![]()

One currency pair that tends to follow stock market moves is the EUR/JPY. Just like equities today, the EUR/JPY had a hard time getting out of its own way as it fell to levels of support that could potentially be very helpful in mounting any kind of advance. News out of Greece today wasn’t great as the Troika evidently dismissed Greece’s ideas for reform as just that -- ideas. They stated that it wasn’t a concrete plan for reform, but we haven’t gotten to the point of a Grexit freak-out quite yet. The EUR weakened on the day, but it wasn’t particularly noteworthy, and may have some fight in it as we coast to the end of week.

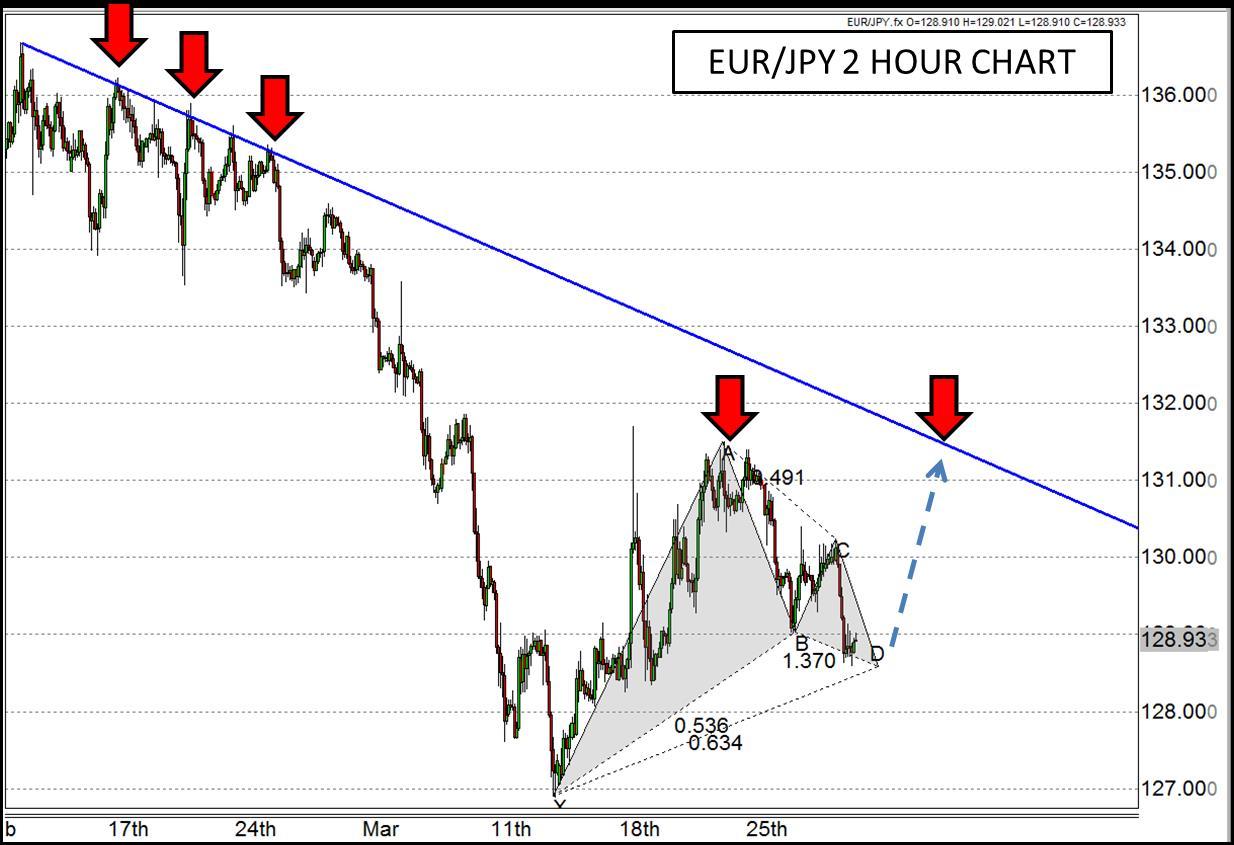

Considering that this week ends with a holiday for a majority of the world, it wouldn’t be out of the question to see the EUR give more of a sideways feel instead of a general sell-off or strong rally. For that reason, finding levels of recent support or resistance may be most helpful as they could signal starting and ending points for rallies and drops. Conveniently, the EUR/JPY just found a level of support around a round number (129.00) that has also previously provided both support and resistance, and happens to coincide with a Fibonacci based Bullish Gartley pattern that is completing in the same region. While the overall trend is down in this pair, the clustering of support may give it enough of a boost to advance back toward the longer term falling trend line which may also coincide with previous price resistance.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.