![]()

It looks like a combination of weaker US economic data; tensions in the Middle East and a sharp decline in the dollar index have started to bite USDJPY, which has fallen below 118.50 on Thursday. It is also coming up to fiscal year end in Japan, which can have a positive impact on the yen.

Key support ahead

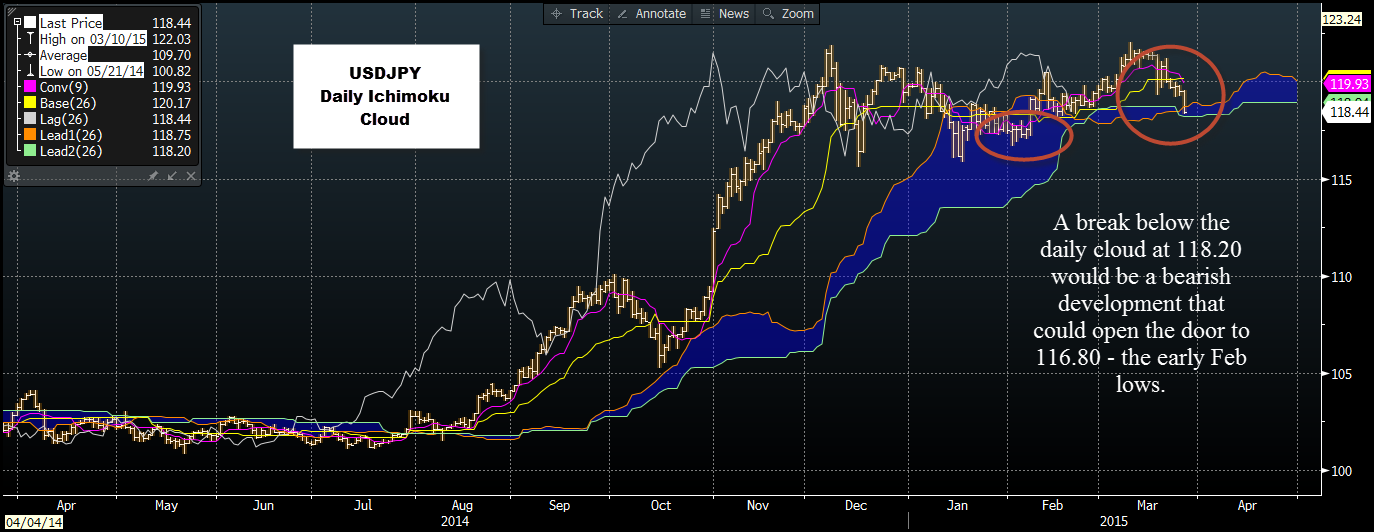

The biggest short –term risk to this pair from a technical perspective is a break below the daily Ichimoku cloud at 118.20 (see the chart below). When prices fall below the cloud this can signal the start of a technical downtrend, and it could signal another leg lower in the US dollar sell-off.

The USD is one of the weakest performers in the G10 FX space. Since the FOMC meeting last Wednesday, only the British pound has underperformed the dollar. Even the EM FX space has managed to pull back some recent losses versus the USD, with the ruble up more than 5%, the Polish zloty up 2.7% and the South African rand up 1.5%.

USD weakens as the Fed focuses on inflation

Economic data is fairly thin on the ground in the European session; however US jobless claims data is worth watching along with comments from the Fed’s Lockhart who speaks later this afternoon. Comments from the Fed’s Bullard this morning sounded a warning note on the drop in inflation expectations and also said that US monetary policy is to remain “exceptionally accommodative”, which helped to take the shine off the buck. Although he acknowledged that the Fed can’t keep interest rates at the zero bound forever, the focus on weak price pressures could keep a lid on the dollar for the time being and could weigh on USDJPY.

The technical view:

The break below the 100-day sma at 118.84 was a bearish development; if USDJPY falls below the bottom of the cloud at 118.20 then it reinforces the bearish trend for this pair. A move below that level could open the door to a further decline back to 116.80 – the early February lows.

If USDJPY can manage to stay above the cloud, then key resistance is the cloud top at 118.75, ahead of 120.00, which corresponds with the Kijun and Tanken lines.

Figure 1:

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.