pair ascend as well as all four major releases (Initial Jobless Claims, Continuing Jobless Claims, Markit Manufacturing PMI, and New Home Sales) missed their consensus expectations and put the USD on its back foot. Equity markets started the day lower, but are trying to mount a rally as we head in to the lunch hour.

Call me a skeptic, but all of this celebration related to an unnamed Greek official who THINKS that talks are going well seems a little overdone. We have been fooled before as Greece sees progress where others see derision, and for skeptics like me; “once bitten, twice shy” doesn’t even begin to describe the never-ending Greek melodrama. For that reason, I am prone to seek opportunities that assume that another official will tell us that this whole thing is a hot mess, and that nothing will get accomplished.

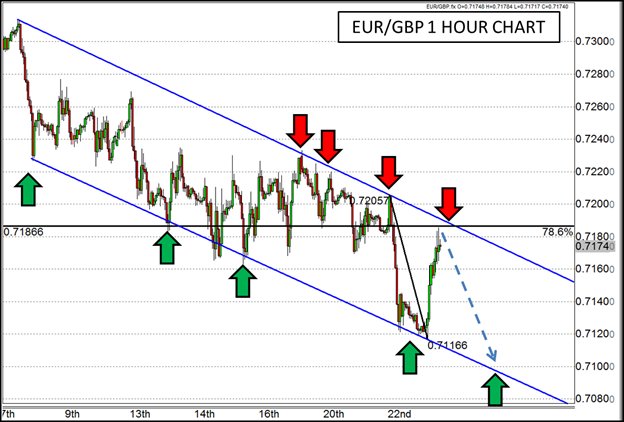

The EUR/GBP appears to be approaching a technical level where the pessimistic among us could logically see a rejection of the EUR rally. Not only is this pair rallying in to the top of a declining channel, but it is also approaching the 78.6% Fibonacci retracement of yesterday’s high to today’s low. If the one-two punch combo of trend line resistance and Fibonacci resistance can align near current prices, the skeptical investors may be able to mount a reversal of the current rally as we head in to the second half of the trading day.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.