![]()

The second half of North American trade provided very little in the way of excitement as most of the major moves that had occurred earlier in the day maintained throughout the rest of the day. Equities were higher by over 1 percent in the Dow, WTI remained above $57 per barrel, and the USD remained on the front foot against a majority of her peers. However, the global atmosphere could get shaken up for the rest of the week as we trudge ever closer to another Greek telenovela at the end of the week.

For those who are unfamiliar with the next Greek crisis, there will be another Eurogroup meeting on Friday where discussions between Greece and its debtors is most assuredly going to be a major topic of conversation. Greece was just in the news this morning based on an order from Prime Minister Alexis Tsipras to local governments that they move their funds to the central bank. Those funds will then evidently be used to pay salaries, pensions, and the next payment for the International Monetary Fund. The demand from the central government to the local governments seems to exemplify the need for Greece to receive another bailout, to which they didn’t fully receive at the last Eurogroup meeting.

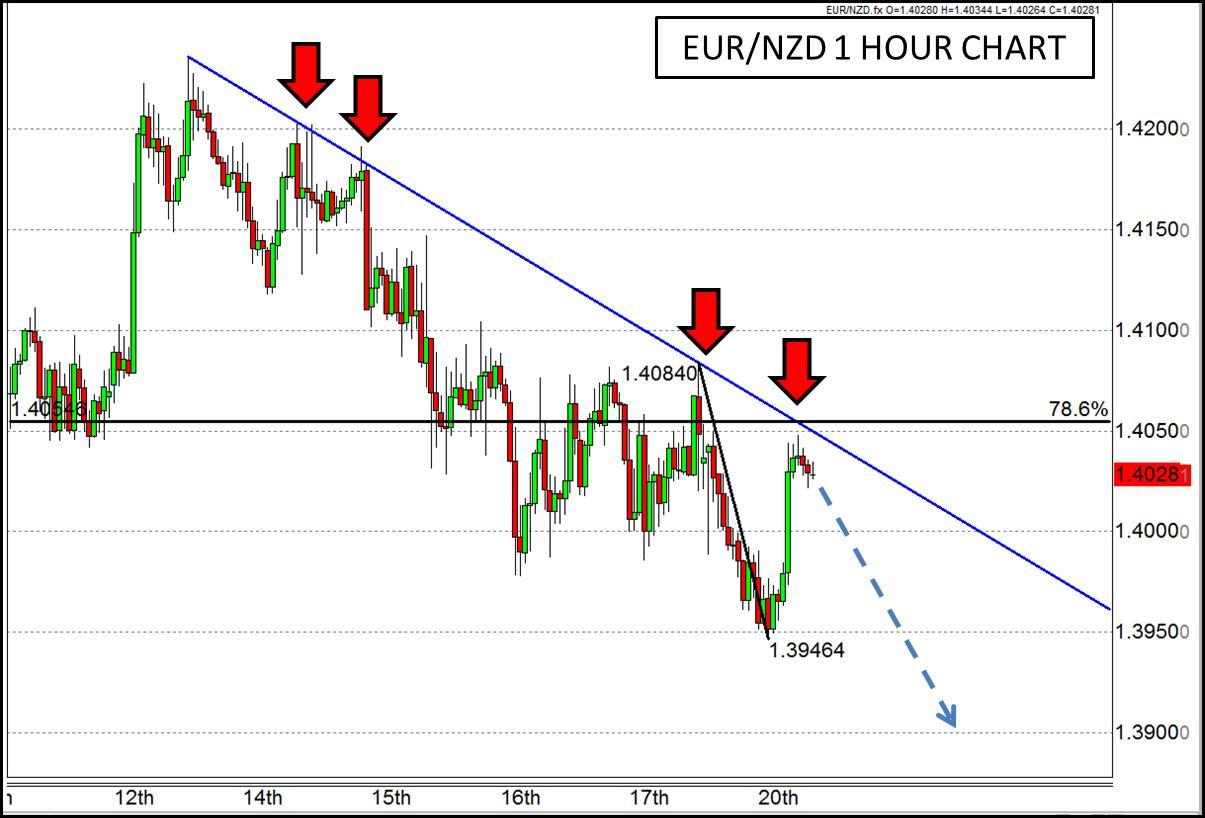

All this strange action from Greece likely points to uncertainty in the Eurozone and a really good reason for euro bears to assert their dominance against the moribund currency once again. One currency pair that is setting up technically for a potential drop as well is the EUR/NZD. Sure, I just gave you a couple of reasons to be skeptical of the Kiwi merely a few hours ago, but that was against the USD; against the EUR, it may be just the opposite. The EUR/NZD has been following a plunging trend line over the last week or so, and over the last few hours it has advanced right up to that line once again. Fortuitously, it has also reached a 78.6% Fibonacci retracement from Friday’s high to today’s low which may thwart any further advance. Therefore, despite the skepticism we may hold for the NZD, said skepticism may be more powerful and evident against the EUR, leading to a continuation of the current trend.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.