![]()

The whole world finally returned to the trading realm today as Easter celebrations are finally over in Asia and Europe and have joined in on the over-analyzation of the Non-Farm Payroll disappointment experienced on Friday. For their part, both Asian and European stock markets were markedly higher today with virtually all of the major indexes logging healthy gains, just as US stocks did yesterday. US equities are joining in on the fun too with both Dow and S&P racing out to higher levels in early trade. The reason I say that there is a bit of over-analyzing going on for NFP is that one bad report doesn’t typically make monetary policy change course drastically, and that realization is beginning to play out particularly for the USD.

When NFP was released, doom and gloomers were carving the gravestone for USD dominance and declaring that the Federal Reserve wouldn’t be increasing interest rates in 2015. According to those that were most pessimistic, you had better get on the USD down elevator quickly because all is lost. Granted, that may have been a fringe element of the economic literati, but they were out there, and they were particularly loud after such a large NFP miss. However, cooler heads have prevailed early this week already with some Fed members trying to calm the panic, and the USD has returned to pre-NFP levels once again.

Another argument for the bad NFP simply being an outlier instead of a new trend is the JOLTS Job Openings report releasing this morning. This alternative employment indicator surged to its highest level since 2001 and the quits rate remained elevated, indicating that people have the confidence to leave their current job in search of others or taking another job. The IBD/TIPP Economic Optimism Index released this morning also recovered to post a strong reading of 51.3 with 20 of the 21 groups the measure tracks scoring optimistic in the Personal Financial component. If this economic release is any indication, there could be a surge in spending coming for the world’s largest national economy.

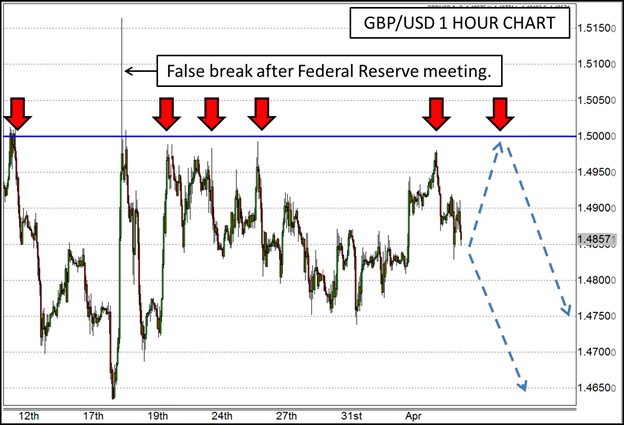

Considering the fundamental factors involved, the USD might go right back to retake the throne it temporarily relinquished. If that is the case, there is a good technical reason to think about the downside in the GBP/USD. The 1.50 level has been a virtual cap on this pair since the Fed had their last monetary policy meeting, and the recent failure for any GBP rallies could continue to keep it capped. While this pair may attempt another run at the psychological 1.50 barrier, the path of less resistance may be down as more investors come to realize that the USD may not be dead quite yet.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.