![]()

The second half of the North American trading day wasn’t too compelling if you were watching charts as a healthy portion of traders were likely taking extended lunches to enjoy the start of the NCAA Tournament. Therefore the moves of the morning pretty much remained for the duration, but Asia is lying in wait to pick up the liquidity. On tap for the region is Meeting Minutes from the Bank of Japan, Reserve Bank of Australia’s Governor Glenn Stevens giving a speech, and a couple of minor New Zealand economic releases. The first two have a decent chance of moving markets particularly now that the world is up to date with the thoughts of the Federal Reserve.

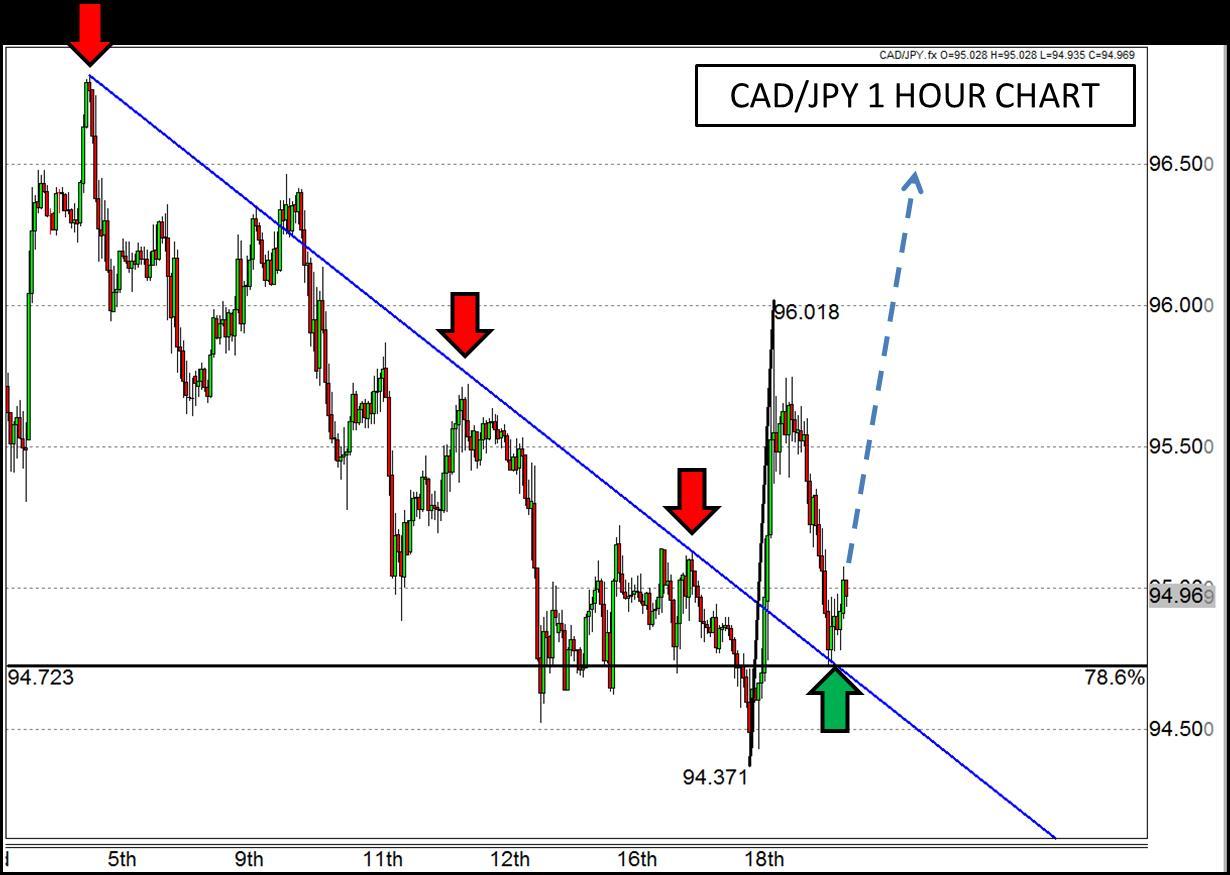

Moving away from the US though may be a wise path to follow for the time being. After witnessing yesterday’s extreme market moves along with today’s reversal of those moves could mean that the market is still trying to figure out what the Fed really meant. In a nod to the aforementioned tournament, sometimes it is better to pick a market underdog to find opportunities, and Canada may qualify (particularly in comparison to the US). The CAD/JPY had an extreme move yesterday after the Fed meeting as well, and has retraced back to an interesting level that correlates with a trend line and a Fibonacci level.

Canada will be releasing a couple of market moving metrics tomorrow including CPI and Retail Sales that have a chance of being good for the CAD. So far this month, the Bank of Canada sounded more optimistic than anticipated, GDP was pretty decent, and Employment wasn’t as bad as expected; perhaps those good vibes could leak over to inflation and sales. If those fundamental factors combine with the former trend line resistance turned support, and 78.6% Fibonacci retracement of yesterday’s low to high, a rally back above 96.00 and beyond may be a possibility.

Figure 1:

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.