![]()

Are you following the FOREX.com Research Team on Twitter? If not, you are missing up to the minute updates about market moves, insight in to what, when, why, and where of market moves, as well as links to easily accessible published material as soon as it is finished. Just in case you missed some of our most popular tweets of the week, here’s a Top 5 countdown to catch you up to speed.

5. (tie) 9 RETWEETS AND 5 FAVORITES = 14 ACTIONS

https://twitter.com/FOREXcom/status/579985215726194688

Source: www.twitter.com/FOREXcom

Fawad correctly foresaw that the IBEX was heading higher after it cleared its “major hurdle,” but it didn’t quite get all the way up to 11750 (yet) as it paused near 11625 before retracing back down to 11300.

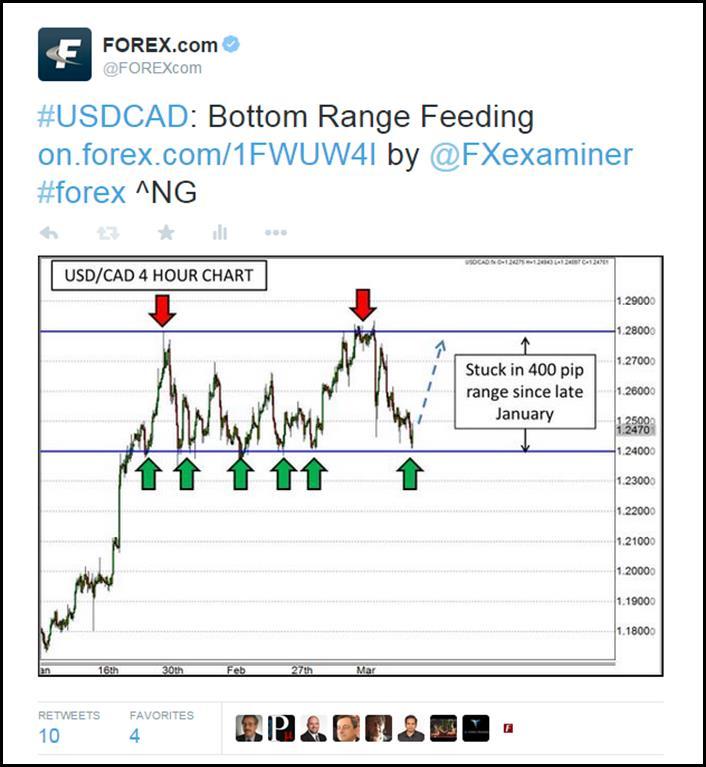

5. (tie) 10 RETWEETS AND 4 FAVORITES = 14 ACTIONS

https://twitter.com/FOREXcom/status/581121068485738497

Source: www.twitter.com/FOREXcom

The USD/CAD has been one of the strongest performers in terms of USD strength as we end the week. The range that I pointed out in this article held firm and this pair has already rallied back up to 1.26 in the process.

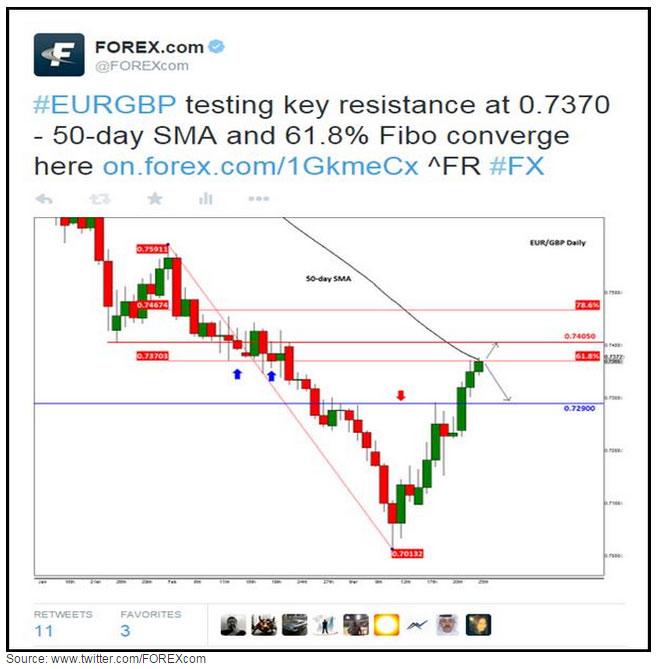

4. 11 RETWEETS AND 3 FAVORITES = 14 ACTIONS

https://twitter.com/FOREXcom/status/580692163295612928

Once again Fawad nailed his analysis, but this time it was on the EUR/GBP. The 0.7370/80 level was too resistant to the pair as it fell all the way down to 0.7265 after being rejected.

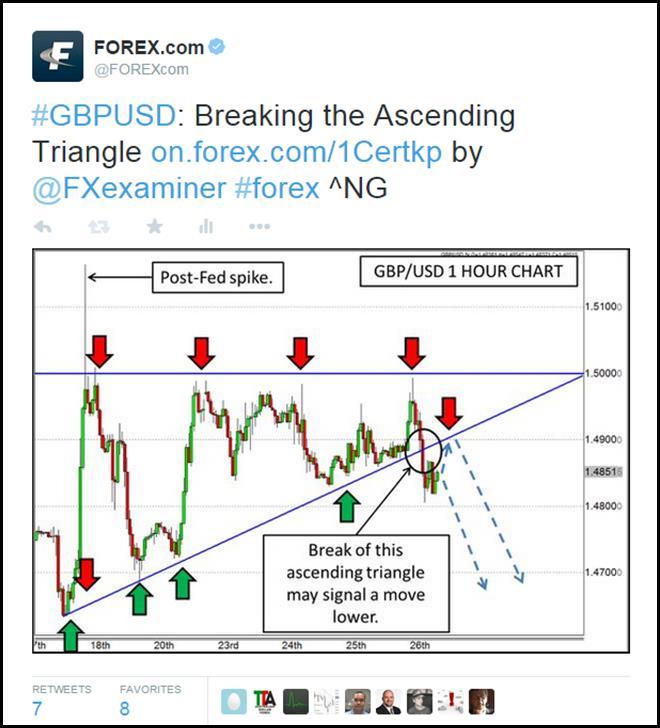

3. 7 RETWEETS AND 8 FAVORITES = 15 ACTIONS

https://twitter.com/FOREXcom/status/581183117773443072

Source: www.twitter.com/FOREXcom

The thought that the GBP/USD could rally back up to 1.49 and be rejected off former support turned resistance due to the break of an Ascending Triangle pattern has come to fruition as we take a pause for the weekend. We’ll have to keep our victory cigars holstered for the time being though as this move is still in its infancy.

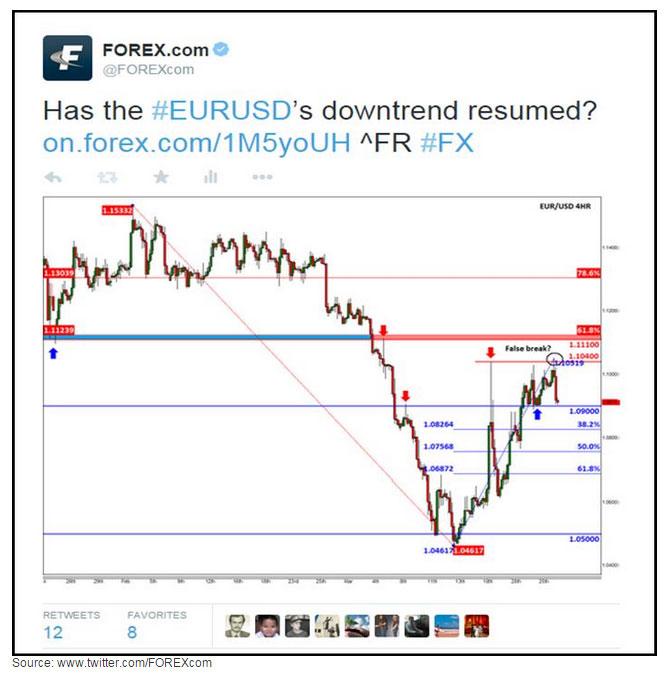

2. 12 RETWEETS AND 8 FAVORITES = 20 ACTIONS

https://twitter.com/FOREXcom/status/581147638571098112

The EUR/USD was a popular subject to tweet about this past week due to its unexpected strength in the face of relentless Quantitative Easing from the European Central Bank. The run back up to 1.10 has given many prognosticators pause as to the likelihood of parity in the near future, but there are even more hurdles remaining for this pair to the topside as Fawad eloquently points out in this article.

1. 20 RETWEETS AND 9 FAVORITES = 29 ACTIONS

https://twitter.com/FOREXcom/status/580094433376526336

Source: www.twitter.com/FOREXcom

In what was easily the most popular tweet of the week for us was this one in which I pointed out that the EUR/USD was in an area where a strong move was destined to take place. If it broke though this resistance level with force, the next level of resistance was near 1.12, but if it was rejected once again, 1.07 looked like the destination. As we end the week, this decision is still being made as neither a significant break higher nor lower has materialized, but 1.10 still looms as major resistance.

Did one of your favorite Tweets or Tweeters not make the cut this week? You can have an influence by making it a FAVORITE or RETWEETING it and sharing it with the world. Every little bit counts, and maybe you will be the difference maker in next week’s results!

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD remains capped below 1.2470, eyes on US data

The GBP/USD pair trades on a softer note around 1.2450 on Thursday. The softer UK inflation data prompted the expectation that the Bank of England will start lowering interest rates in the coming months, which weighs on the Pound Sterling against the Greenback.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.