![]()

The tenor of the North American trading session so far this morning has been primarily positive as US data has been encouraging and equity markets have popped higher as we approach the lunch hour. The US data news came courtesy of Existing Home Sales which rose to its highest level in 18 months and rose 6.1% over the previous month’s result. Strength in the housing market is a key ingredient to a US recovery and will likely be viewed as another reason for the Federal Reserve to raise interest rates at some point in 2015. While most investors have had that thought process for a while now, the end date is creeping ever closer, and the USD may be a continued benefactor of that proximity.

The AUD/USD is one such currency pair where the USD could come rip roaring back to strength in the near term. The Reserve Bank of Australia has been hinting at a possible rate cut for a few months, and evidently RBA Governor Glenn Stevens is very bearish on the AUD. The better than anticipated CPI reading overnight helped stem a decline in the AUD, but that may not last long, particularly given the ferocity with which Stevens has stated his opinions. Central bank heads don’t typically say things just for the sake of saying them; they are very deliberate in the words they use and conscious of the potential impact those words may have. For that reason, it may be unwise to go against Stevens’ insinuation.

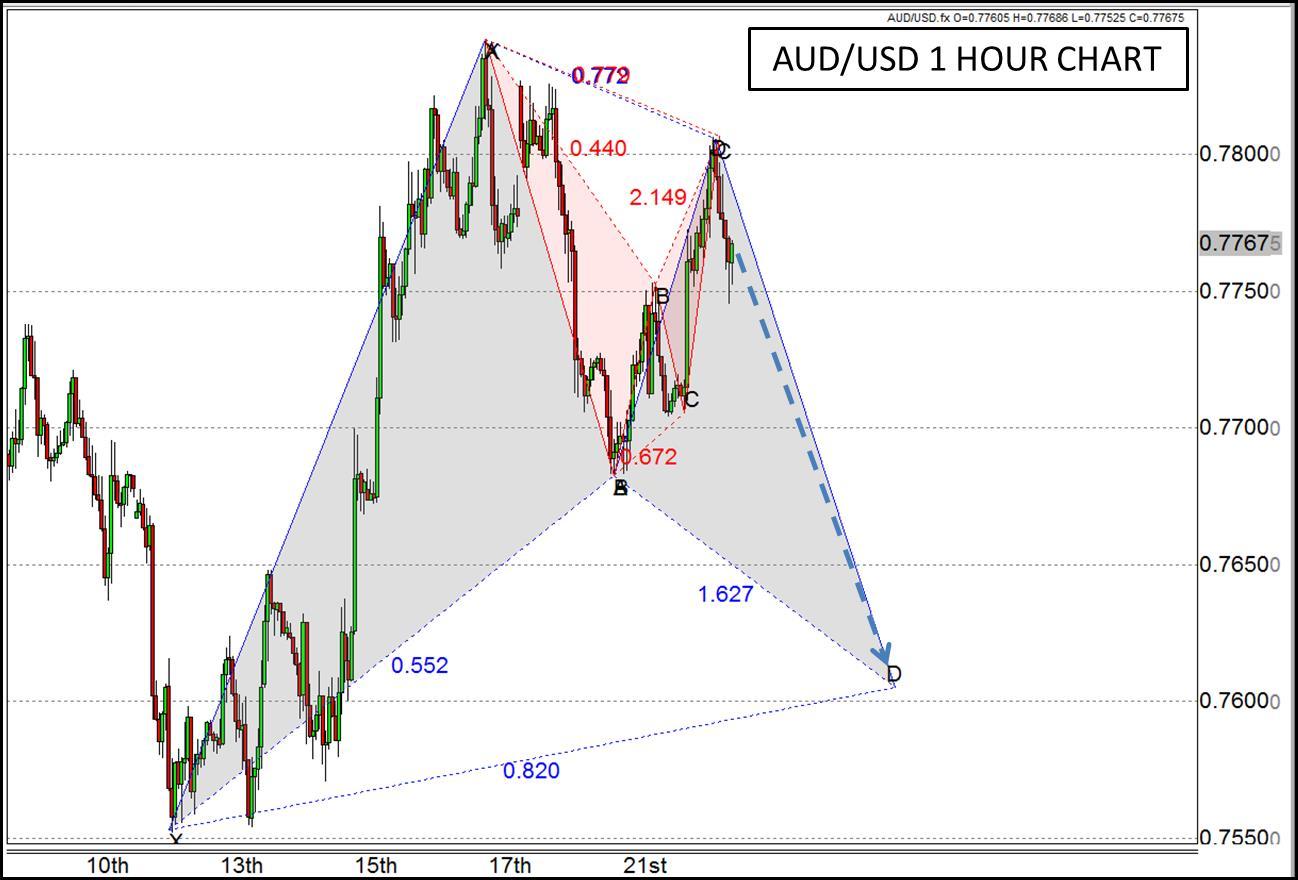

On the technical front, there are a couple of Gartley patterns that could point to a lower move as well. A shorter term Bearish Gartley pattern (red) completed near 0.78 which may help to form a potential Bullish Gartley pattern (blue) if price falls further toward 0.76. Typically, you wouldn’t want to predict that a Gartley pattern will complete, only looking to trade it once the pattern actually forms; but given the fundamental atmosphere, it’s not too far out of the realm of possibility to see the fundamentals help usher the technical in to the light.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.