![]()

The AUD/USD is one such currency pair where the USD could come rip roaring back to strength in the near term. The Reserve Bank of Australia has been hinting at a possible rate cut for a few months, and evidently RBA Governor Glenn Stevens is very bearish on the AUD. The better than anticipated CPI reading overnight helped stem a decline in the AUD, but that may not last long, particularly given the ferocity with which Stevens has stated his opinions. Central bank heads don’t typically say things just for the sake of saying them; they are very deliberate in the words they use and conscious of the potential impact those words may have. For that reason, it may be unwise to go against Stevens’ insinuation.

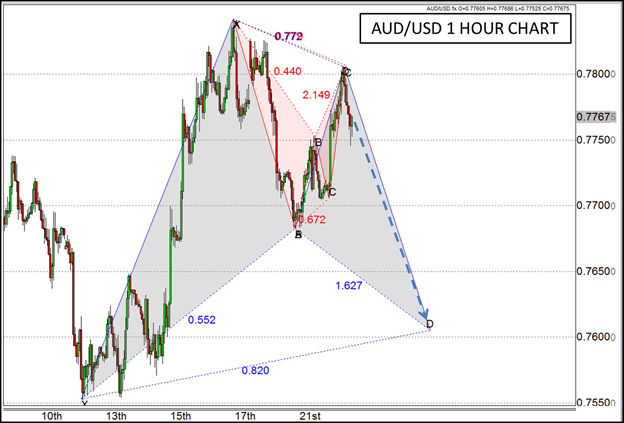

On the technical front, there are a couple of Gartley patterns that could point to a lower move as well. A shorter term Bearish Gartley pattern (red) completed near 0.78 which may help to form a potential Bullish Gartley pattern (blue) if price falls further toward 0.76. Typically, you wouldn’t want to predict that a Gartley pattern will complete, only looking to trade it once the pattern actually forms; but given the fundamental atmosphere, it’s not too far out of the realm of possibility to see the fundamentals help usher the technical in to the light.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.