![]()

Markets are waiting patiently in North America this morning for the Federal Reserve to make their monetary policy decision in a few hours from now. While equities are generally lower, it isn’t extreme by any measure, and the USD is pretty much where it was at the end of trading yesterday. Oil has been a more intriguing story as it continues its march toward the $40 level in WTI as inventories are higher, but trading is likely to remain stable but tense as we get closer to the Fed fireworks. However, once that statement drops, wild fluctuations may be the rule instead of the exception.

Tempting as it may be to try and tell you what will happen at the Fed meeting and the market’s reaction thereafter, I could only venture a guess since I left my crystal ball at home this morning. For what it’s worth, I believe the Fed will be hawkish and signal a rate hike in June. While that is the minority opinion among those who make a living predicting these things, I just have a feeling that the Fed will believe that employment is back to where they want it and low inflation is largely transitory due to low oil prices. If that ends up being the case, the USD could be an even bigger rock star than it currently is in the currency world, and articles about decades old levels being broken will flood your Twitter feed.

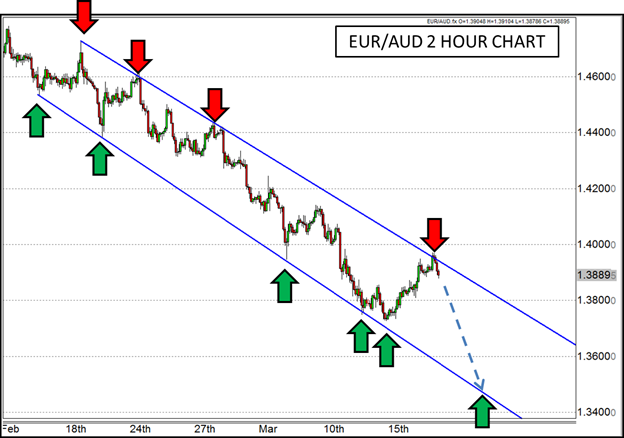

Getting away from the Fed related madness; the EUR has been enjoying a fleeting bit of strength so far this week. The EUR/USD has risen back up to the 1.06 handle and remained there, and the EUR/GBP has turned nearly parabolic as the GBP continues to get pummeled on all fronts. However, the EUR isn’t faring so well in the EUR/CHF(shameless plug) which was rejected off declining trend line resistance, and there is potential that it could happen in the EUR/AUD as well.

The EUR/AUD has been following a declining trend channel for about the last month and very recently tested the upper bound of that channel. If the channel continues to hold, there could be a rather significant move lower from current levels as the bottom of the channel may not be reached until 1.35, or even 1.34, if the timing works out accordingly.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.