![]()

The German index has taken a battering in the last few sessions, falling some 4.5% since Wednesday. The trigger has been Greek default fears; however, surely it is starting to look oversold after such a sharp move to the downside?

The tech view:

Yes and no. From a technical perspective, this index could still have further to fall. It attempted to form a bottom on Wednesday when it made an inverted hammer on the daily candle chart, however this did not stop the sellers coming in on Thursday as news about the IMF rebuffing Greece’s alleged pleas to delay its debt repayment next month were made public.

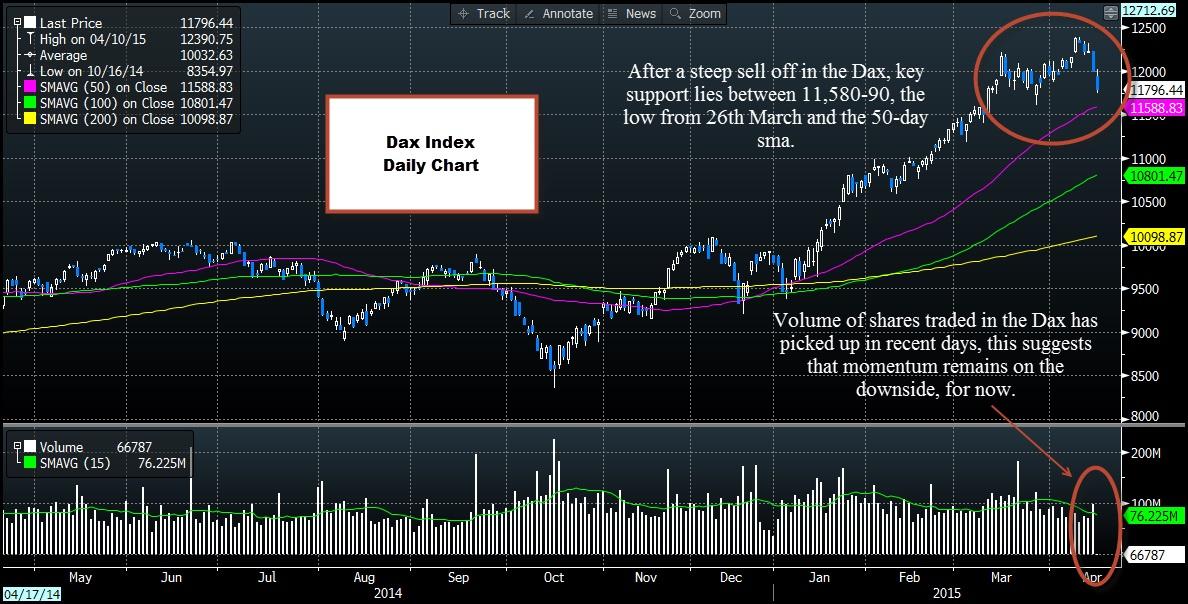

Although this index looks oversold from an RSI perspective, especially on the shorter term charts, the selling may continue until we reach a key support zone between 11,592 – 11,588, the low from 26th March and the 50-day sma respectively.

Turnover in Dax shares has picked up in recent sessions, as you can see in the chart below, which suggests that market momentum is on the side of the sellers, for now. This suggests caution amongst those looking for a near-term bounce higher. We do expect the selling to end, but unless we close higher than today’s extreme low at 11,743, then the selling may not end until we get into next week.

The fundo view:

From a fundamental perspective, the outlook is more Dax-friendly for a few reasons:

Strong economic data in Europe’s largest economy, including a strong composite PMI for March.

Decent trade and exports data for Feb, which could boost Q1 growth.

Greece: even if Greece does default, we expect a managed “exit” from both debts and the Eurozone, which could limit the fall-out from another Greek tragedy in the coming weeks and months.

However, it’s worth noting that the Dax has a fairly strong inverse correlation with the EURUSD, at -0.6%, thus, as the EUR is rallying on Friday this could add to the selling pressure on the Dax. The pick-up in inflation in the currency bloc could also undermine the German index as it could threaten the longevity of the ECB’s QE programme, which has been a key driver of the Dax this year.

Takeaway:

As you can see, the fundamental outlook for the Dax index is cloudy at the moment, so it may be worth looking at the technical picture before making a decision to buck the selling trend.

Although we think that the sell –off in the Dax will come to an end, momentum seems to be on the sellers’ side right now.

Key support lies between 11,592-11,588, which may stem the decline if the selling pressure keeps up over the weekend.

We mention above that we think the market will, eventually, be able to take a Greek default/Grexit in its stride. However, during this messy negotiation phase we would be wary of going long the Dax right now as potential event risk could build over the weekend, which may trigger another sell off at the beginning of next week.

So, patience could be a virtue for Dax sellers right now.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.